Best Of The Best Info About Negative Accounts Payable On Cash Flow Statement

Low profits your business’s primary source of income is profit.

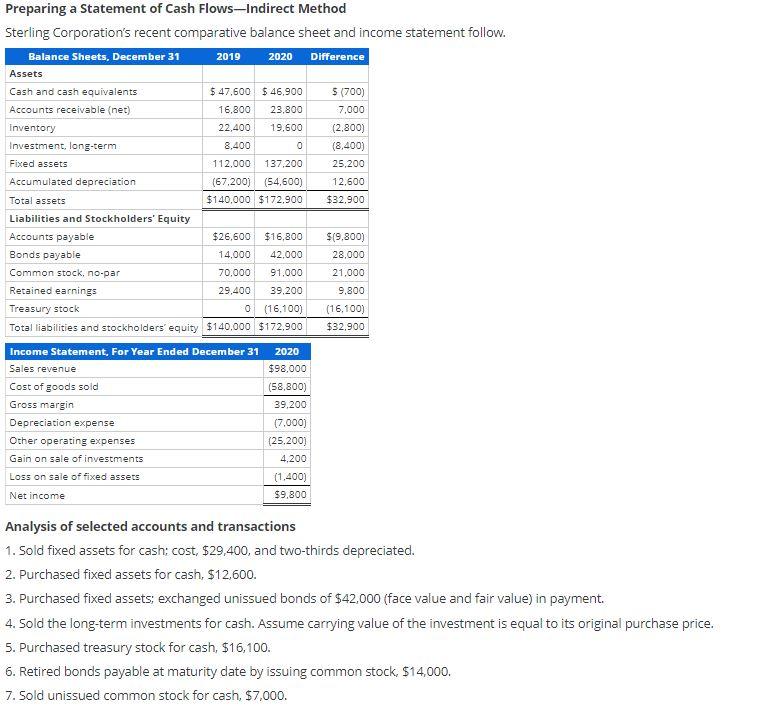

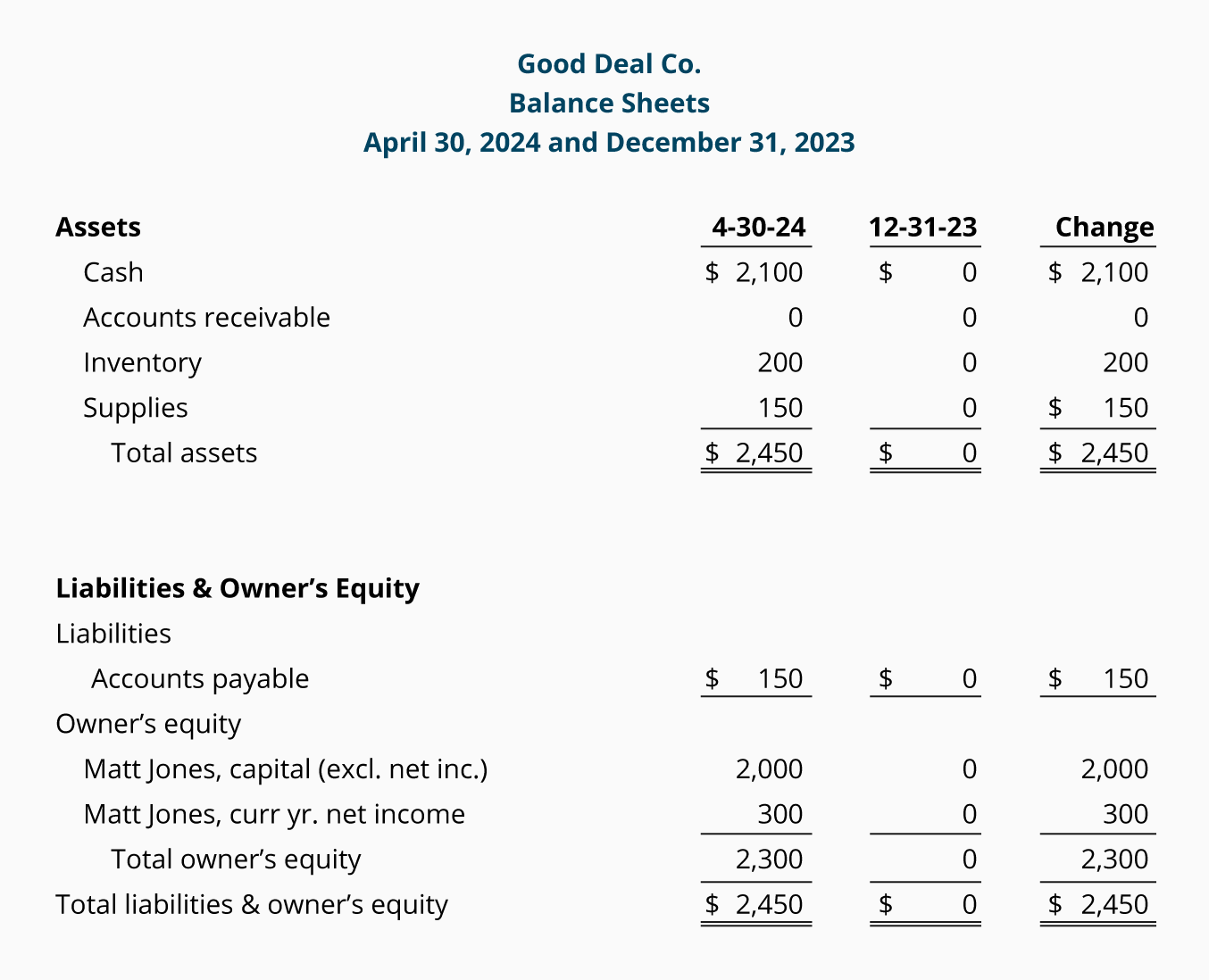

Negative accounts payable on cash flow statement. For this reason, a decrease in accounts payable indicates negative cash flow. A decrease in the accounts payable means a decrease in the available cash. Negative cash flow vs.

