Simple Info About Concept Of Profit And Loss Account

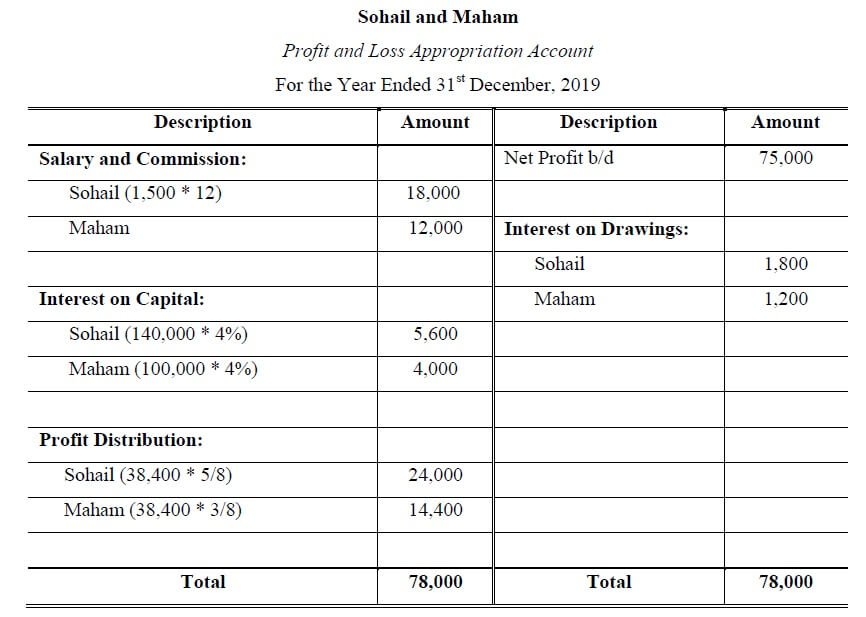

This account should not be confused with the typical profit and loss account but rather seen as an extension of it as it is made after making the profit and loss account.

