One Of The Best Info About Journal For Bad Debt Provision

Bad debt exp —————dr.

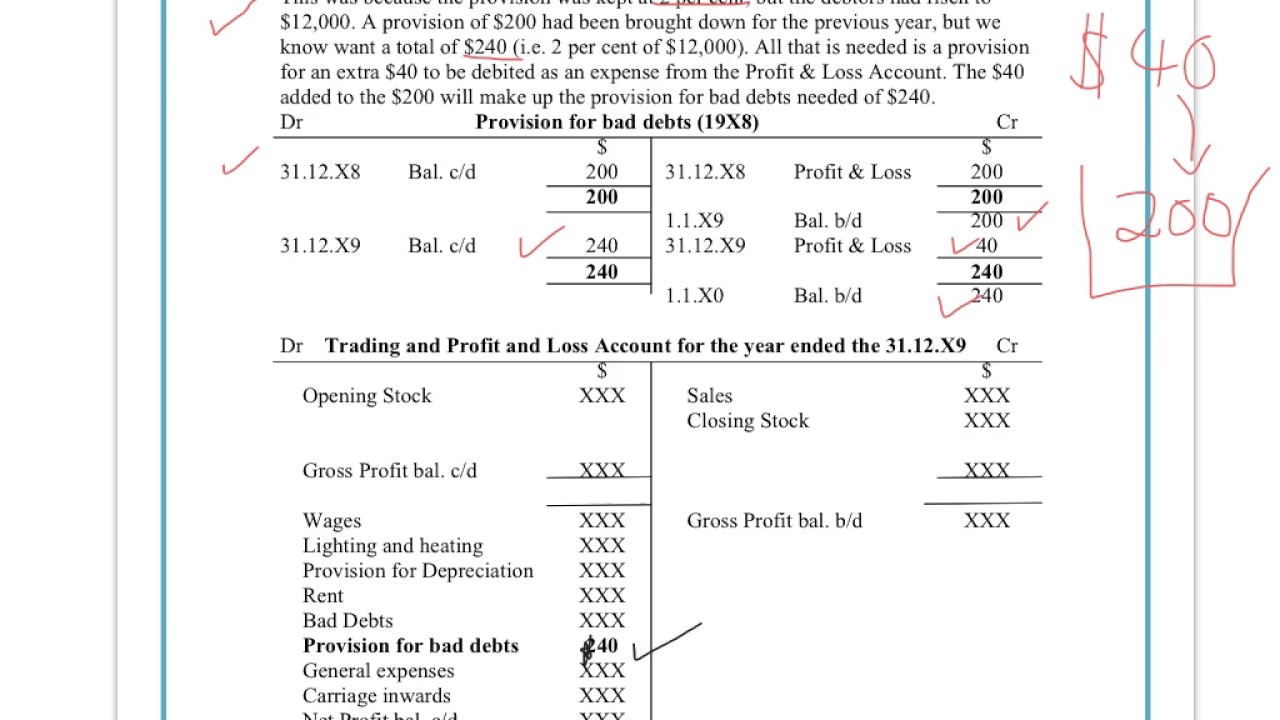

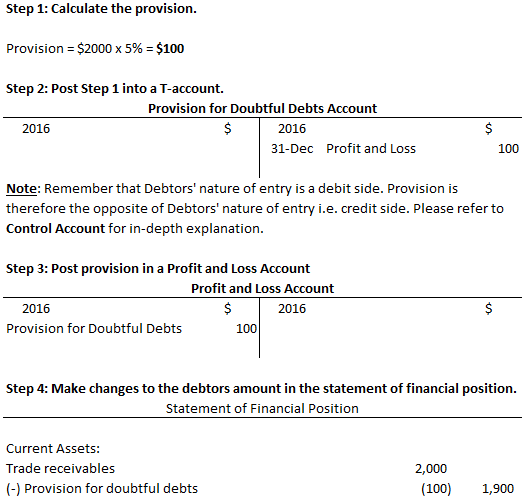

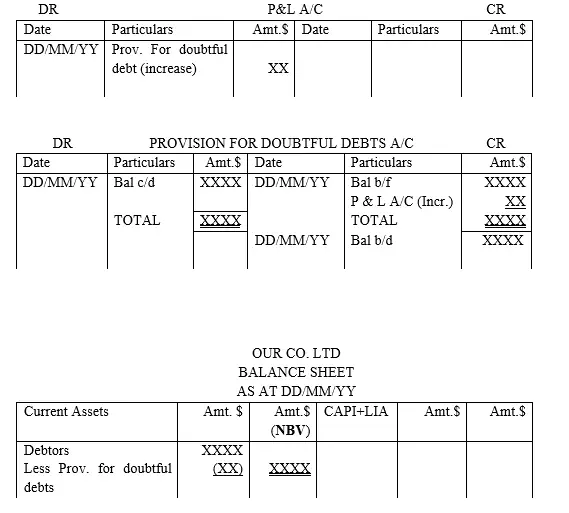

Journal for bad debt provision. In the first year 1. Provision for doubtful debts, on the one hand, is shown on the debit side of the profit. The provision for doubtful debts is the.

