Supreme Tips About Loss On Disposal Journal Entry

When you lose control of your subsidiary by the full sale of shares, ifrs 10 requires you to:.

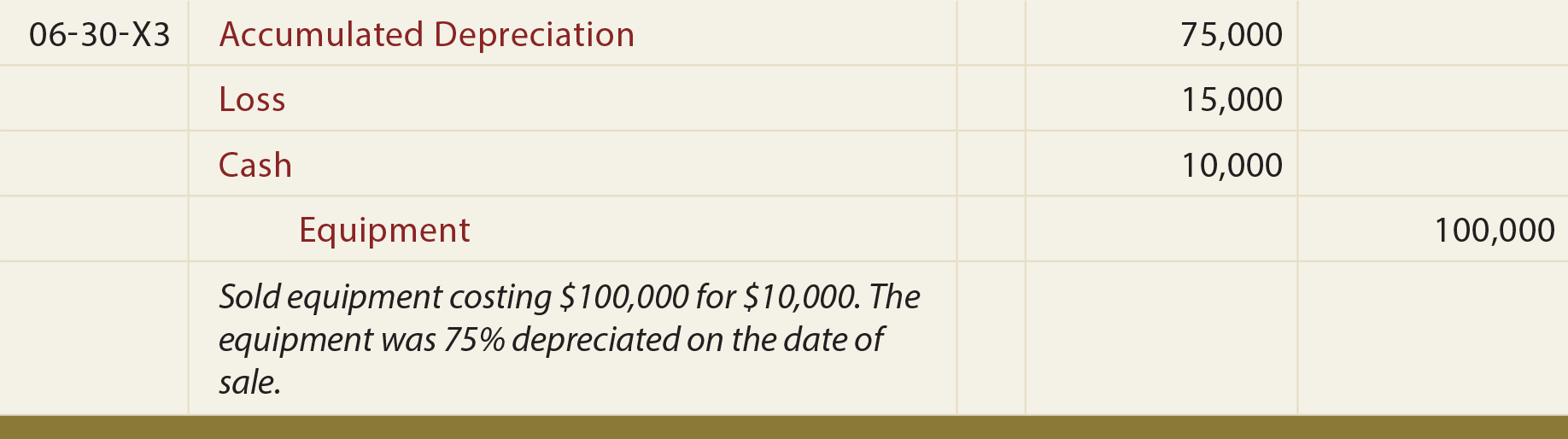

Loss on disposal journal entry. This journal entry is made to remove the $10,000 equipment that has been fully depreciated and is no longer useful for our business as of december 31. This is important to totally eliminate all hints of a resource from the monetary. Asset disposal with a loss.

