Outstanding Info About Define Financial Ratio

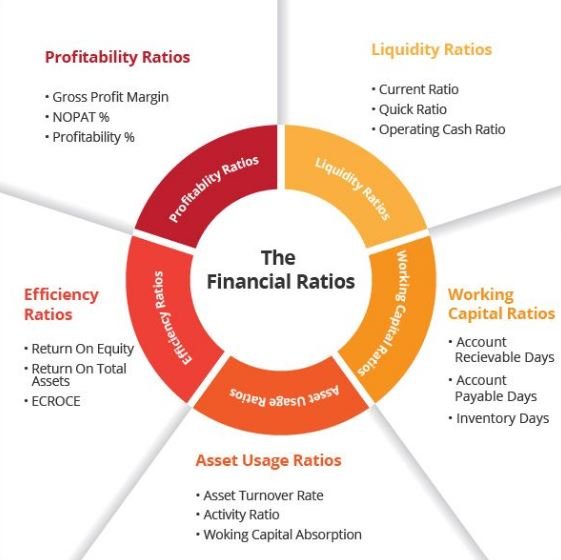

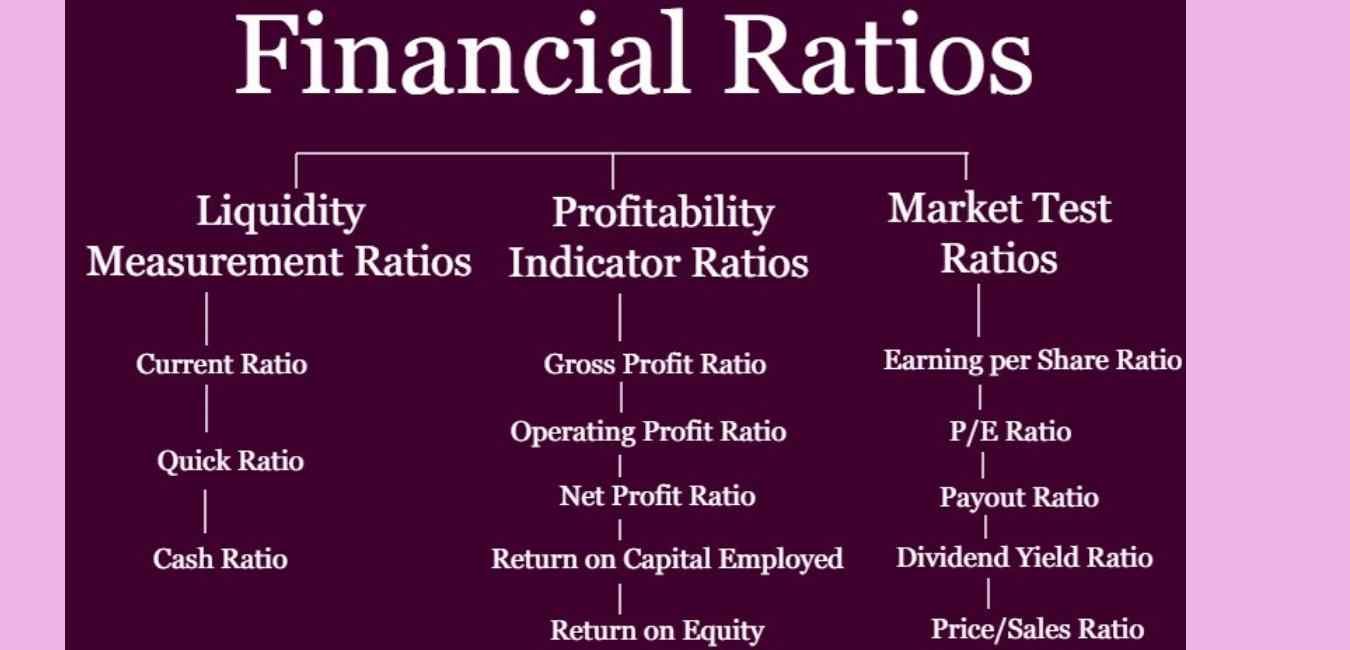

Things such as liquidity, profitability, solvency, efficiency, and valuation are assessed via financial ratios.

