Fabulous Tips About Treatment Of Dividend In Cash Flow Statement

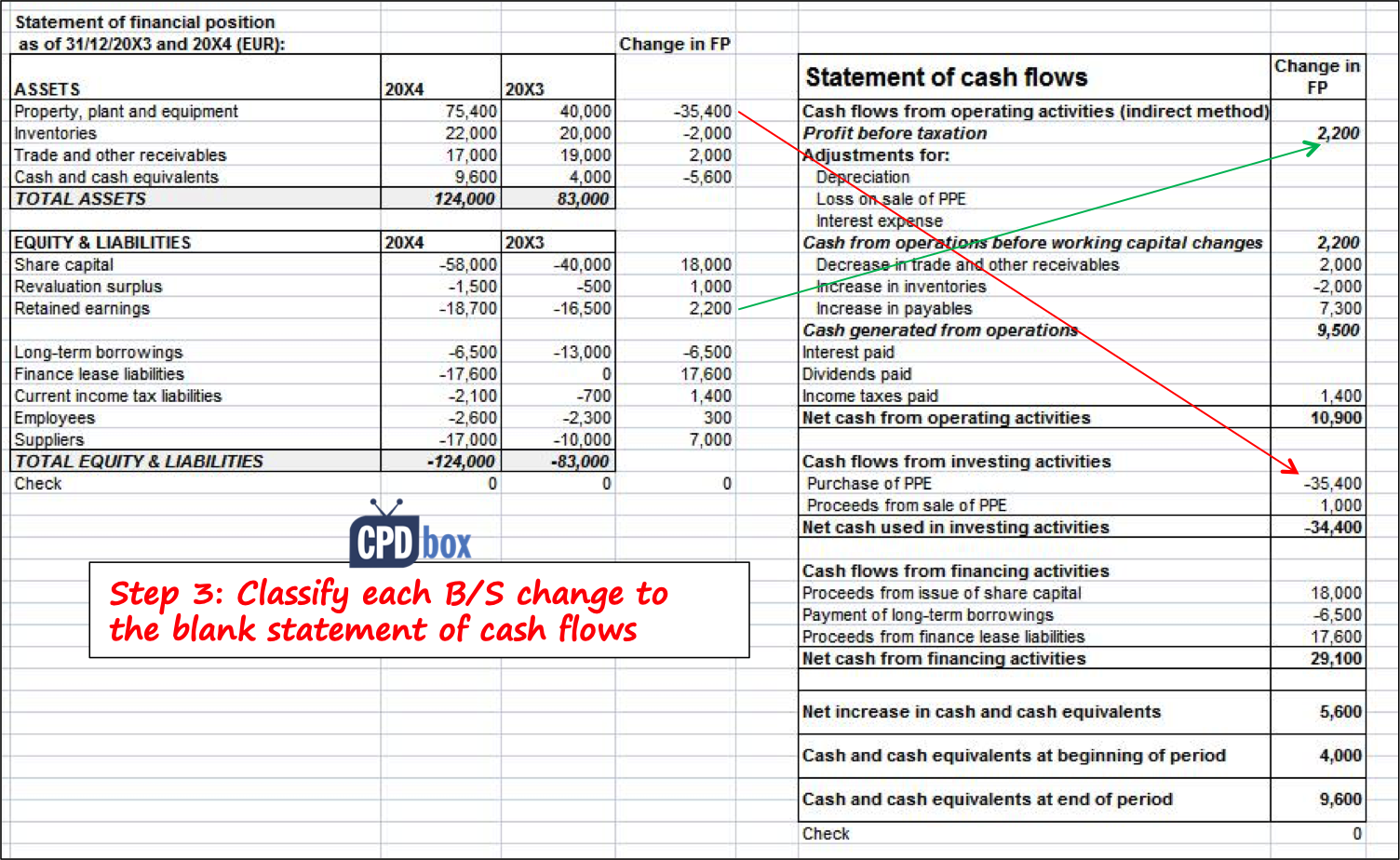

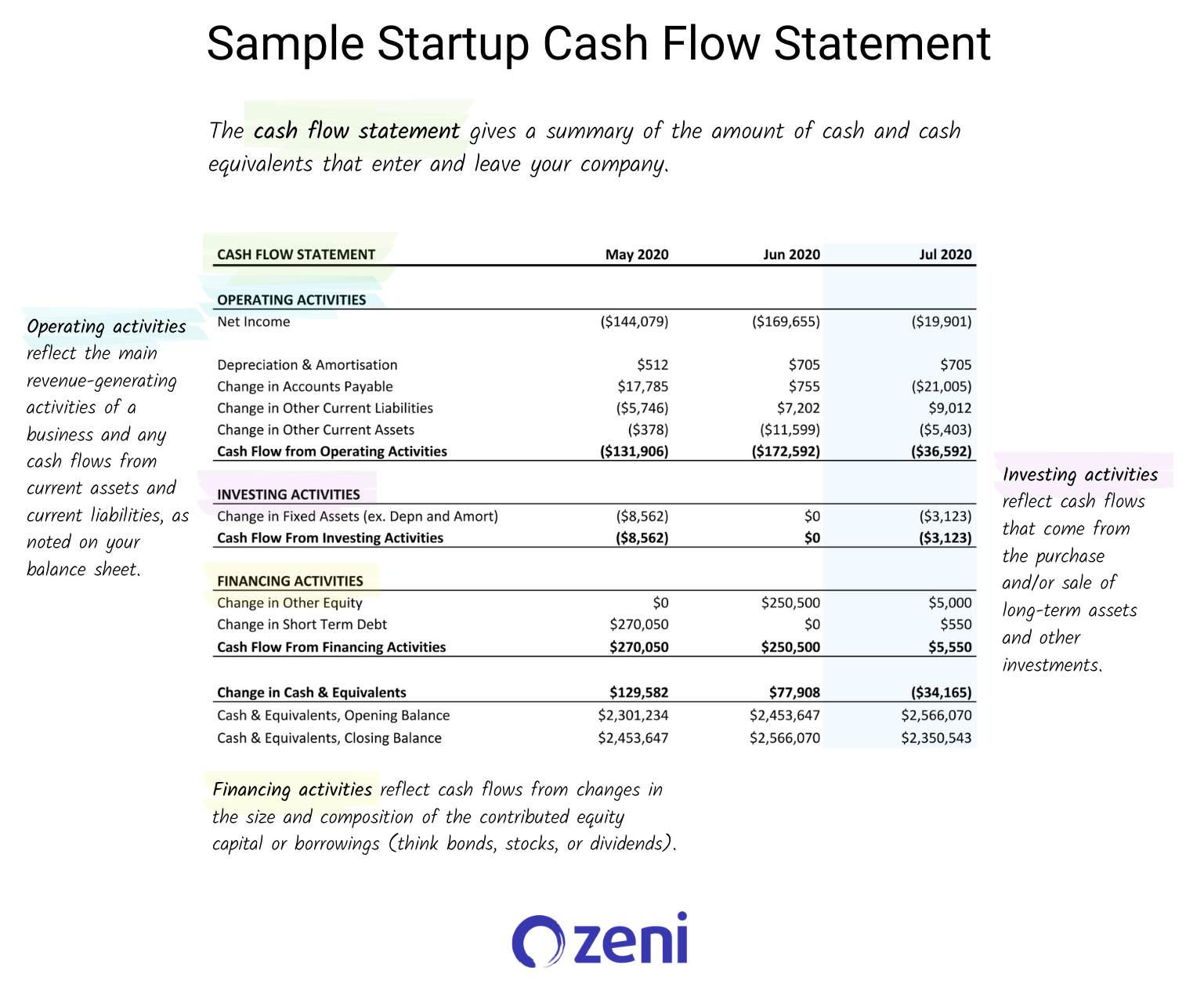

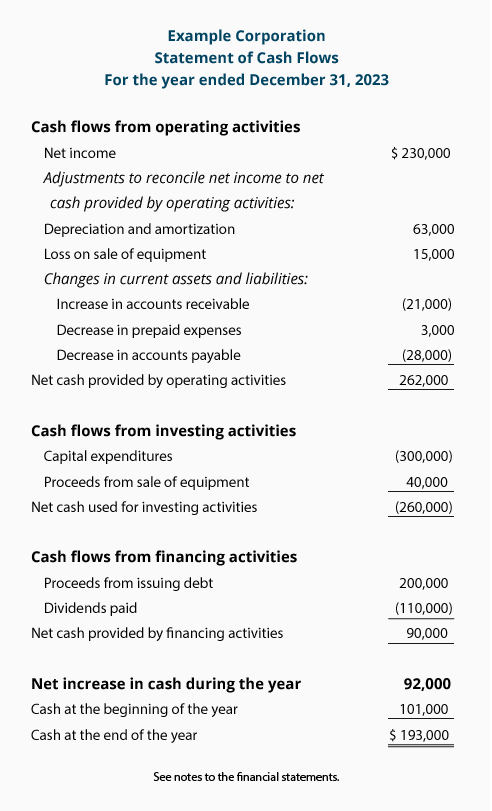

Treatment of dividend in cash flow statement. In the current year, the proposed dividend of previous year will be declared (approved) by the shareholders in their annual general meeting because the meeting will be held after the end of the financial year. Balance sheet combination and projections; The statement of cash flows analyses changes in cash and cash equivalents during a period.