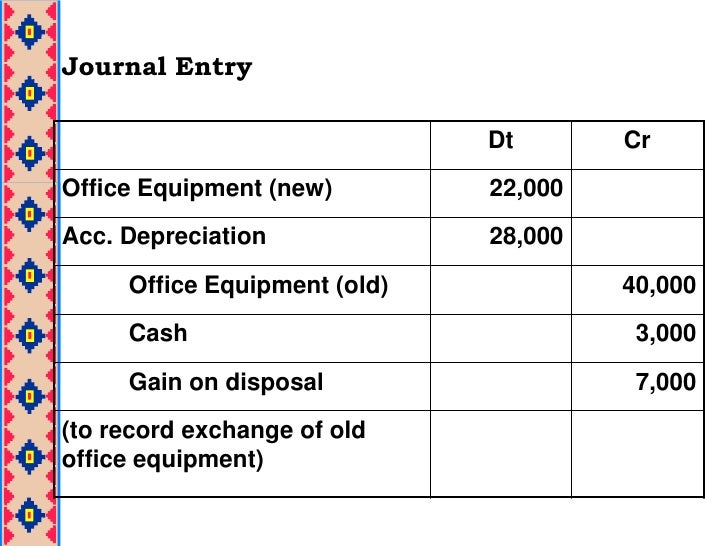

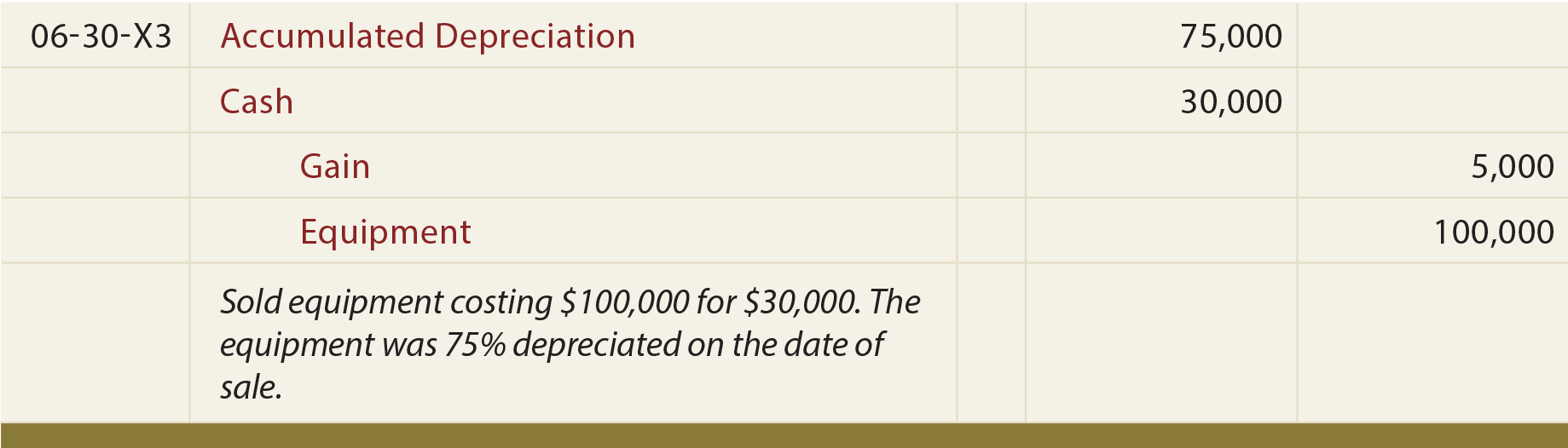

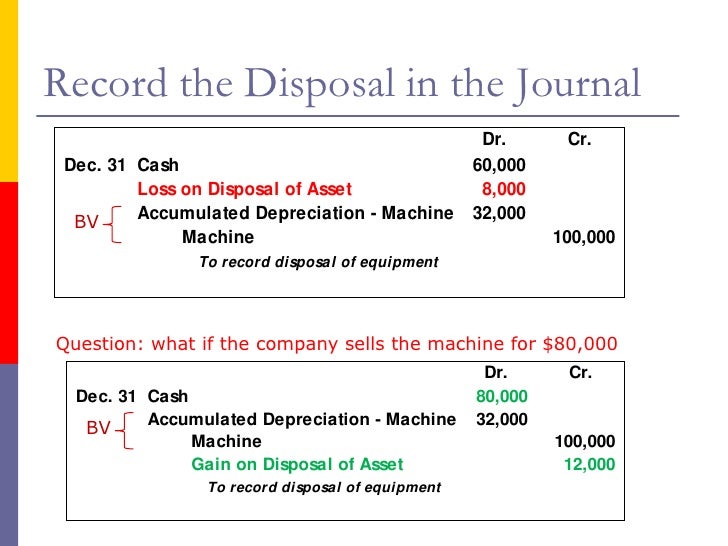

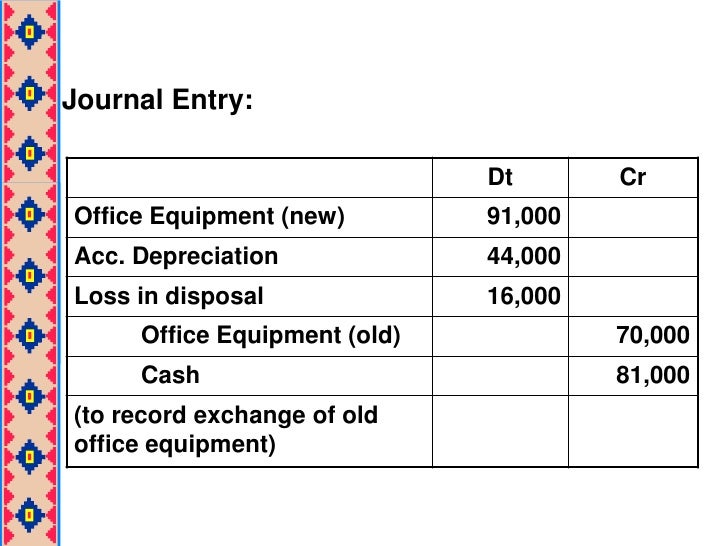

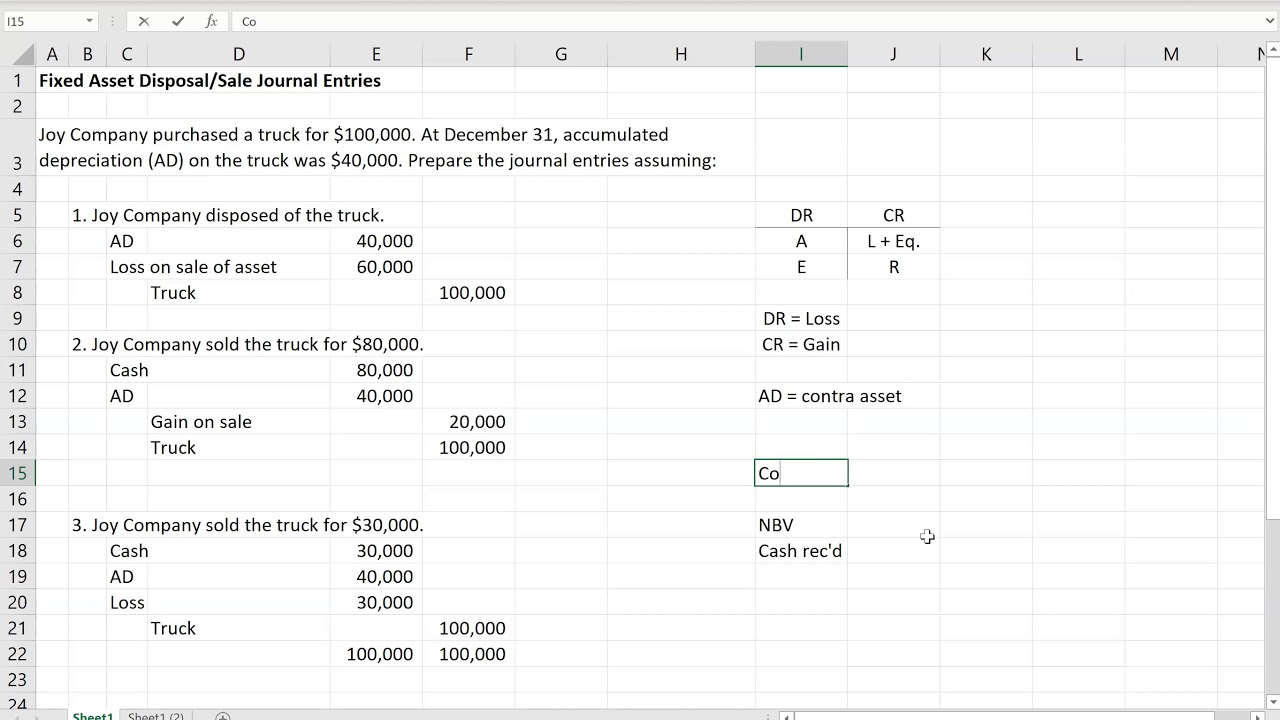