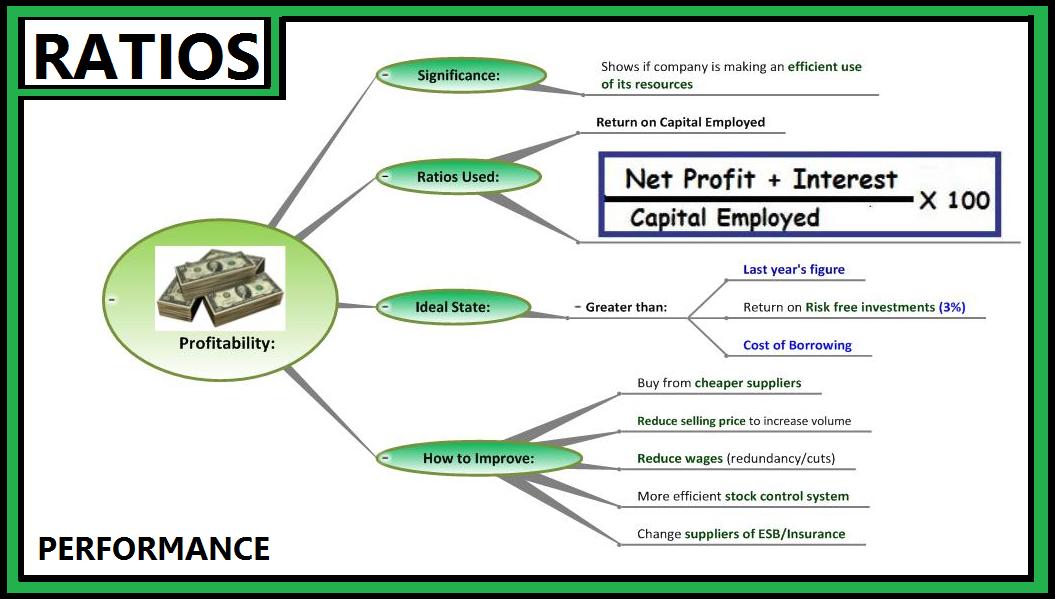

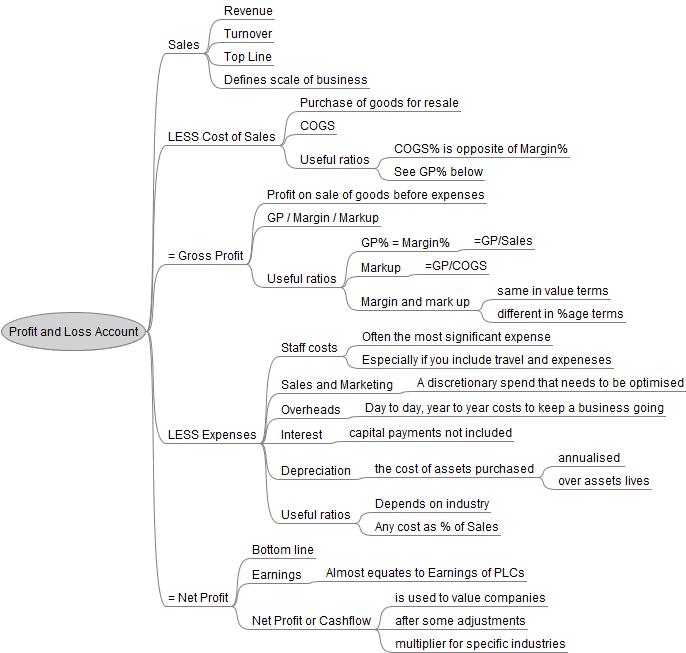

Concept of profit and loss account. The main objective of a profit and loss statement is to identify whether a company made a profit or lost money during a specified time, usually a month, quarter, or year. Profit and loss basic concepts let us learn profit and loss concepts in maths. The profit and loss account is the “scoreboard” of the firm’s performance during a particular period of time (usually one year).