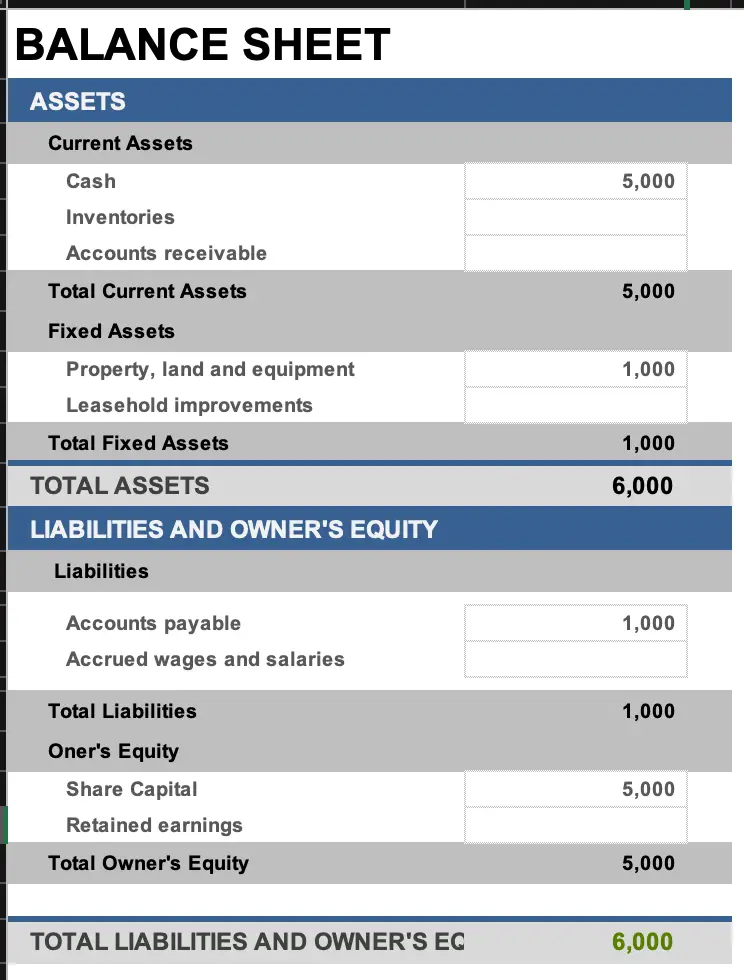

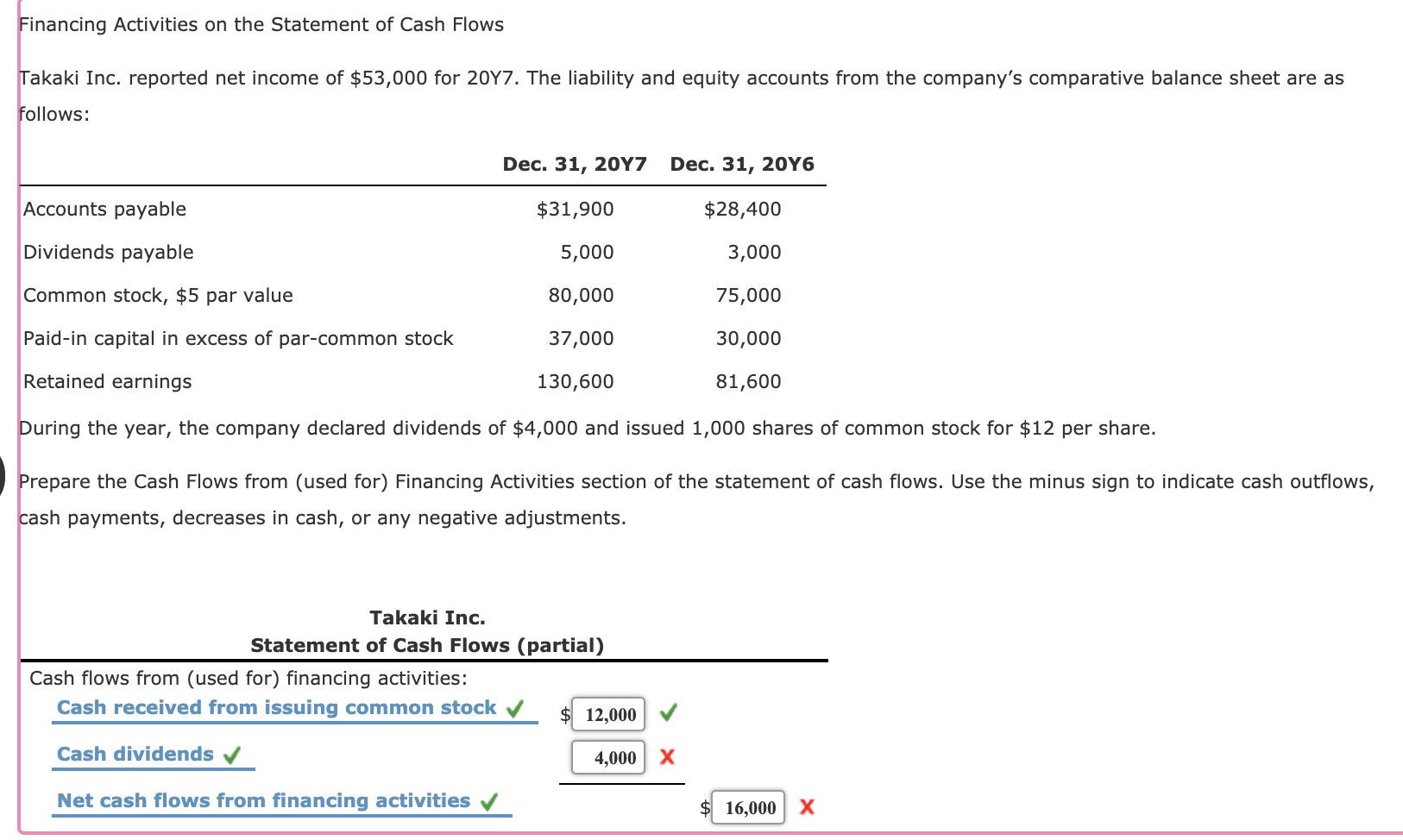

The average payable period is the best indicator of your success in managing your cash. This means that the decrease in accounts payable has a negative effect on cash flows. How should you account for cash overdrafts (also called negative cash balances) on a balance sheet and in a cash flow statement?