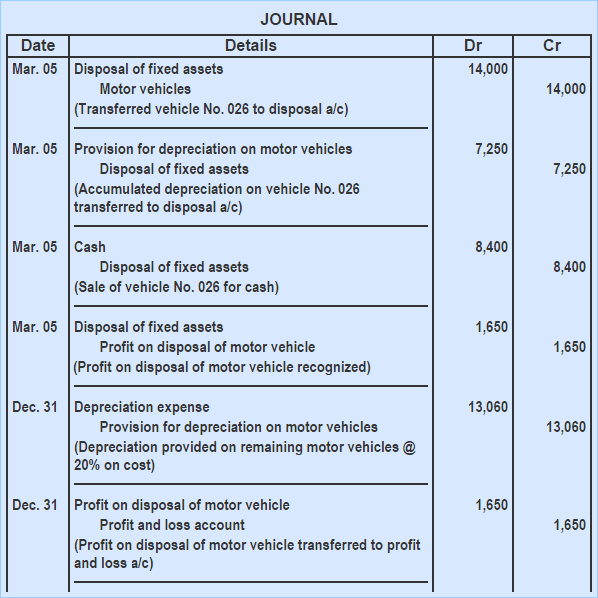

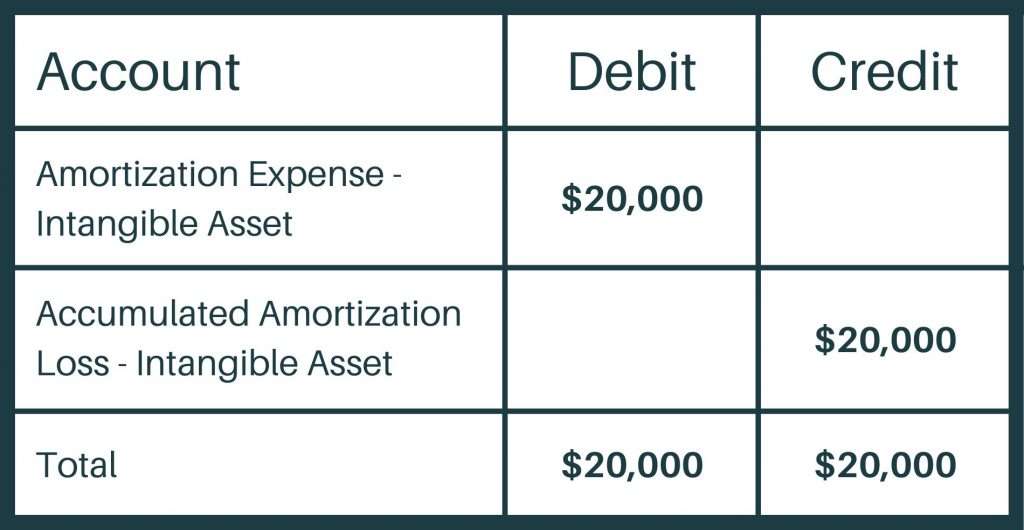

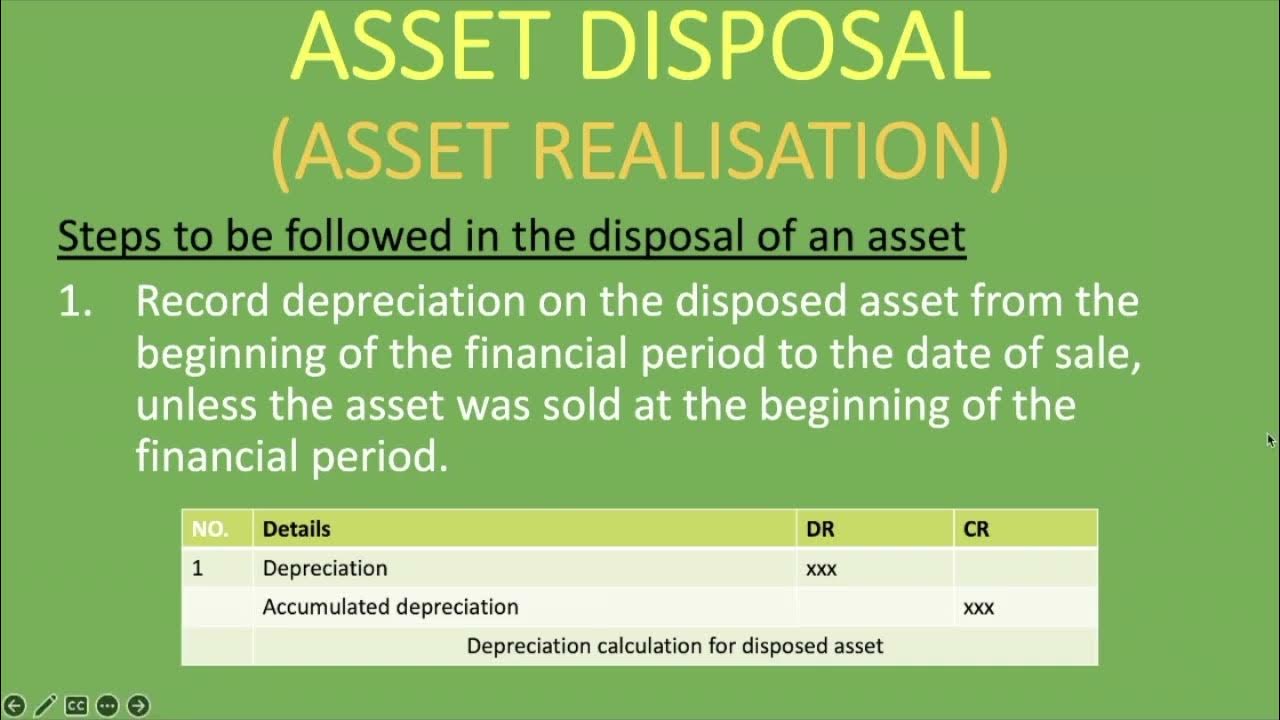

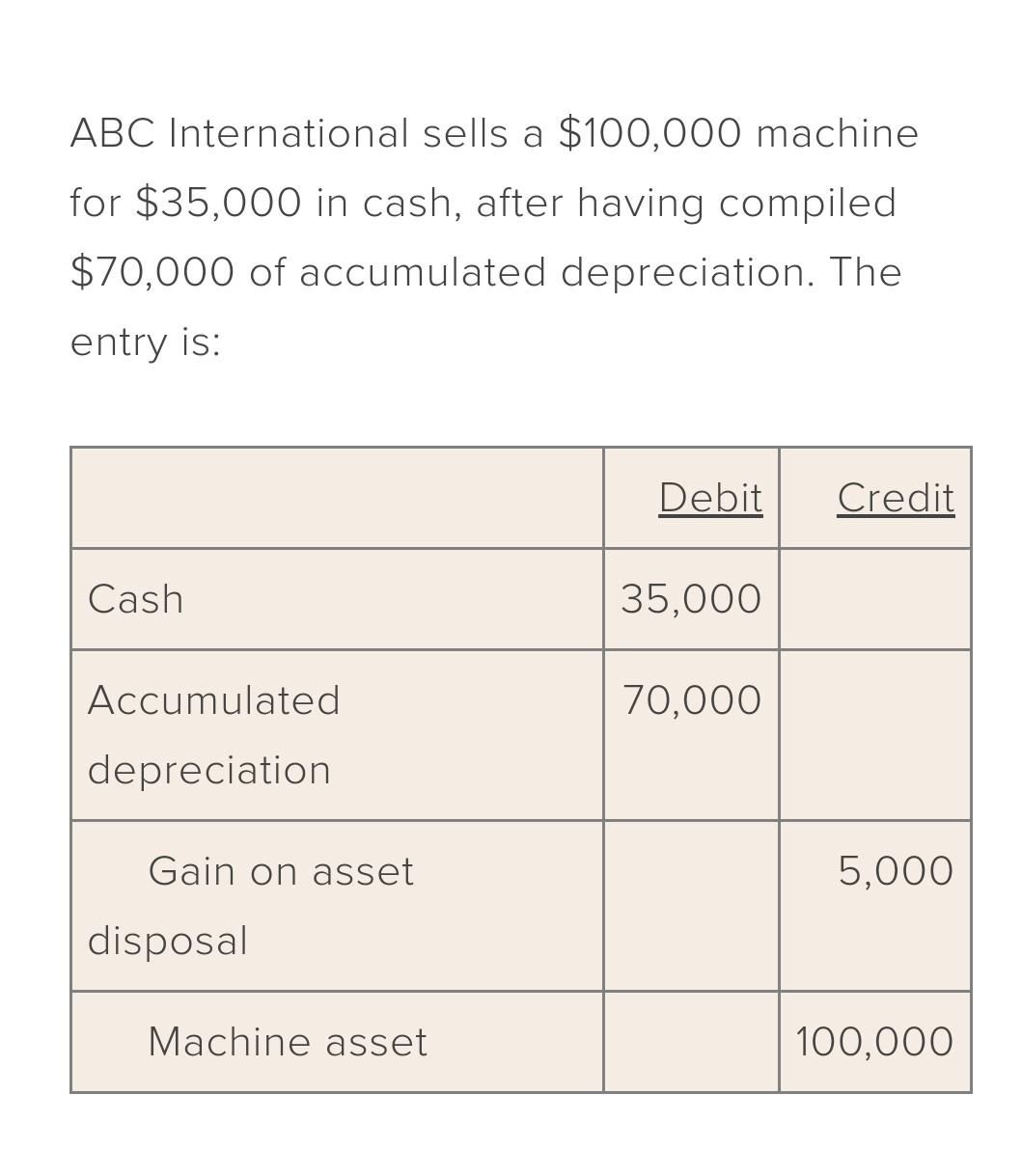

Journal entries of asset disposal with