Simple Info About 26as And Form 16

The first step in the income tax return filing process is to gather all the required documents.

26as and form 16. One of the critical pieces of material included in form 16 part a is a clear account of the tds deposits taken on. One can login to traces website to check whether the. To be able to file your itr, it is essential that tax credit in form 26as and form 16 should be the same.

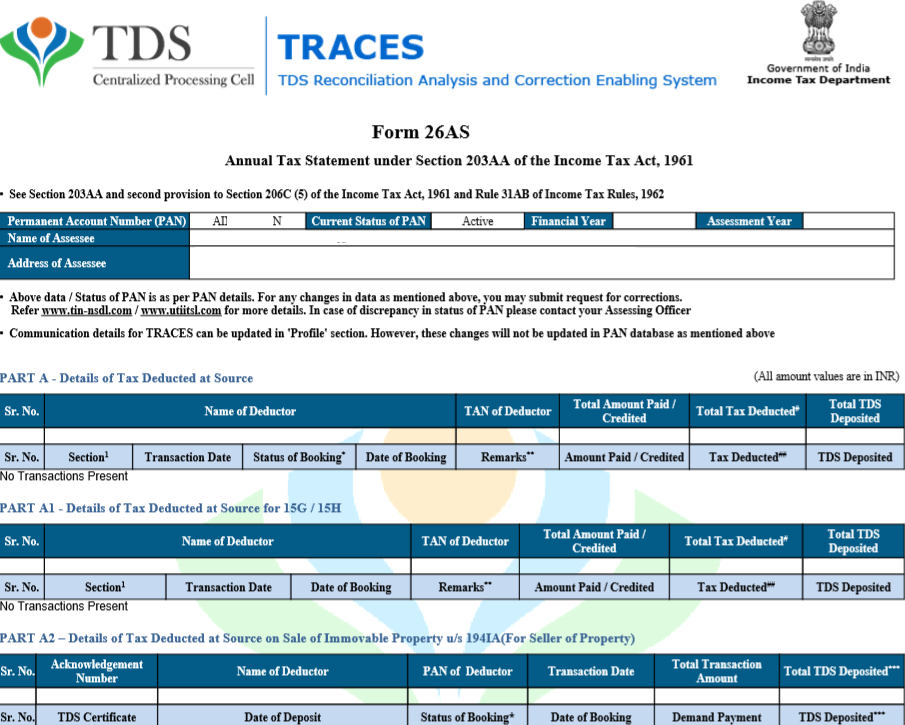

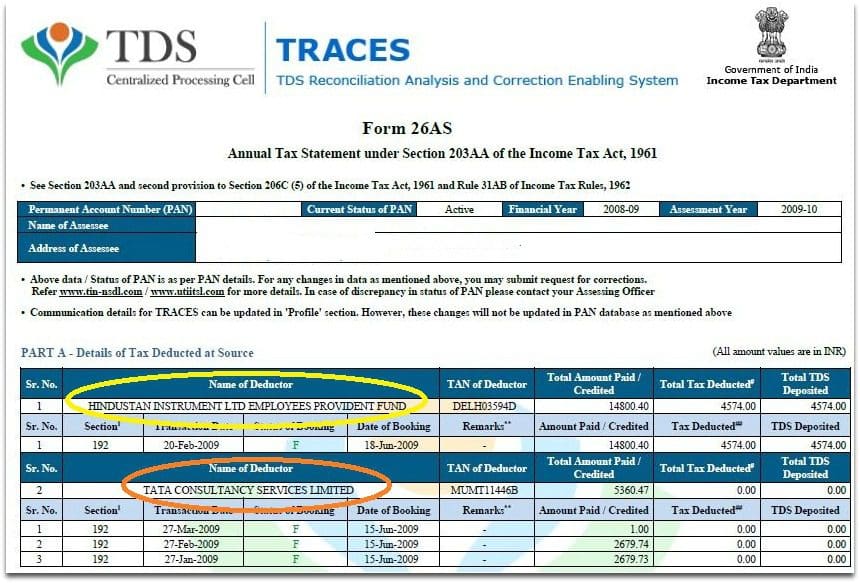

The form 26as records information of all the taxes paid by the taxpayer or sign in join Easily, taxpayers can verify online in the traces whether the deductions made by the employer or tax deductor. Understanding form 16 and form 26as.

As we have seen above, form 16 and form 16a are used by the employer for tds deduction. Waiting for the final updates minimizes the chances of mismatches between form 16 and form 26as. This tax document is issued by the income.