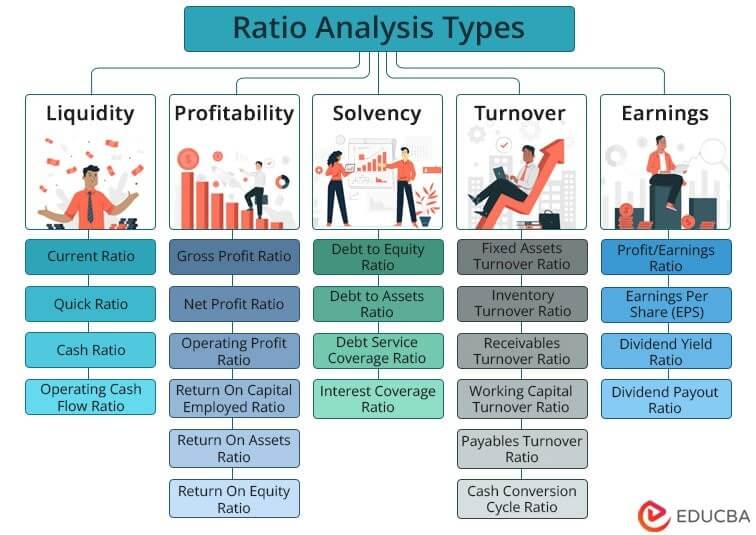

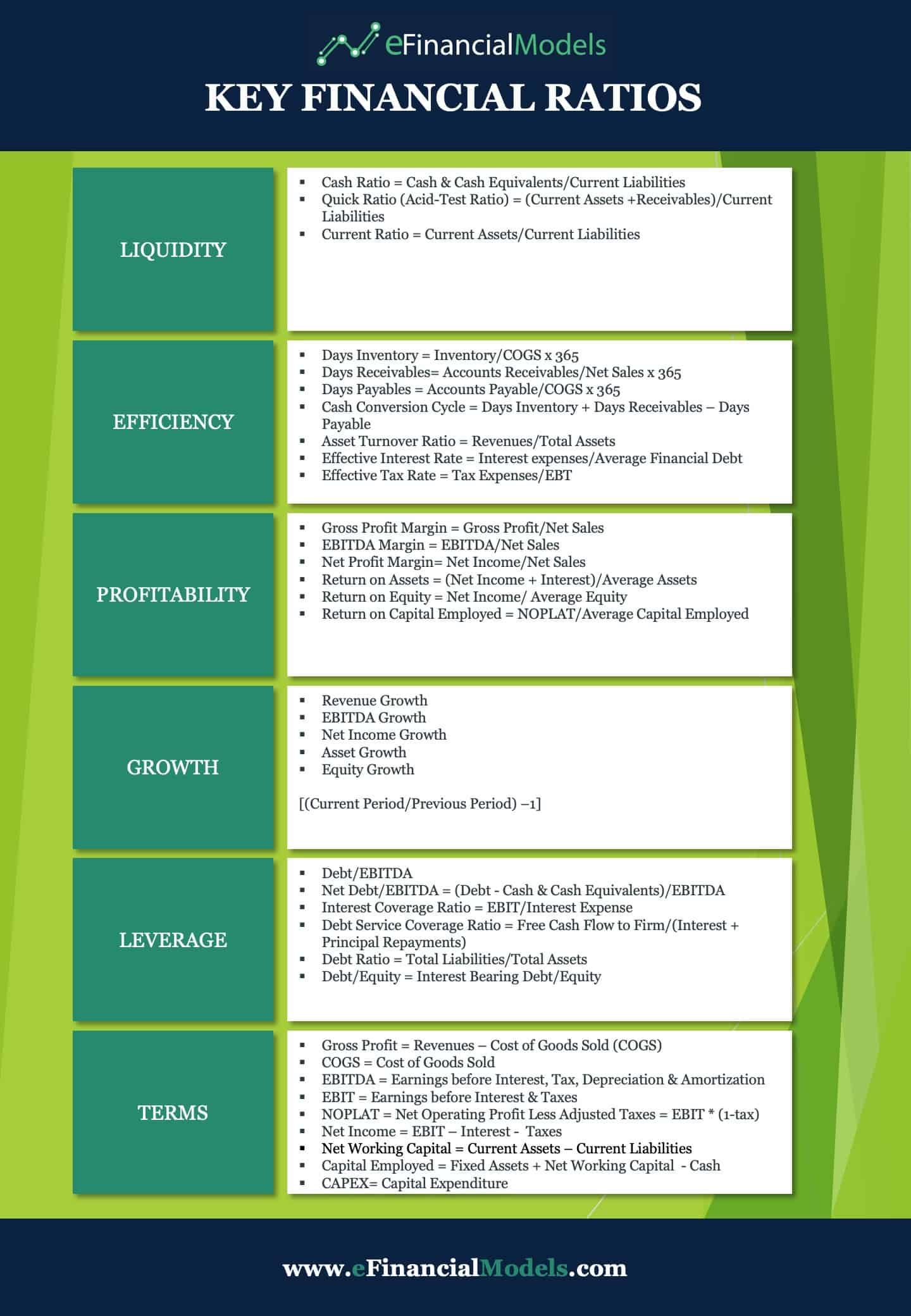

Define financial ratio. Ratio analysis refers to the analysis of various pieces of financial information in the financial statements of a business. Analysts compare financial ratios to industry averages (benchmarking), industry standards or rules of thumbs and against internal trends (trends analysis). These ratios are applied according to the results required, and these ratios are divided into five broad categories:

Definition and meaning asset turnover ratios. Dividend policy ratios help us determine a firm’s prospects for future growth. The formula is net profit, divided by sales.