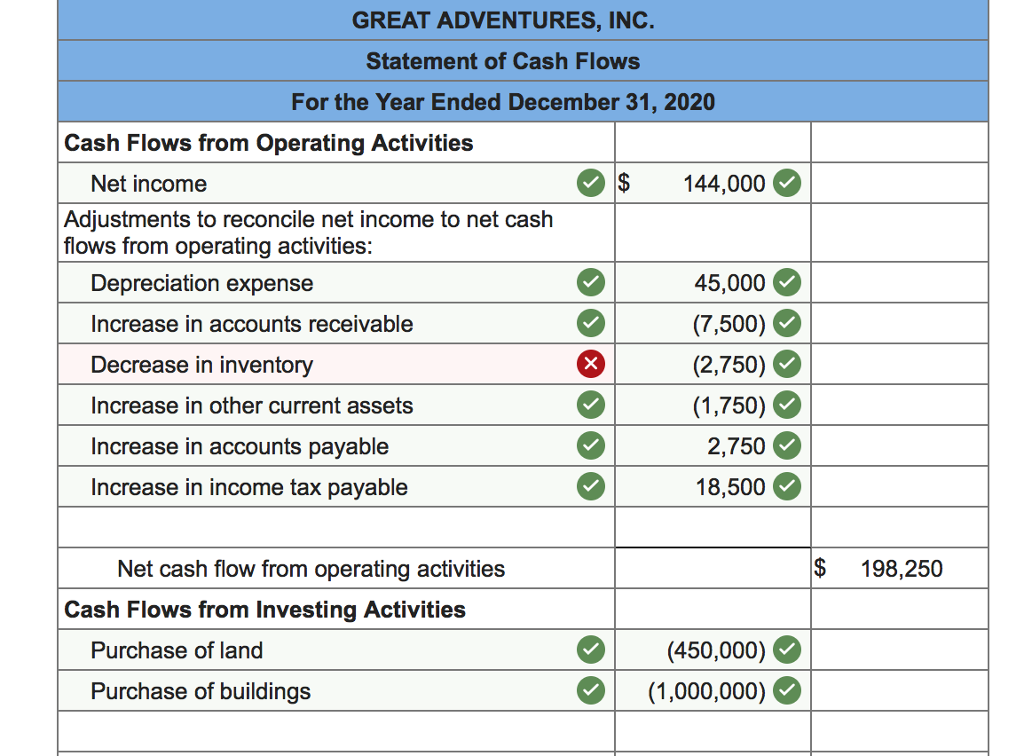

As a result, it will decrease the cash flow for the business in the current period. Of course, it cost your business money to manufacture or provide goods or services. However, this will lead to a decrease in cash balance (credit) as a result of cash outflow from the business.

And then if there is an increase in the account payable during the time for which the cash flow statement is prepared. Why do account payable (ap) show a negative balance? Negative cash flow is not always a cause for alarm;

