Top Notch Tips About Accounting For Depreciation Expense

What is depreciation expense?

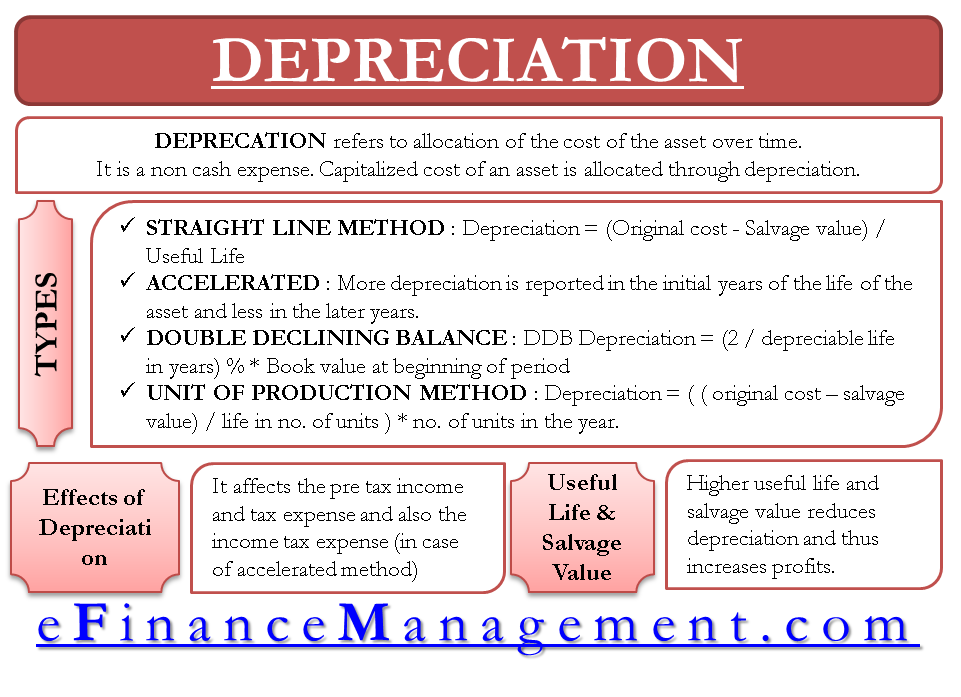

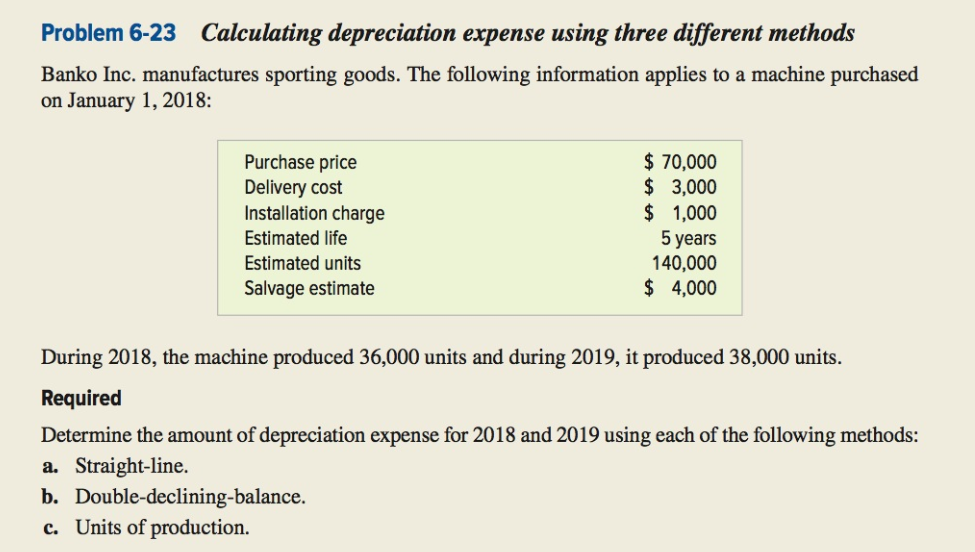

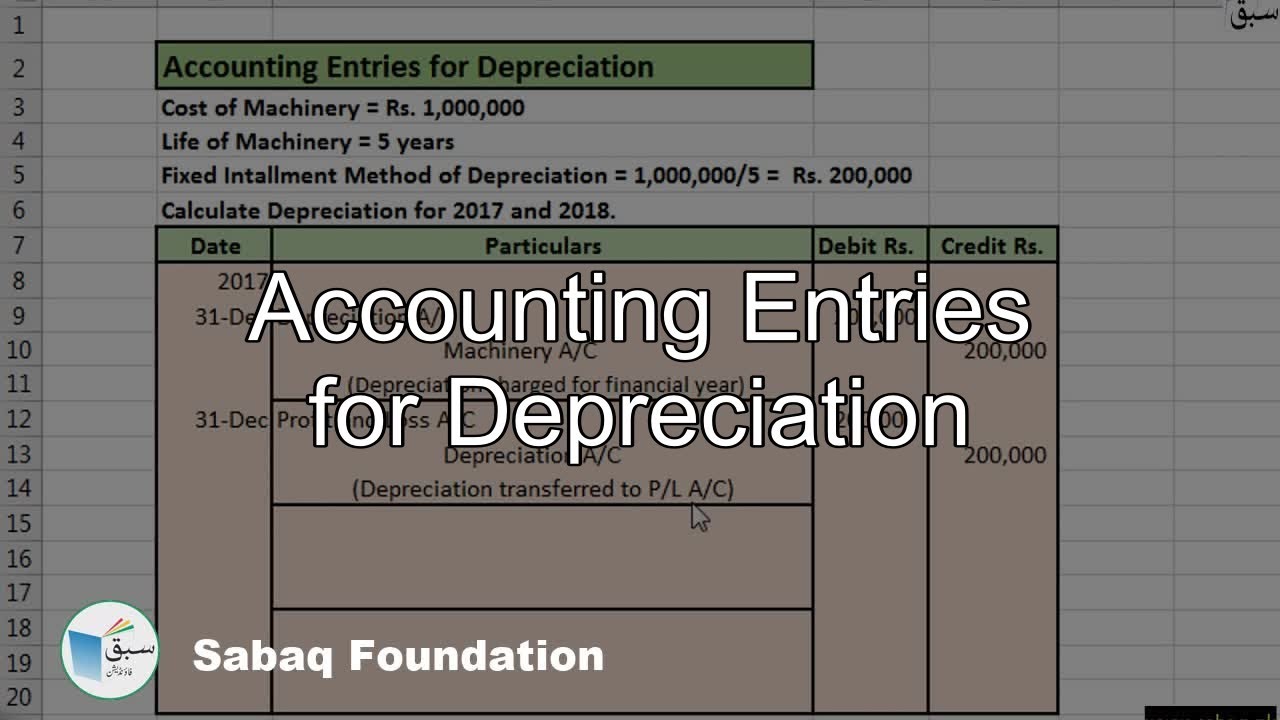

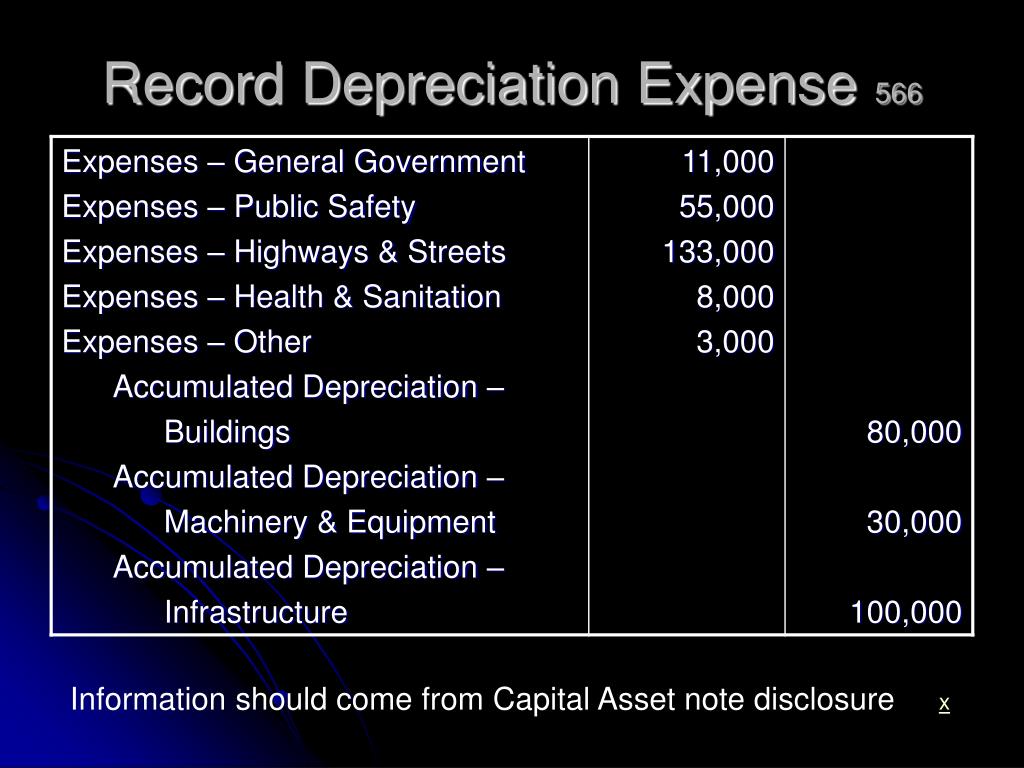

Accounting for depreciation expense. Depreciation expense is the cost of an asset that has been depreciated for a single period,. The basic journal entry for depreciation is to debit the depreciation expense account (which. It states that this cost should be capitalizing on its estimated useful life.