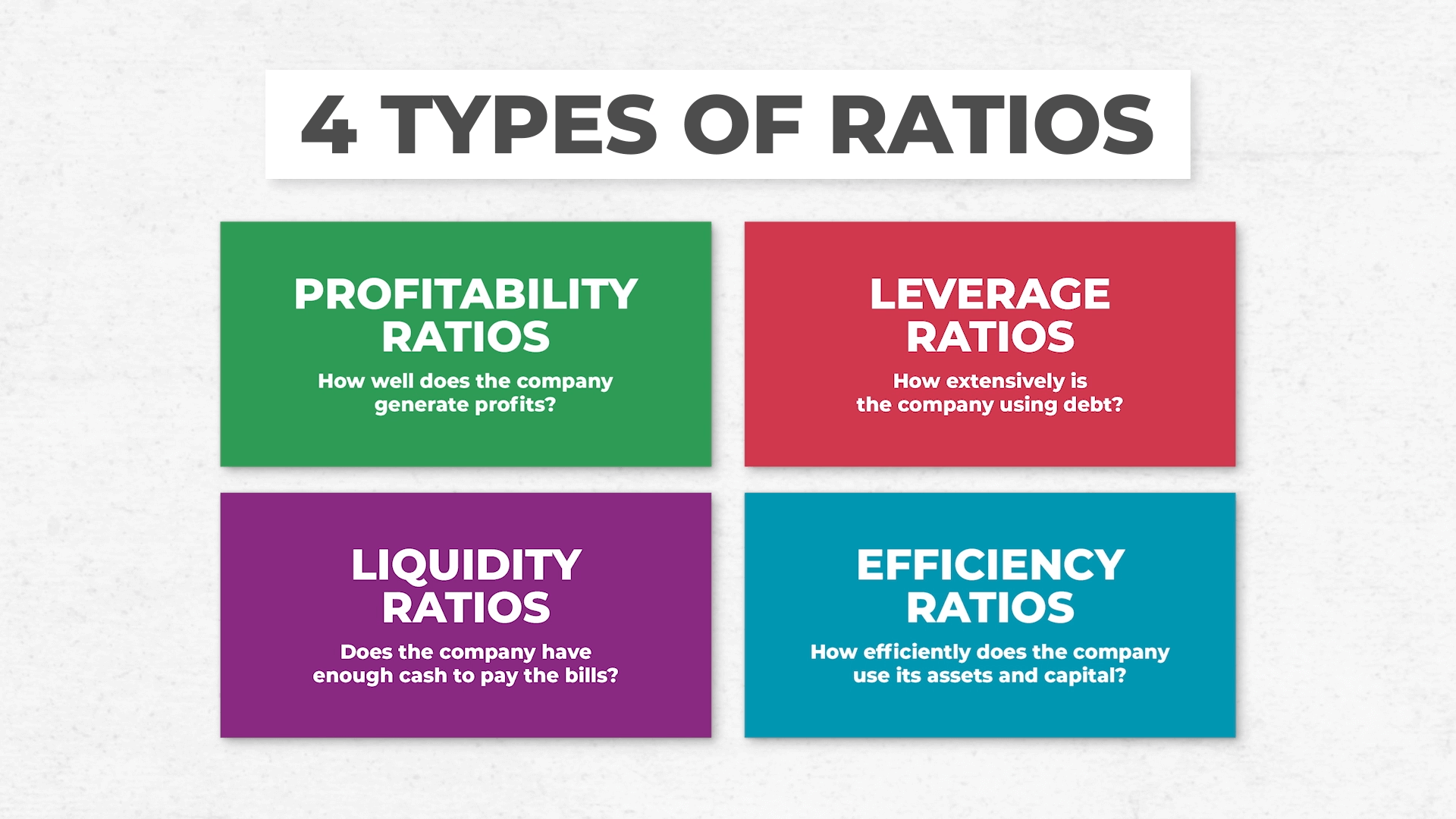

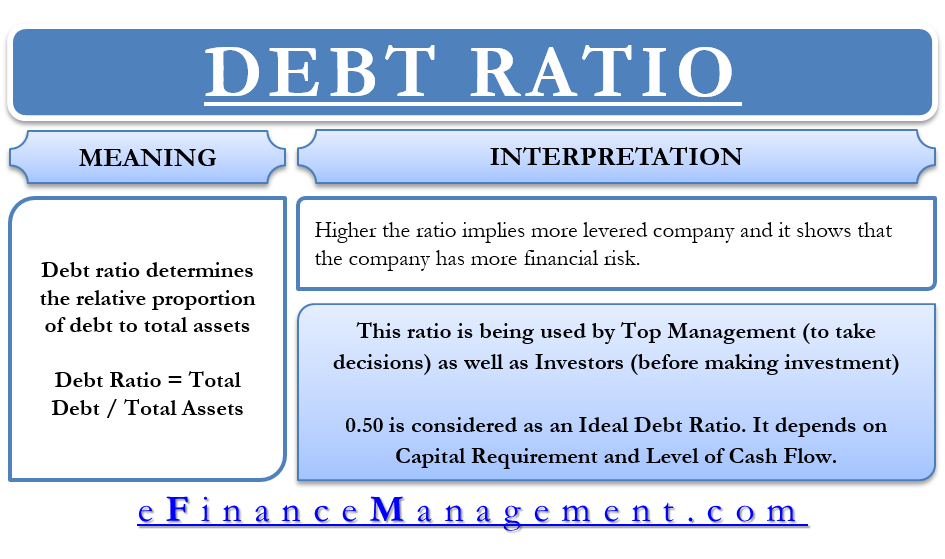

Definition and importance of financial ratios. Financial ratios are the indicators of the financial performance of companies. Also called financial leverage ratios, solvency ratios compare a company's debt levels with its.