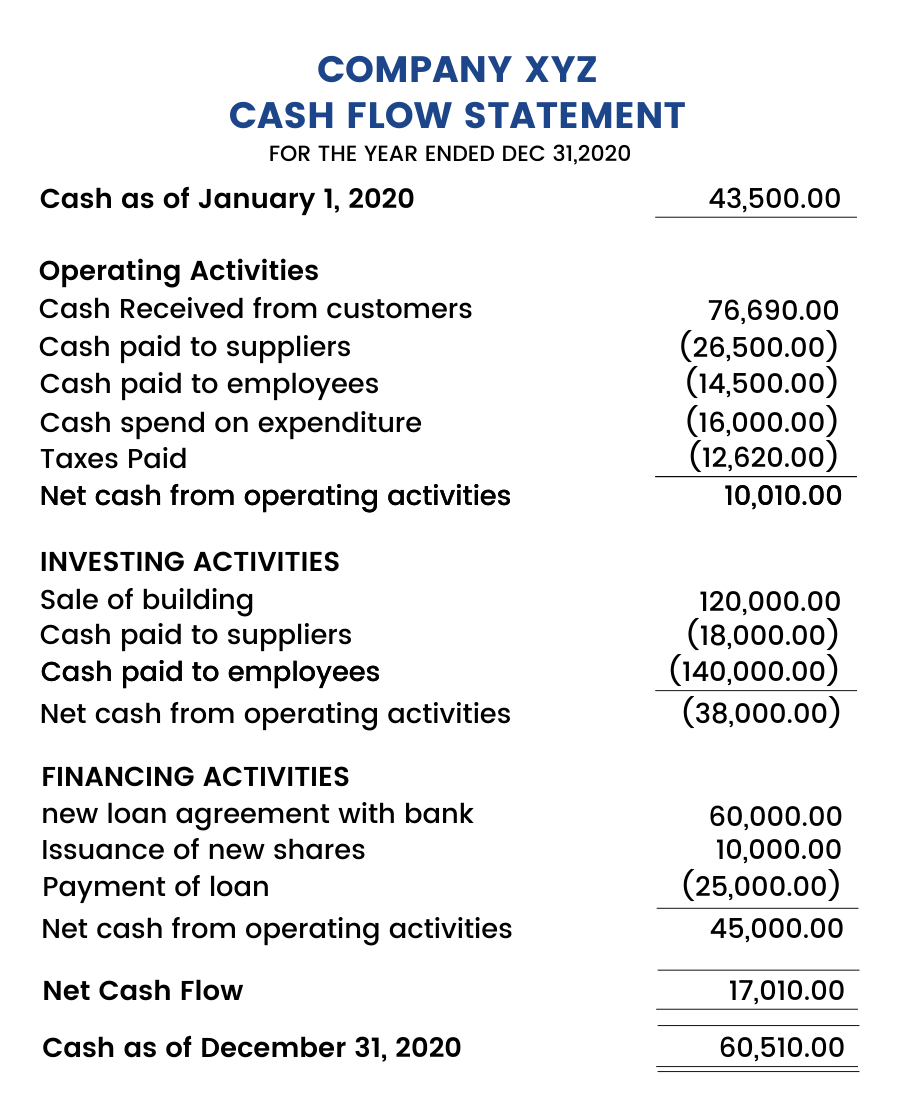

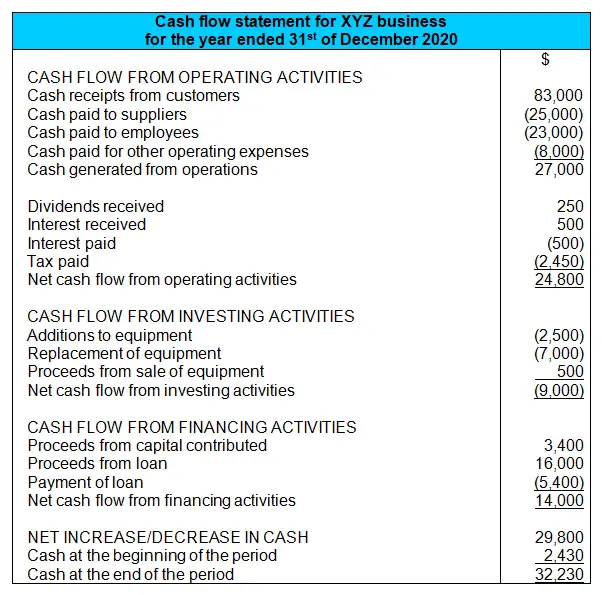

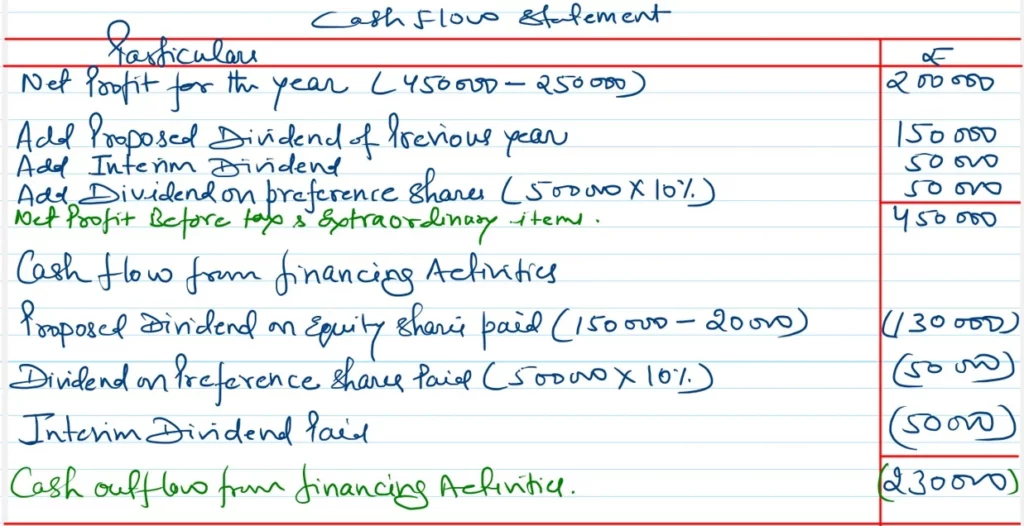

This part of the cash flow statement shows all your business’s financing activities, including transactions that involve equity, debt, and dividends. Adding up the cash flow from preferred and common dividends tells you how much of the company's capital goes toward shareholders payments. There is no impact on the statement of cash flow.