The intent of this charge is to gradually reduce the carrying amount of fixed assets as their value is consumed over time. How to calculate depreciation expense. The allocation is necessary to comply with the matching principle, ensuring that the expense of owning the asset is matched to the revenues generated by the asset.

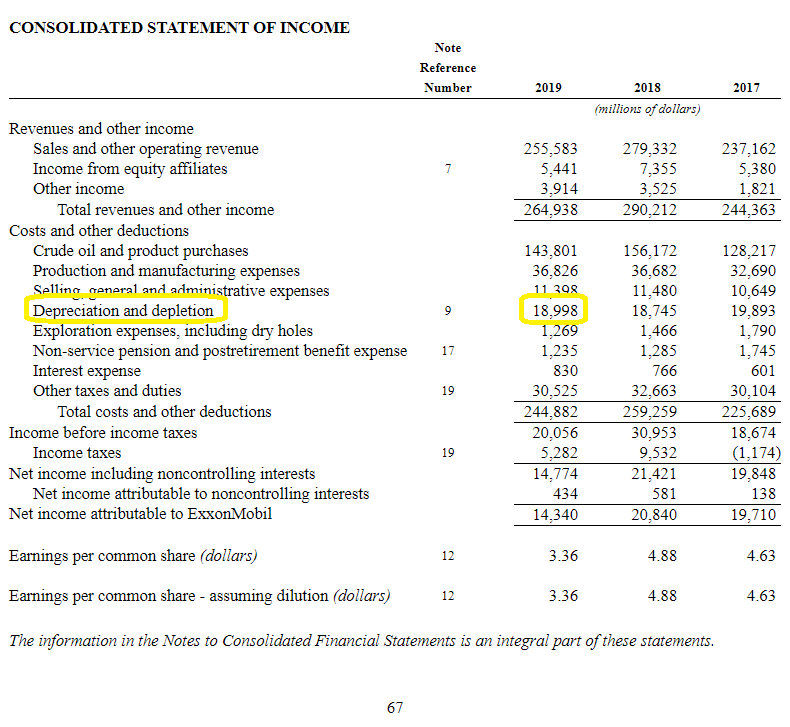

With the information in the example above, we can calculate the monthly depreciation expense as below: It represents how much of an asset's value has been used up, providing a way to match the cost of using an asset with the revenue it. Depreciation expense is the appropriate portion of a company's fixed asset's cost that is being used up during the accounting period shown in the heading of the company's income statement.

Depreciation is an accounting practice used to spread the cost of a tangible or physical asset over its useful life. This amount is then charged to expense. This is known as depreciation, and it is the source of depreciation expenses that appear on corporate income statements and balance sheets.

It is the depleting value of a tangible asset. Fixed assets lose value over time. Depreciation is a systematic process for allocating (spreading) the cost of an asset that is used in a business to the accounting periods in which the asset is used.