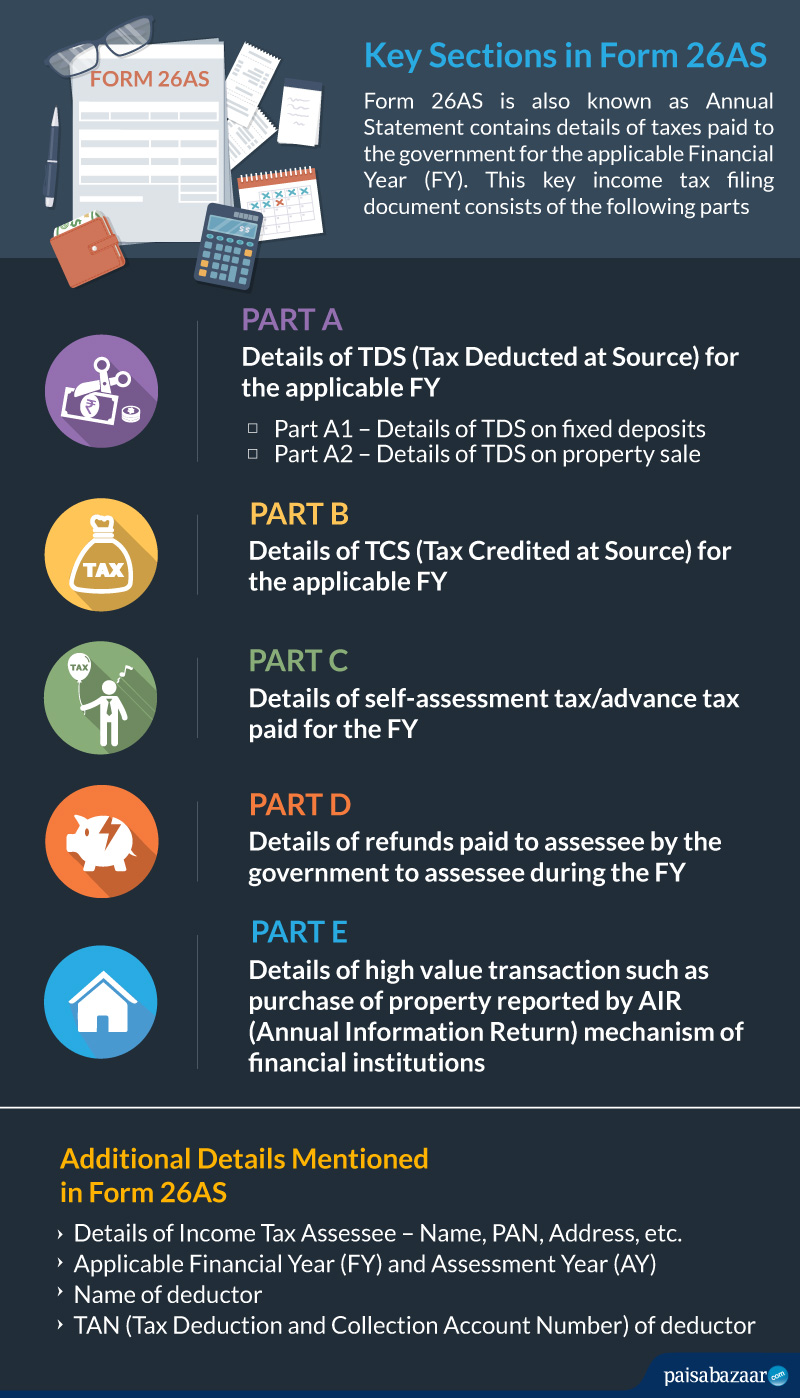

The form 26as contains details of tax deducted on behalf of the taxpayer (you) by deductors (employer, bank etc.). Part a includes details like your employer's name, address, and pan (permanent account number), along with your. Form 16 has two parts:

Ensure that you have received the correct. Difference between form 16 and. Every salaried individual who falls under the taxable bracket is permitted for form 16.

This is where form 26as comes into the picture. Similarly, ais is the extension. In this video we have explained everything about form 26 as and form 16 / form 16a.

Is there a connection? Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer. Form 16 shows the tds deducted from your salary income and is issued by the employers.

The employer is not obligated to provide this form if an employee does not fall. On the other side, as a part of e. Part a and part b.

So, tds deductions that are given in form 16 / form. This digital reconciliation ensures no. Form 16 is a certificate issued by employers to their employees which gives a detailed summary of the salary paid to the employee and the tds deducted on the.

It’s imperative to know from an employee’s perspective that the tax deducted from their salary is paid to the it department or not. Form 26as reflects all details mentioned in form 16; Both the forms are explained with the help of real example for the clarity.