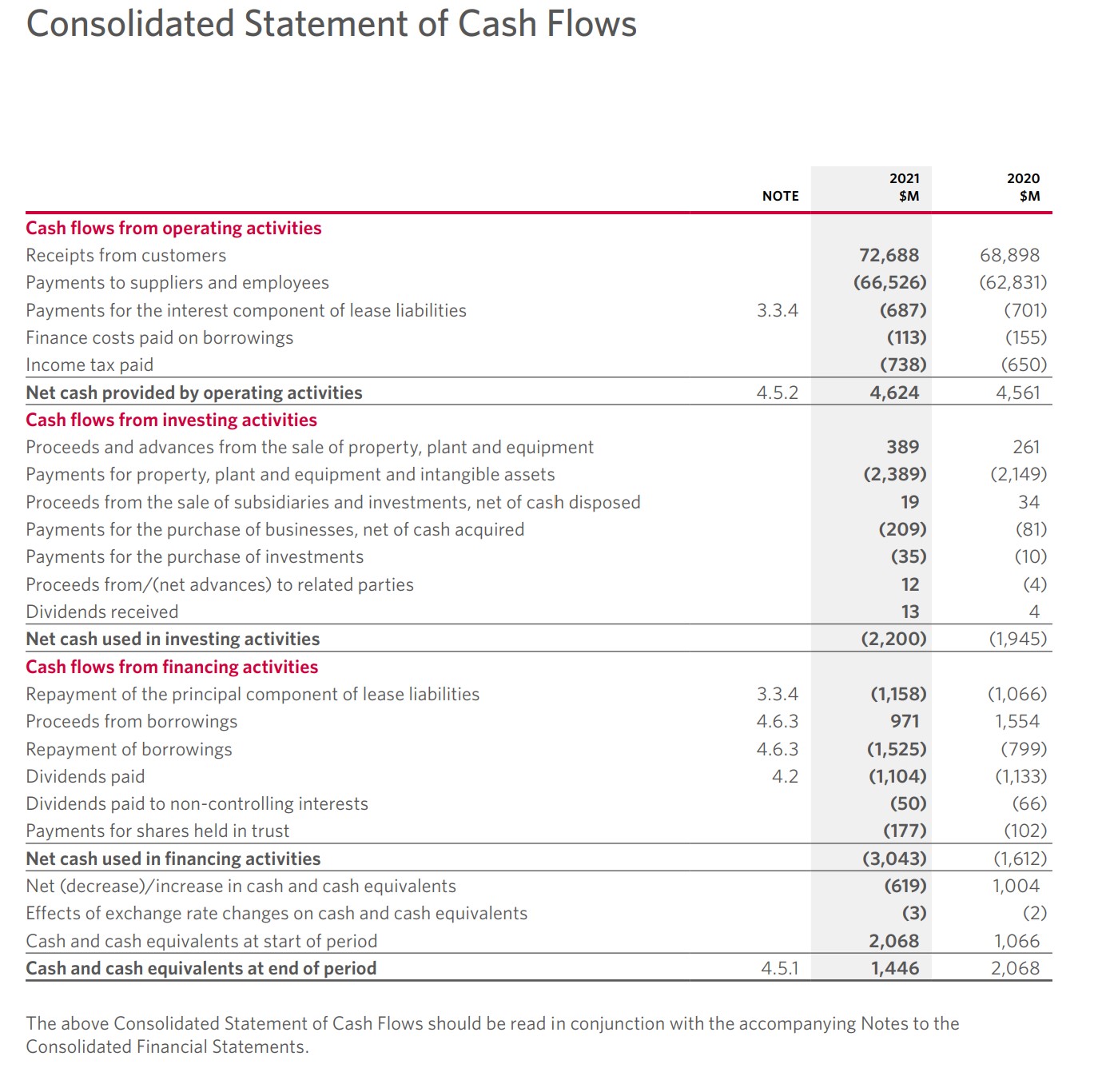

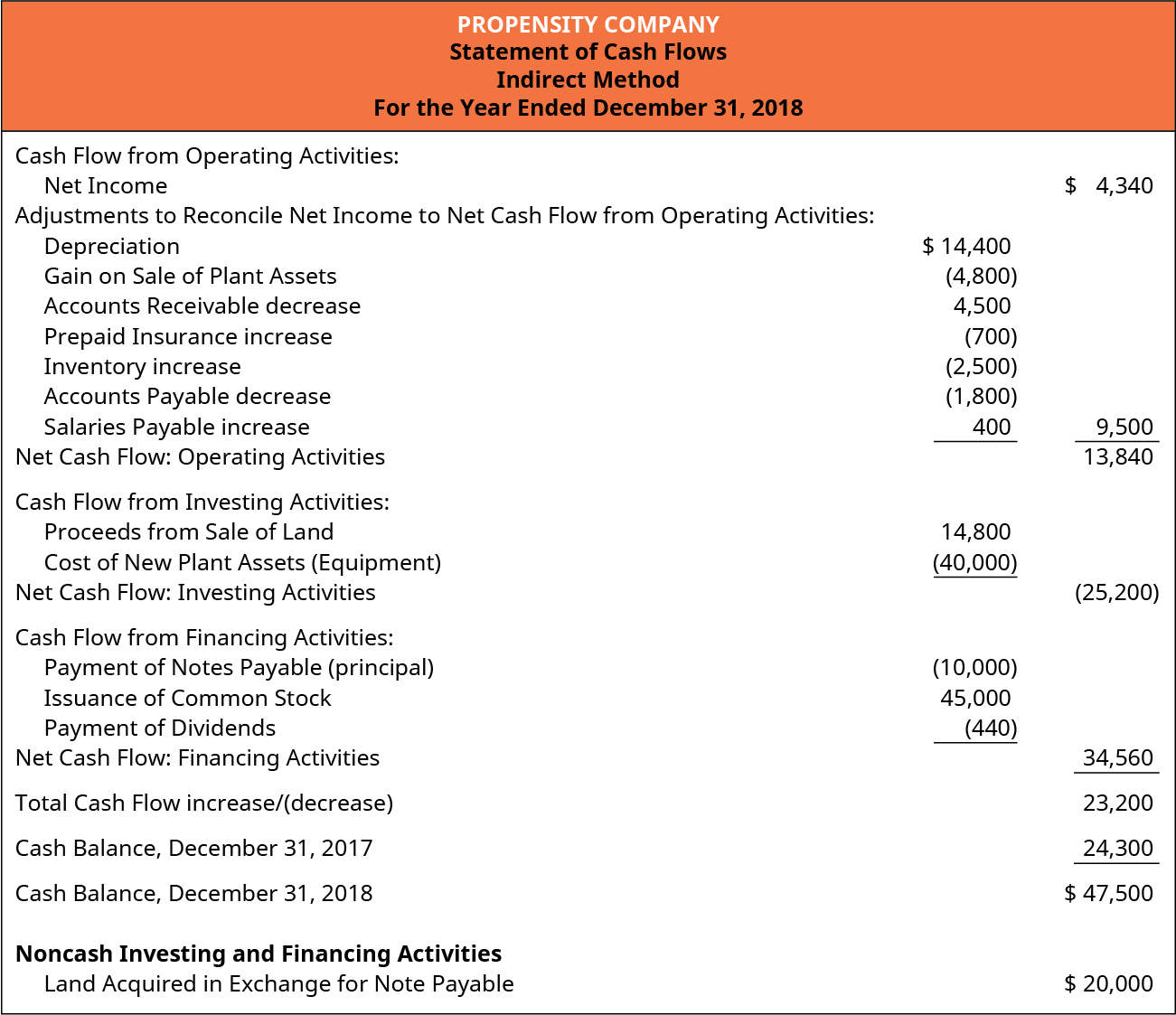

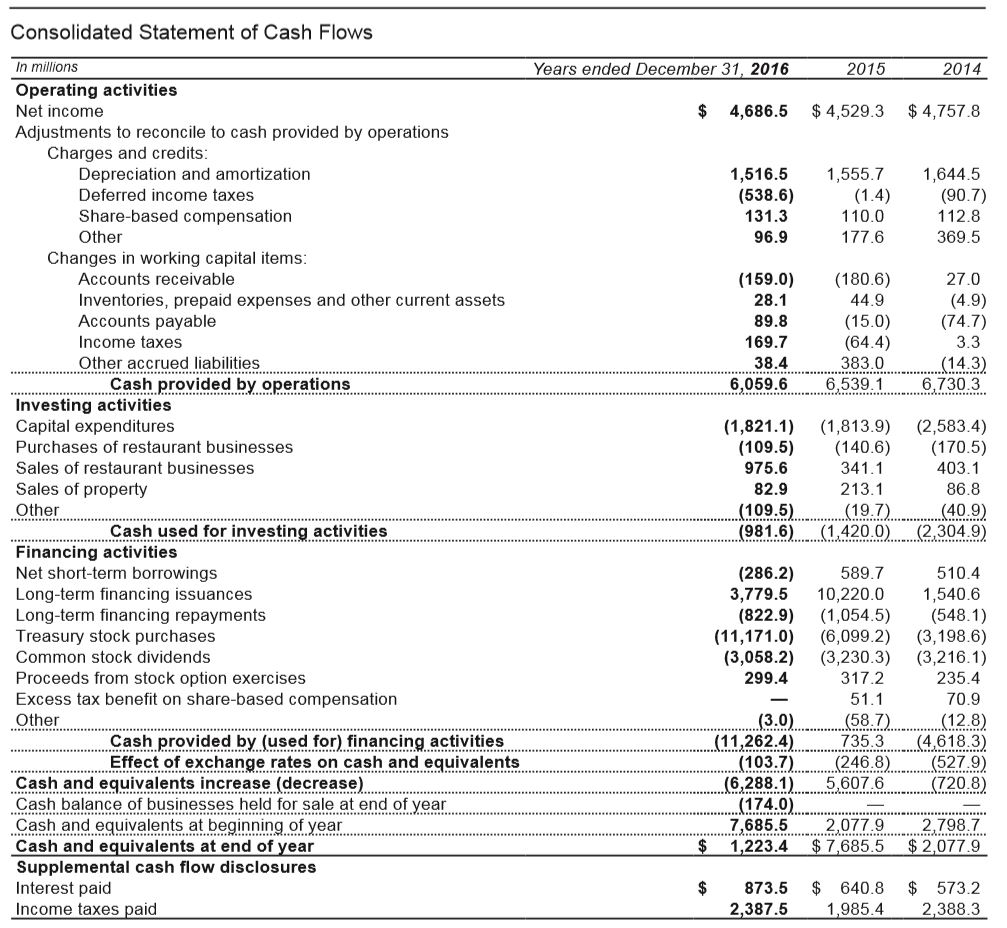

The answer to this is not so straightforward. The largest line items in the cash flow from financing activities statement are dividends paid, repurchase of common stock, and proceeds from the issuance of debt. Dividends paid are normally treated as financing activity, because they are a cost of obtaining financial resources, in the form of equity investment.