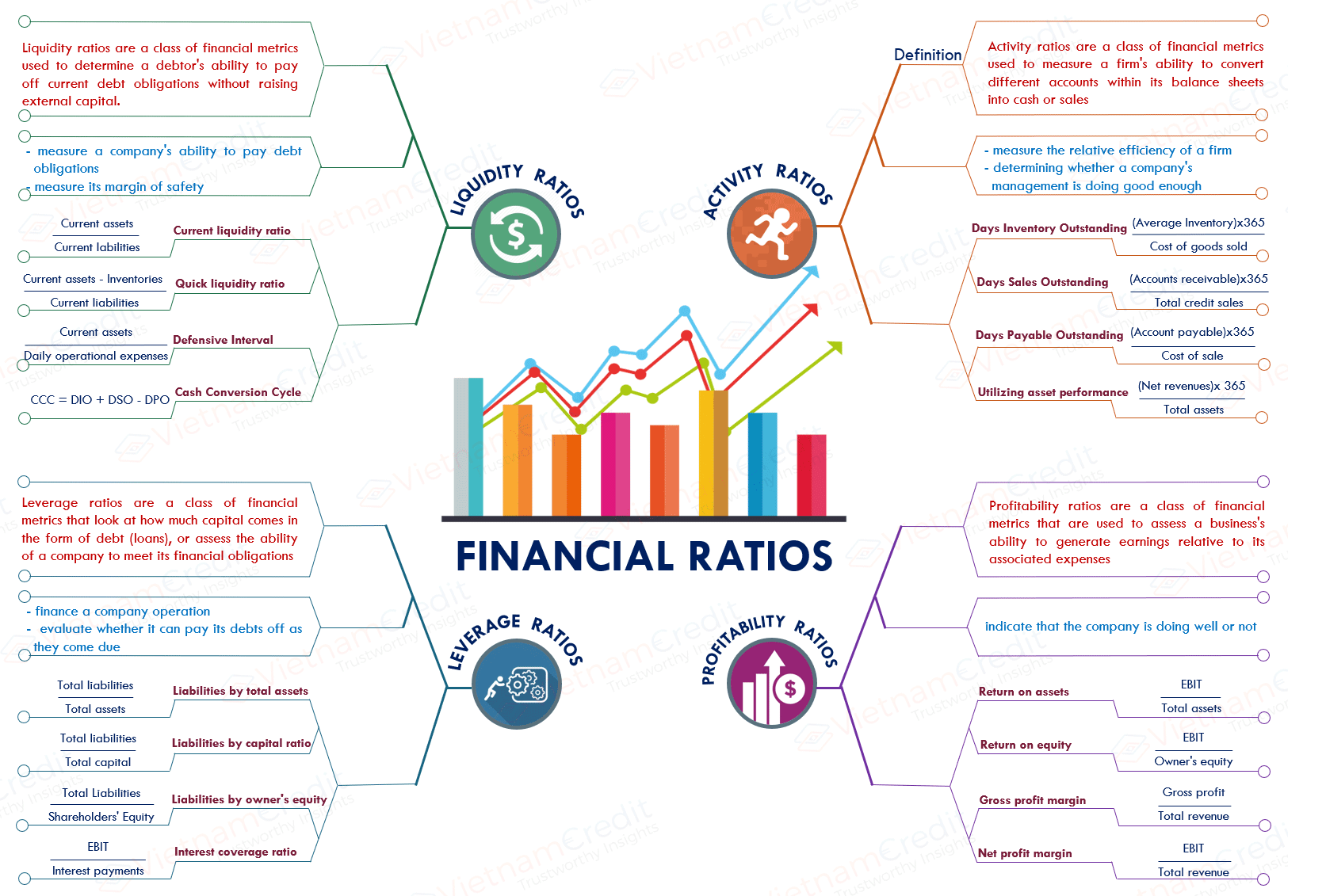

Liquidity ratios, leverage financial ratios, efficiency ratios, profitability ratios, and market value ratios. Financial ratios are numerical expressions that indicate the relationship between various financial statement items, such as assets, liabilities, revenues, and expenses. The most useful comparison when performing financial ratio analysis is trend.

The liquidity ratios answer the question of whether a business firm can meet its current debt. There are five types of financial ratio: The term liquidity refers to how easily a company can turn assets into.

One can use it to evaluate the ability of a company’s core operations to generate a profit. The us business school, part of the. Often used in accounting, there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization.

Financial ratios that are used frequently include the gross margin ratio, return on assets ratio and return on equity ratio. A financial ratio is a representation of numbers that show the state of a company's finances. Operating income ratio.

It is mainly used as a way of making fair comparisons across time and between different companies or industries. They are mainly used by external analysts to determine various aspects of a business, such as its profitability, liquidity, and solvency. A financial ratio is a metric usually given by two values taken from a company’s financial statements that compared give five main types of insights for an organization.

A leverage ratio is any one of several financial measurements that look at how much capital comes in the form of debt (loans) or assesses the ability of a company to meet its financial. The financial ratio is not a calculation but an explanation of the economic status of a company, in terms of profit, liquidity, leverage, and market valuation. Ratios are comparison points between different figures in a business' financial statements.

What are financial ratios? The financial ratio or financial indicators are coefficients or reasons that provide financial and accounting units of measurement and comparison, through which, the ratio (division) together two data direct financial, allow analyzing the state current or past an organization to function at optimum levels defined for it. Types of financial ratios liquidity ratios.