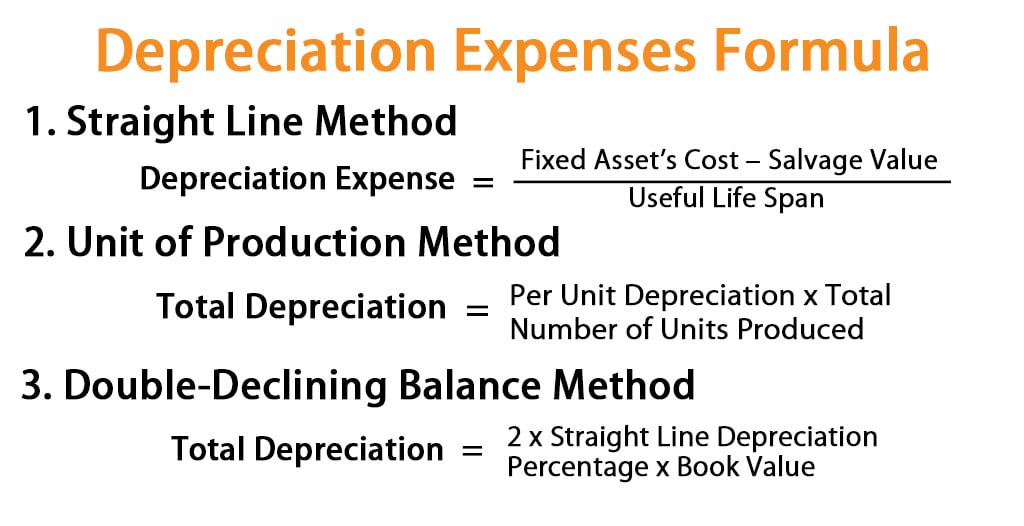

Depreciation expense is computed as: Depreciation is a financial accounting method used to allocate the cost of tangible assets over t. clearias on instagram: The recognition of depreciation is mandatory under the accrual accounting reporting standards established by u.s.