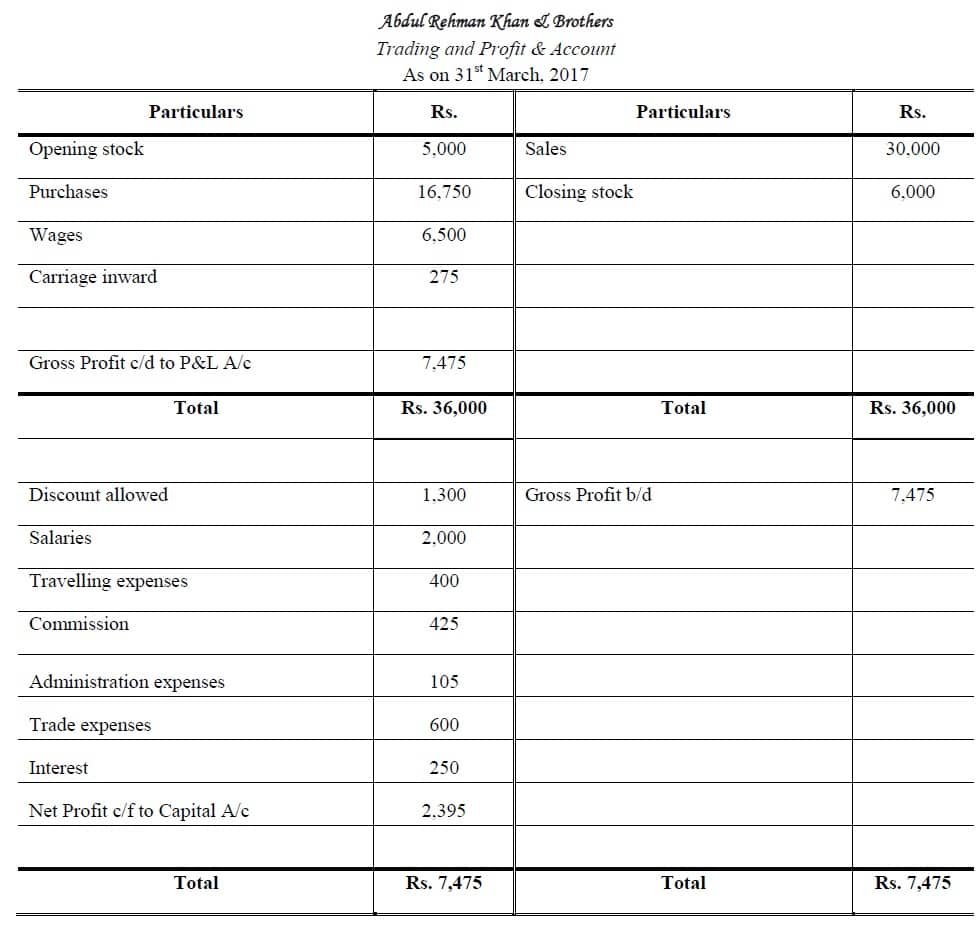

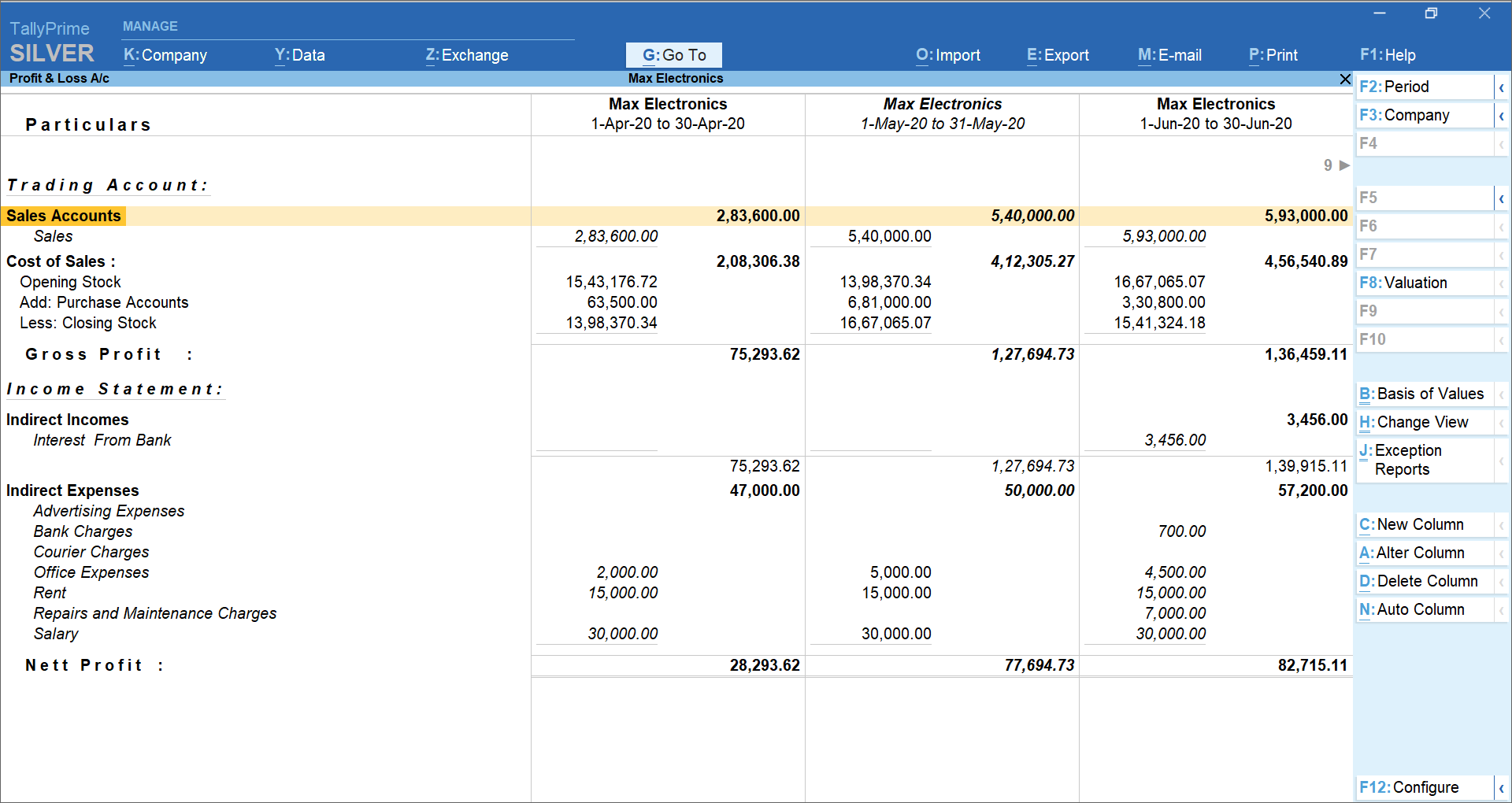

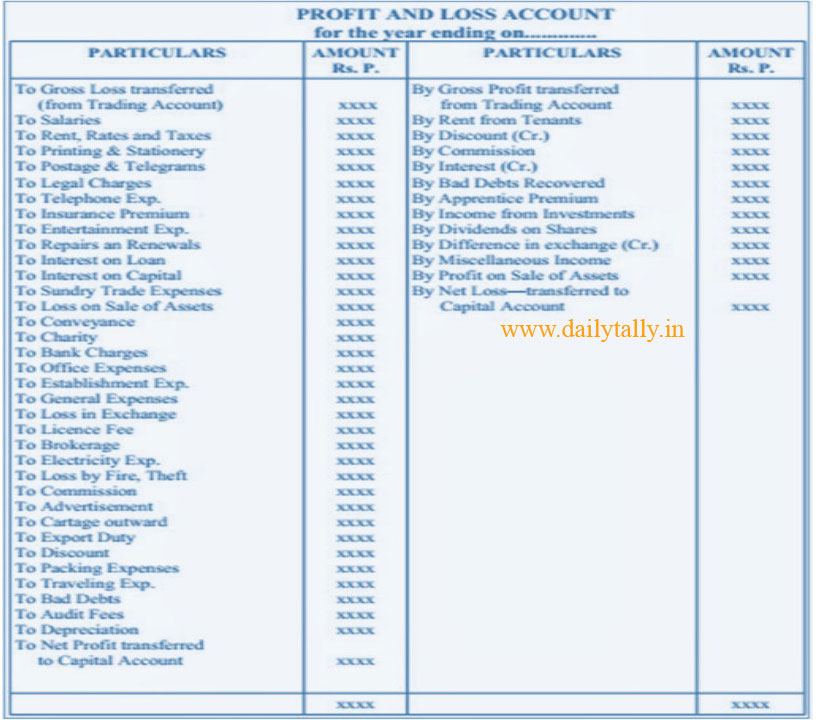

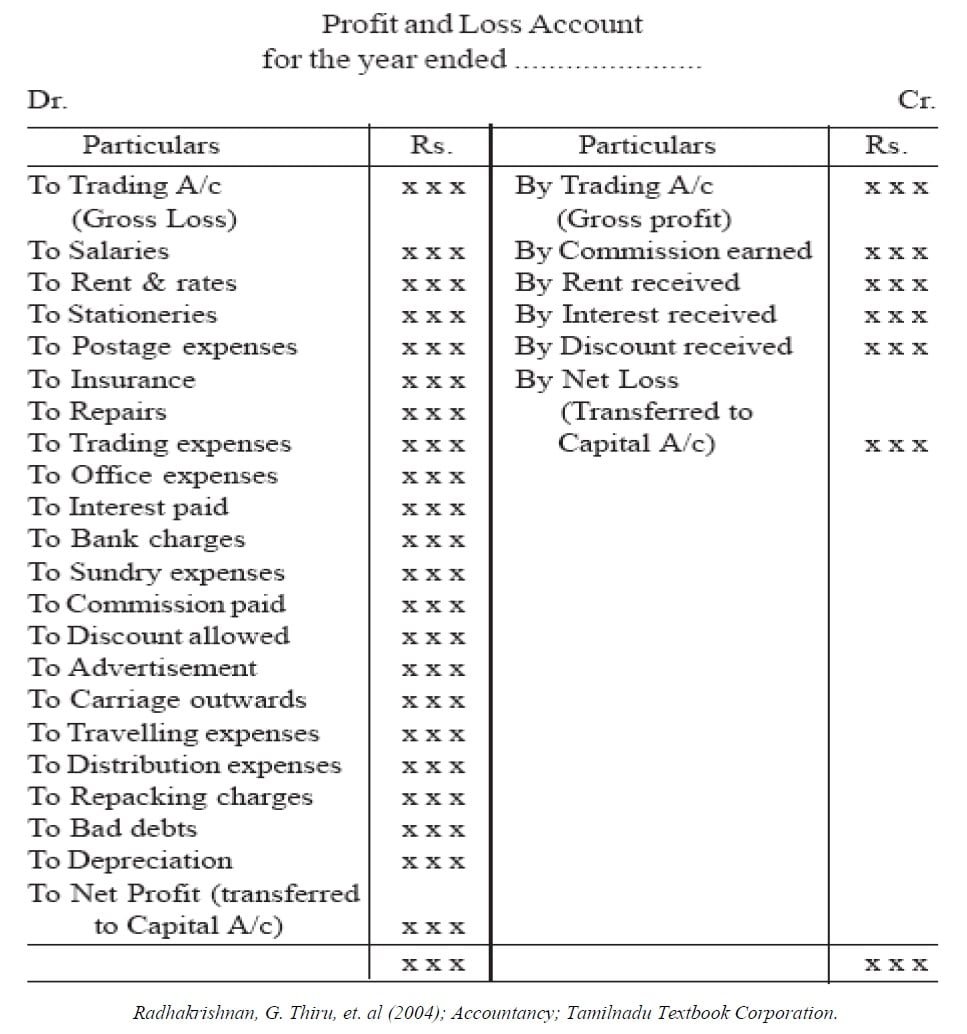

The motive of preparing trading and profit and loss account is to determine the revenue earned or the. On that basic level, profit and loss is derived from taking your costs away from your sales. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year.

A p&l statement, often referred to as the income statement, is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific. A profit and loss statement (p&l) is an effective tool for managing your business. It helps the owner or management evaluate the business’s performance and provides a base for future.

Profit (p) the amount gained by selling a product for more than its cost price. A trading account helps in determining the gross profit or gross loss of a business concern, made strictly out of trading activities. The second of these is information about its financial performance.

Understand the concept of trading account here in detail. The excess of sale proceeds over the cost of non operational items is termed as gain which shall include gain on sale of fixed assets, gain on winning a court case, etc. The statement reveals the financial outcome of a company's operations by subtracting total expenses from total revenues.

A profit and loss account is prepared for the period for which the business wants to evaluate its performance. Since it reflects the results of operations for a period of time, it is a flow statement. According to the accounting standards board (asb), the objective of financial statements is to provide financial information about three aspects of the reporting entity.

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Electric carmaker rivian plans to cut 10% of its salaried workforce. Loss (l) the amount the seller incurs after selling the product less than its cost price is mentioned as a loss.