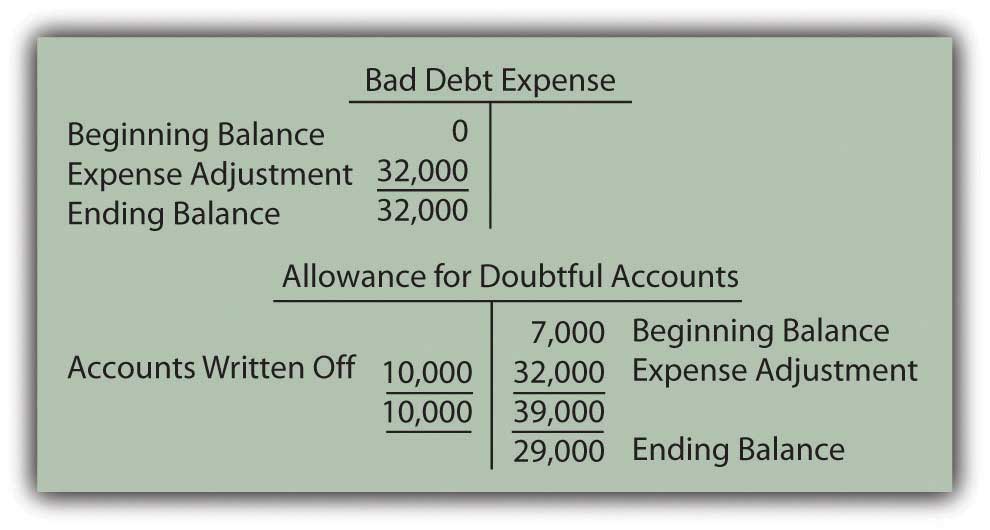

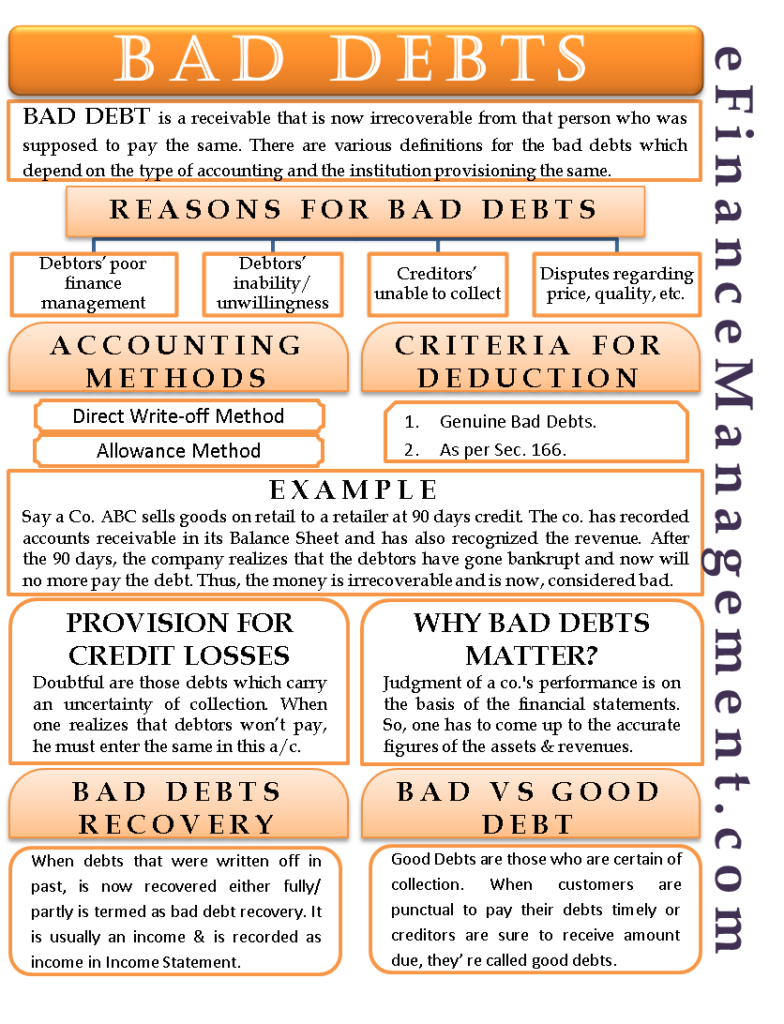

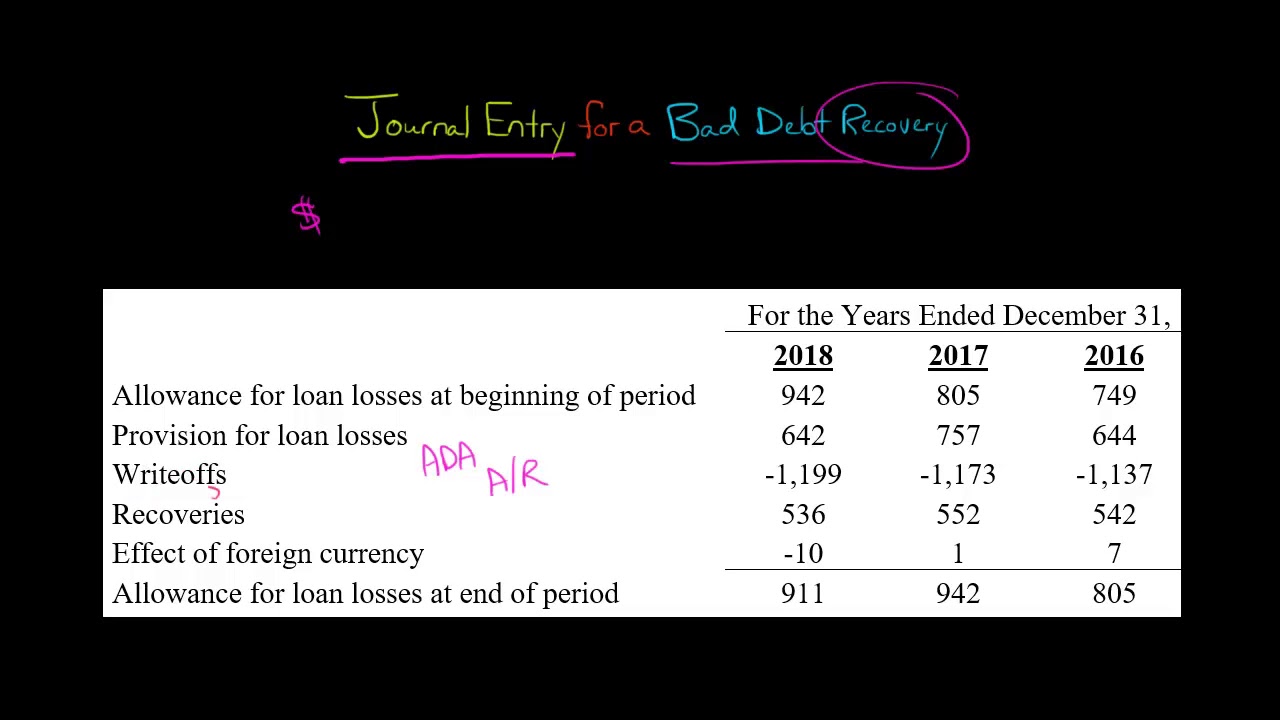

Planning for this possibility by estimating the amount of uncollectible loans is called bad debt provision and can enable companies to measure, communicate, and. When you decide to write off an account, debit allowance for doubtful accounts. Overview, calculate, and journal entries.