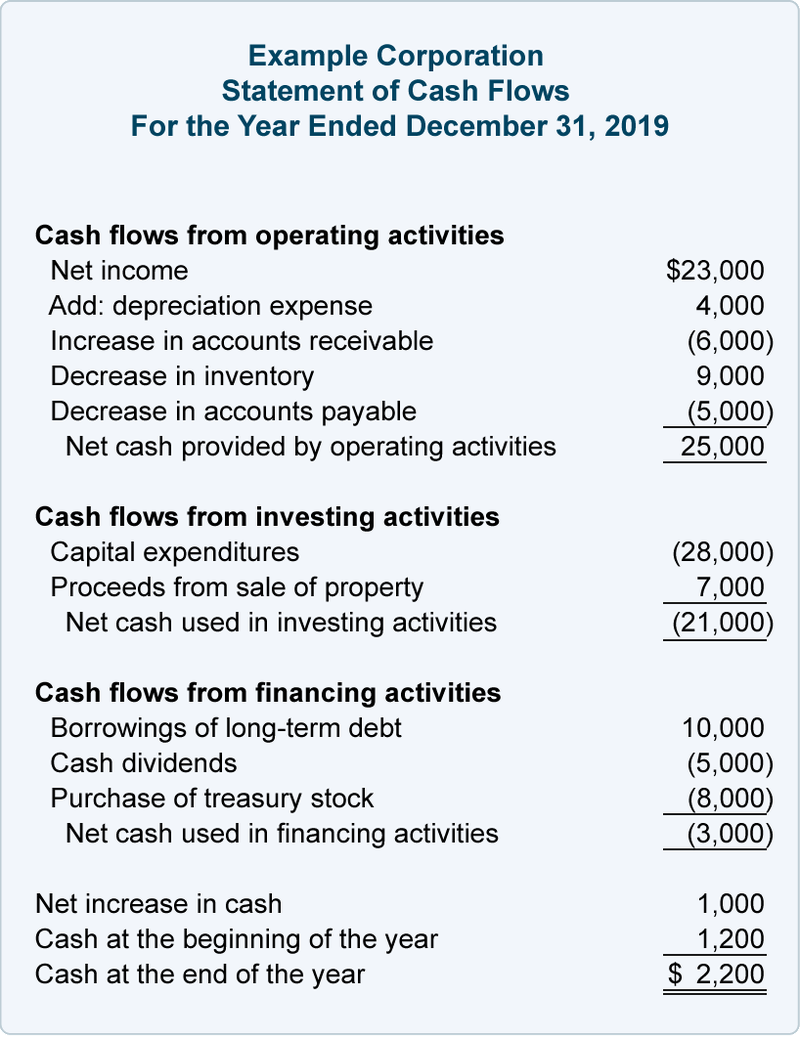

A negative number means cash flow decreased by that amount. Positive cash flow vs. It means a payment to creditors actually has a negative impact on the cash flow of a business.

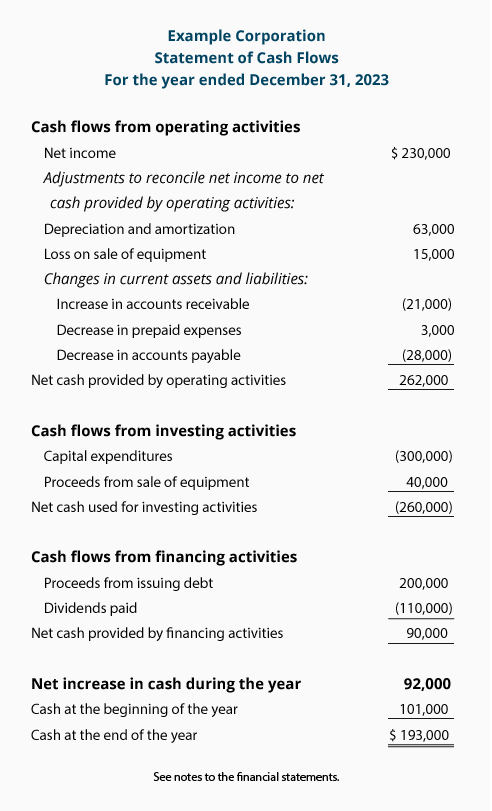

The cash flow statement serves as a bridge between the income statement and the balance sheet. However, just because you have a negative number does not mean you need to panic. Accounts payable is a liability, a guarantee that you will take care of that account.

Without payables and trade credit you'd have to pay for all goods and services at the time you purchase them. The interest rate and terms. Thus, it will be denoted through a decrease in the cash flow statement.

When the amount is due. Company spends $ 500,000 to purchase the inventory (100,000 units x $5/unit) company earns 300,000 from selling inventory to customers (30,000 units x $10/unit) inventory increase from 40,000 units to 110,000. Provisions for bad debts and inventory;

The account payable was remeasured at the beginning of the quarter at $1,200 and the long term note at $120,000. Since accounts payable is money owed to vendors which still need to be paid, it is reflected as positive cash flow in the statement. Similarly, accounts receivable, money yet to be received from customers, is accounted as negative cash flow in the cash flow statement.

When your cfs has a negative number, that means you lost money during that accounting period (for example, you spent more cash than you received). Next, do the same thing for accounts. When the bill is paid, the accountant debits accounts payable to decrease the liability balance.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)