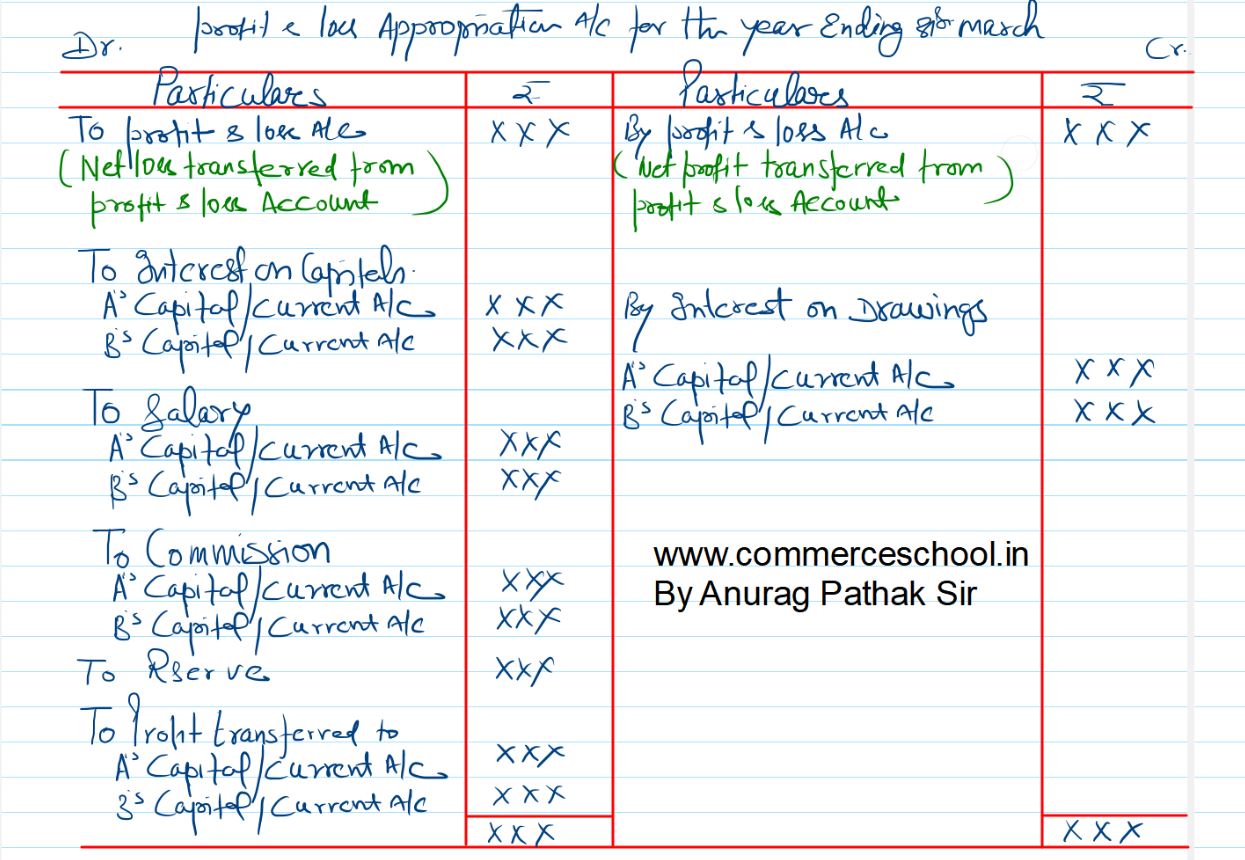

In contrast, the balance sheet is a stock, or status statement as it shows assets, liabilities and owners’ equity at a. Understand what the profit and loss account is. Meaning of profit and loss appropriation account it is a special account that a firm prepares to show the distribution of profits/losses among the partners or partner’s capital.

In the trading account, the cost of goods sold is subtracted from net sales for the period to calculate gross profit. Trading involves buying and selling activities. The profit & loss account reports the incomes and expenses directly related to an organisation to measure the performance in terms of profit or loss.

It gives you a financial snapshot of how much money you’re making (or losing) and can make accurate projections about your business’s future. Understand how profit relates to owner's capital in the balance sheet and the accounting equation. P&l accounting involves the creation of reliable profit and loss statements to assess the financial performance of an individual or business.