losses. The disposal of the asset requires a debit to accumulated depreciation and a credit to the original cost, resulting in a loss. The gain or loss is calculated as the net disposal proceeds, minus the asset’s carrying value.

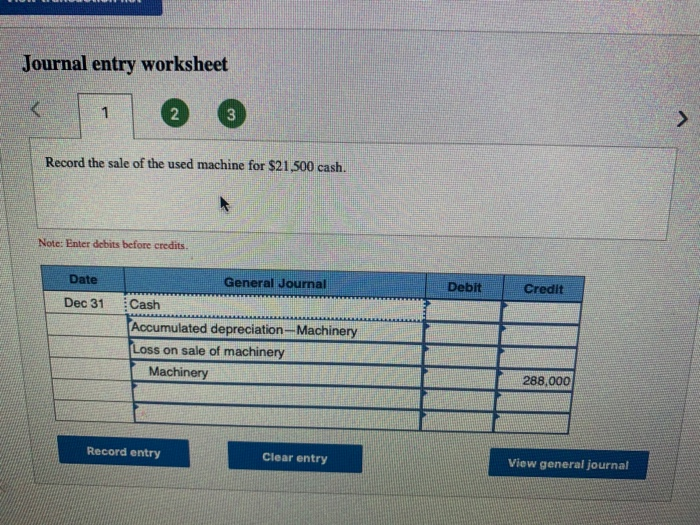

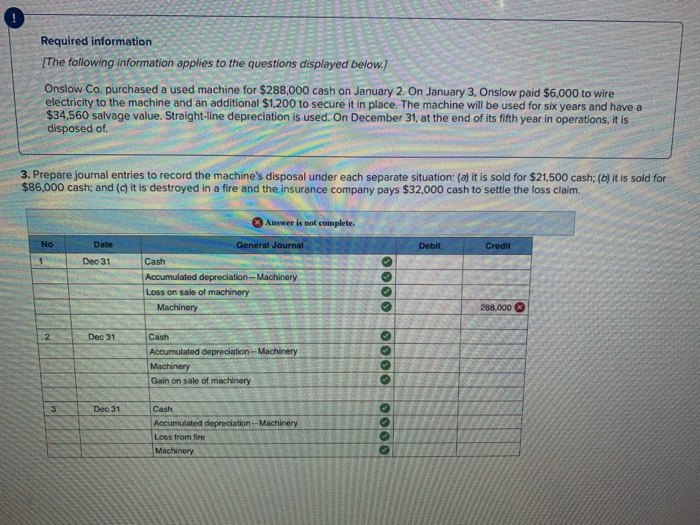

Let’s consider the same situation as in scenario 2, but the selling price was only. Accounting disposal of assets includes eliminating resources from the bookkeeping records. The loss on disposal of fixed asset account in this journal entry is usually reported under the other expenses section of the income statement.