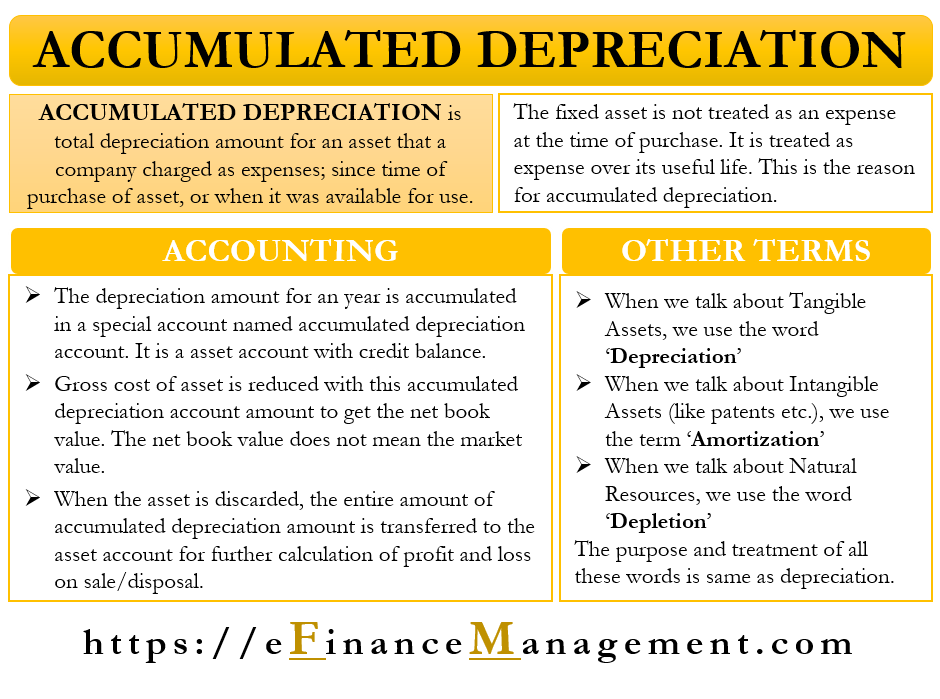

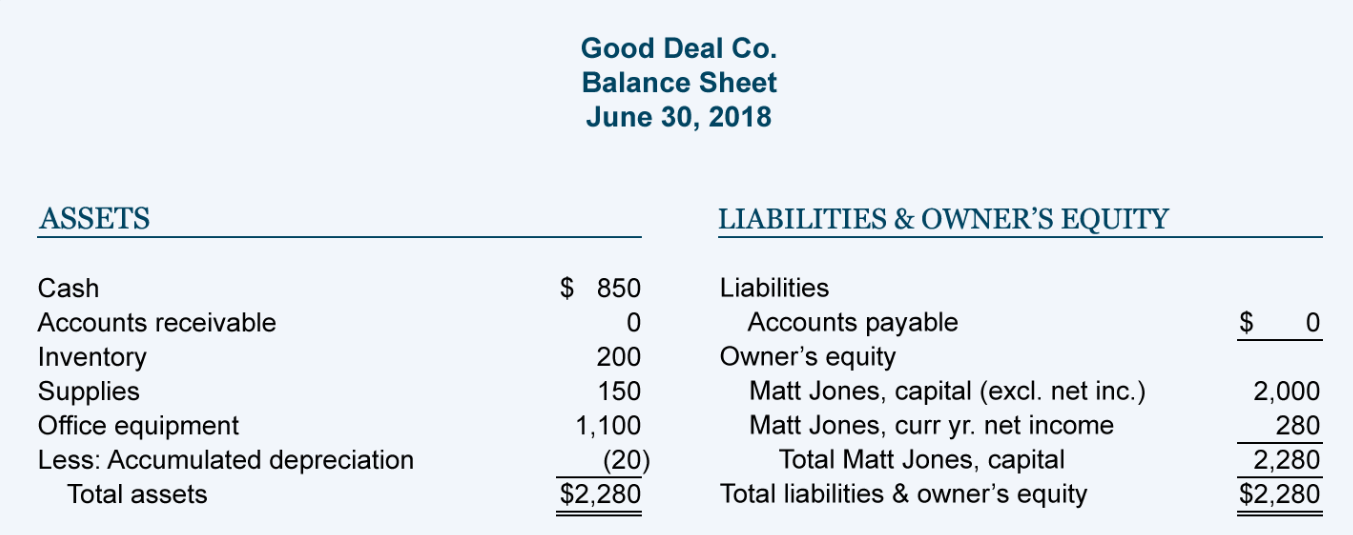

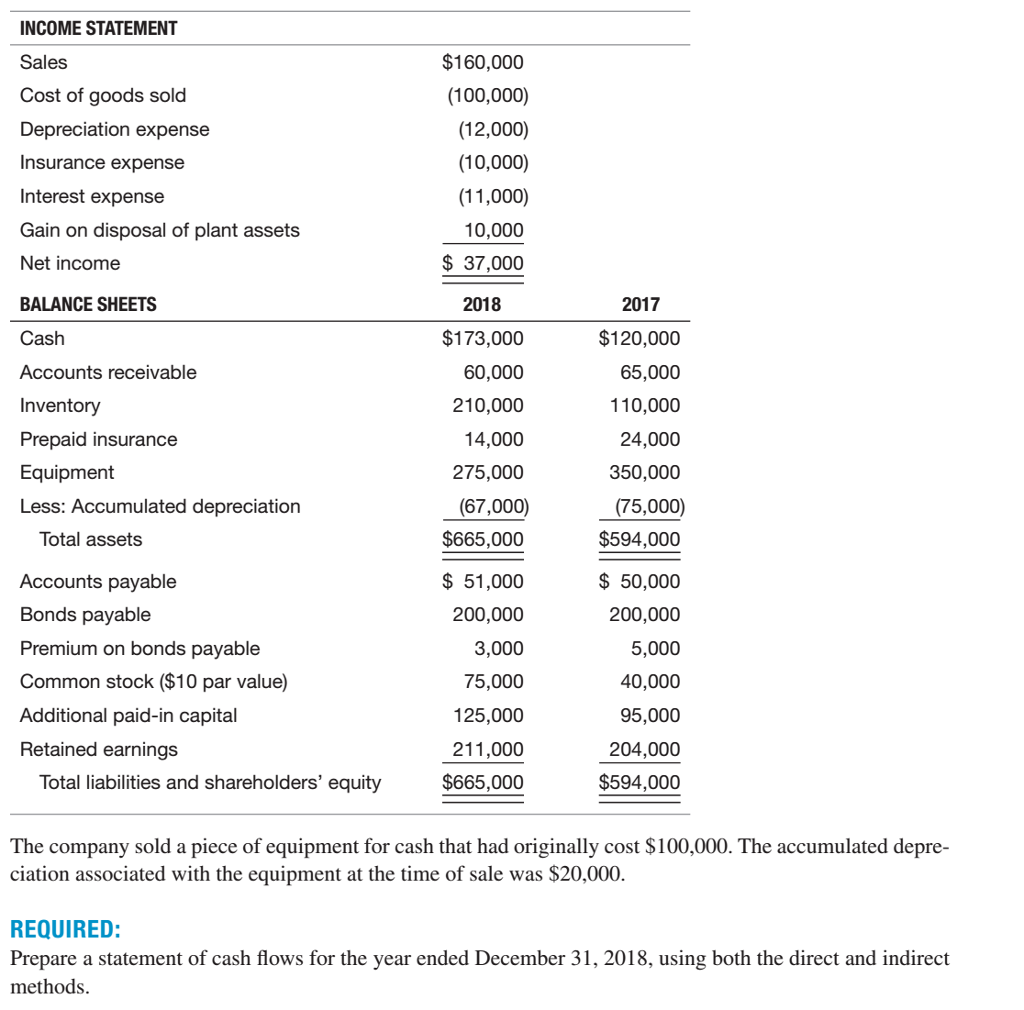

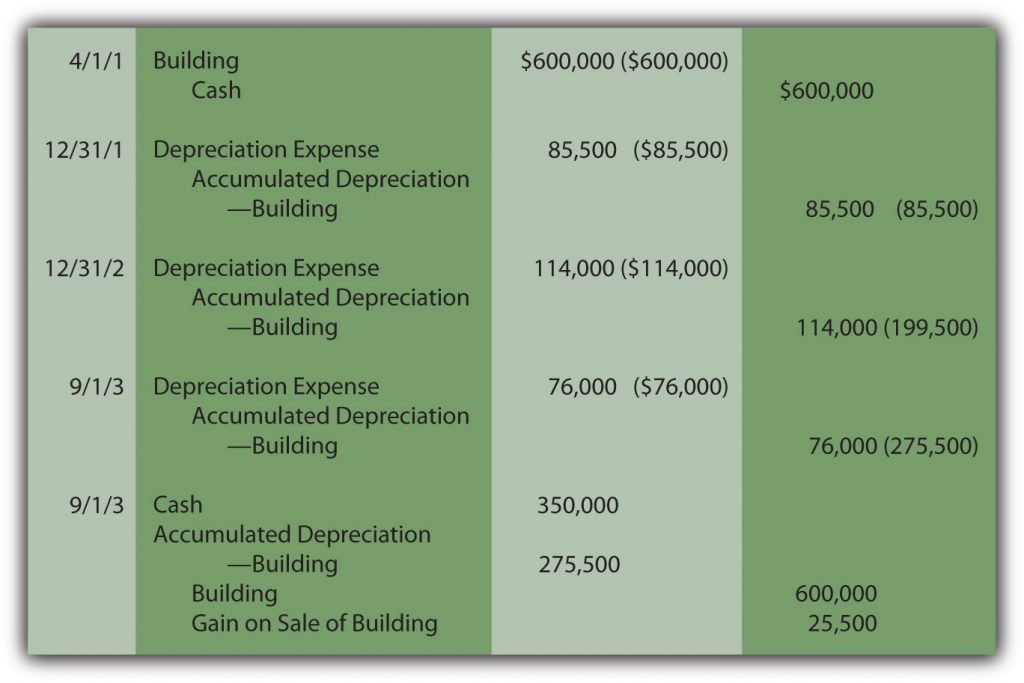

Accumulated depreciation totals depreciation expense since the asset has been in use. Thus, after five years, accumulated depreciation would total $22,000. Depreciation journal entry is the journal entry passed to record the reduction in the value of the fixed assets due to normal wear and tear, normal usage or technological changes, etc., where the depreciation account will be debited, and the respective fixed asset account will be credited.

Fixed assets lose value over time. The value of the assets gets depleted due to constant use for business purposes. Depreciation allows a business to deduct the cost of an asset over time rather than all at once.

Depreciation represents how much of the asset's value has been used up in. Essentially, it is an accounting technique used by companies to allocate the cost of a physical or tangible asset over its useful life. Depreciation expense is the amount that a company's assets are depreciated for a single period (e.g, quarter or the year), while accumulated depreciation is the total amount of wear to date.

Depreciation in accounting refers to an indirect and explicit cost that a company incurs every year while using a fixed asset such as equipment, machinery, or expensive tools. Accounting for depreciation. How to calculate the depreciation.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)