Any company that has a policy of selling goods on credit has to deal with the problem of bad debts. The journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. Provision for bad debts account cr:

The following journal entry is made to record a reduction in provisions for bad or doubtful debts: Bad debt provision is used for doubtful debts. Why do businesses need provisions for bad debts?.

A bad debt provision is a reserve against the future recognition of certain accounts receivable as being uncollectible. Bad debt provision. Journal entries for a provision for bad debts.

Provision for bad debts the provision for bad debts is not the same as bad debts. For provision for bad debts journal. The bad debt provision accounting process allows the management to prepare for potential losses.

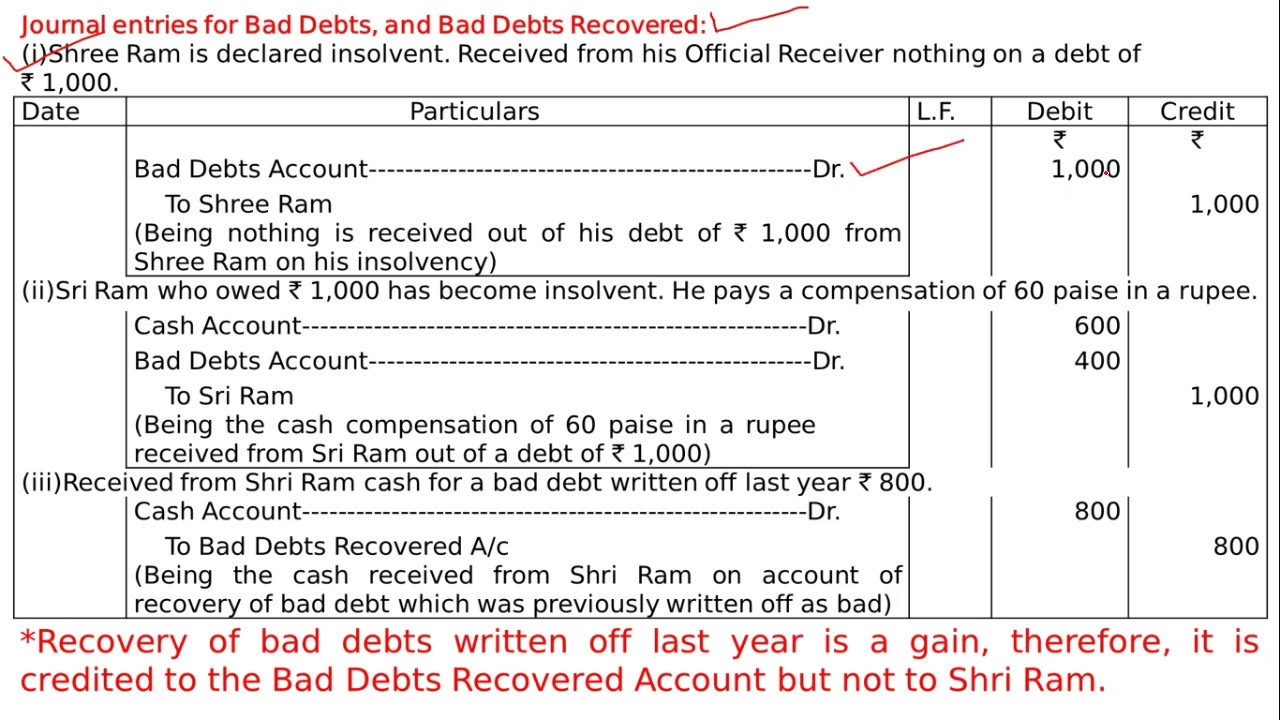

Let us understand the journal entries passed for different scenarios where the debt from a potential defaulting customer is identified. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. November 08, 2023 what is a bad debt provision?

A journal entry is made to write off a provision for bad debt expenditure if a receivable appears on your statement of financial position that you no longer deem. We may come across two methods of journal entry for bad debt expense as below: This method involves recording an estimate of the amount likely to be uncollectible and.

The provision for doubtful debts is also known as the provision for bad debts and the allowance for doubtful accounts. The provision for doubtful debts is an estimated amount of bad debts that are. New provision for bad debts is deducted from debtors in balance sheet.

It may also be necessary to reverse any related sales. Table of contents what is bad debt?

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)