Reduce fixed asset £360 reduce accumulated depreciation £60 post to p&l expense £300 the balance sheet before the adjustment. What deconsolidation procedures should a parent perform? Entries to be completed to the accounts:

The journal entry for the disposal should be: The journal entry for gain or loss on fixed asset disposal above will remove both the disposed fixed asset and its related item (e.g. Journal entry for loss on sale of fixed assets is shown on the debit side of profit and loss account.

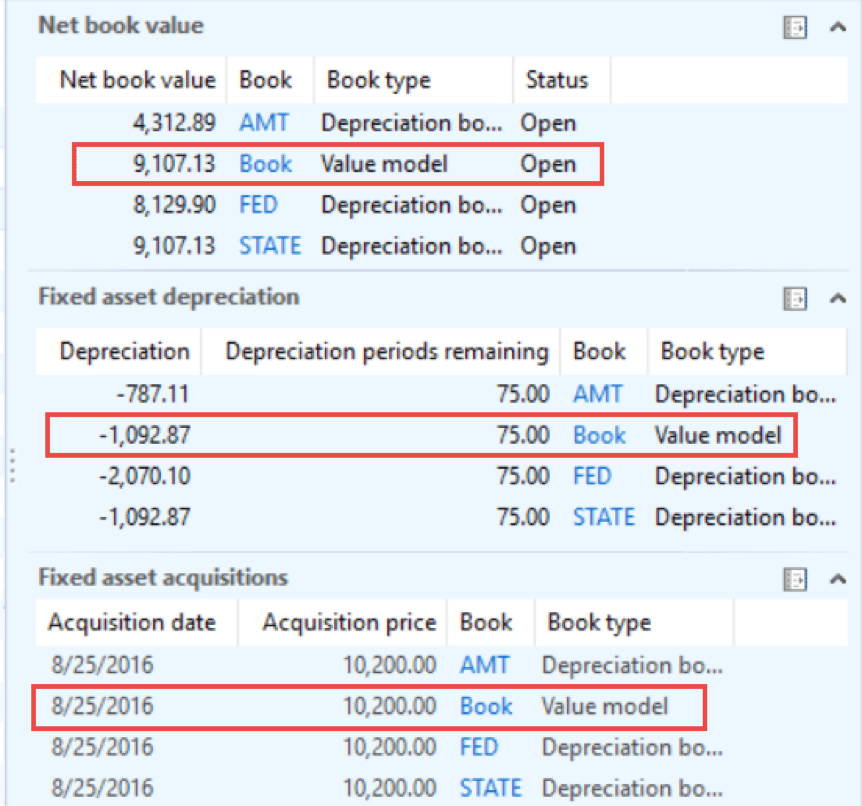

The options for accounting for the disposal of assets are noted. Fixed asset disposal accounting. Please prepare a journal entry for fixed assets removal.

Disposal of the fixed assets journal entry is an accounting transaction recorded in a company’s books to recognize the sale or disposal of fixed assets. When the carrying amount exceeds the proceeds, a loss on disposal is recognised. In this case, we can make the journal entry for the disposal of the $5,000 leasehold improvement that is not fully amortized by recording the unamortized balance of $1,000.

Disposal by asset sale with a loss. When an asset is disposed of with a loss, the journal entries will involve recognizing the loss and removing the. Christine jonick university of north georgia via galileo open learning materials a company may no longer need a fixed asset that it owns, or an asset may.

Loss on disposal of a fixed asset if a fixed asset is sold at a price lower than its carrying amount at the date of disposal, a loss is recognized equal to the excess of. Asset sold with a loss pho my life (pml) noodle shop has sold a piece of kitchen equipment that was not fully depreciated equipment original cost:. Assets should be removed from the accounting records when an asset has been disposed of.