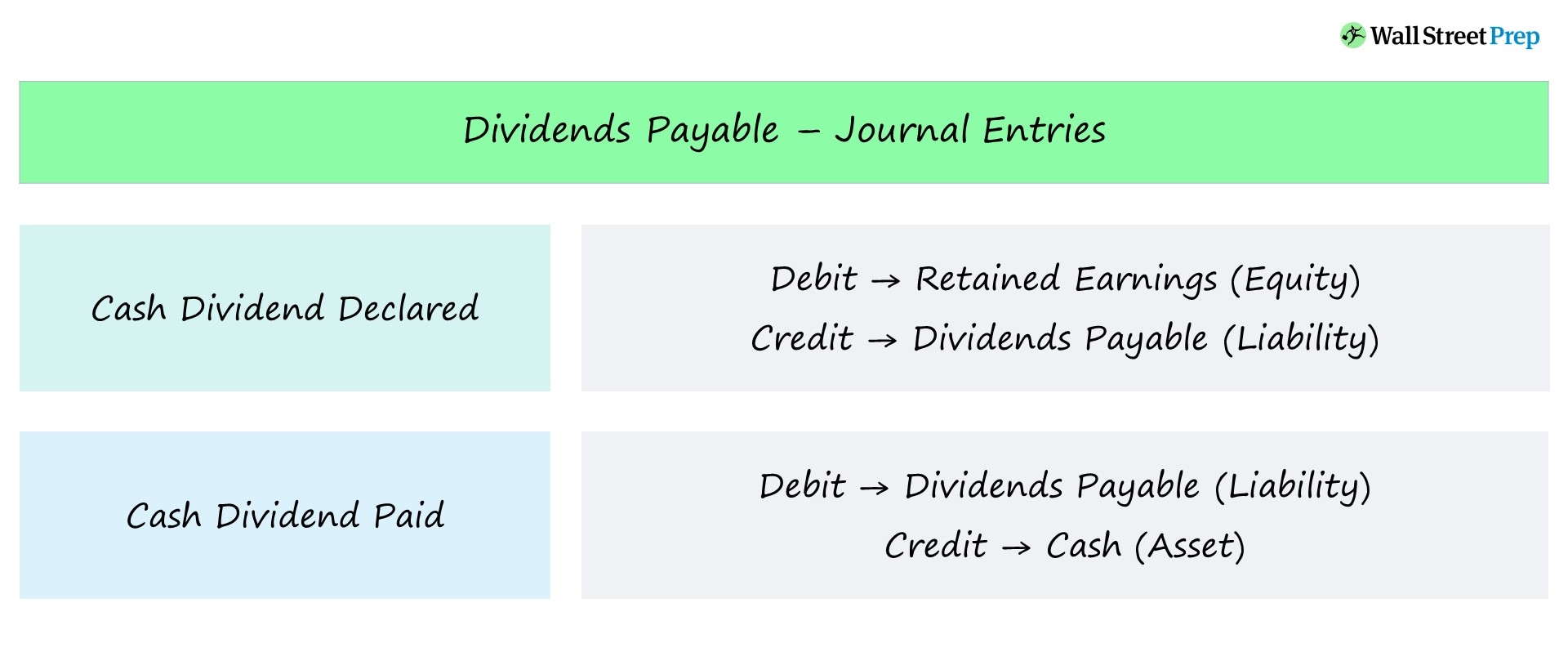

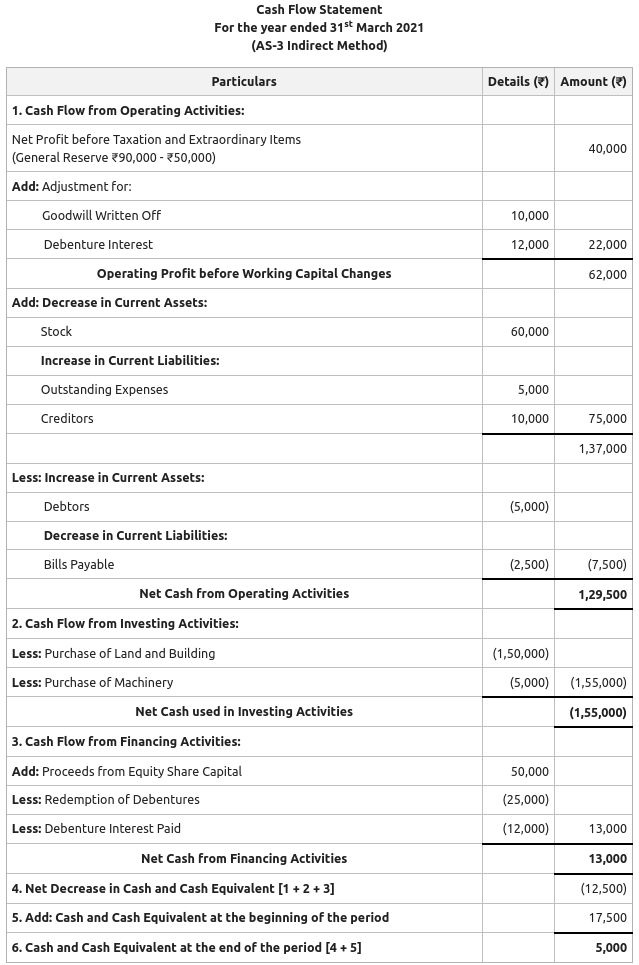

Common cash flow calculations include the tax paid, which is an operating activity cash out flow, the payment to buy property plant and equipment (ppe) which is an investing activity cash out flow and dividends paid, which is a financing activity cash out flow. What is the accounting treatment of proposed dividend in cash flow statement? A dividend is not an expense to the paying company.

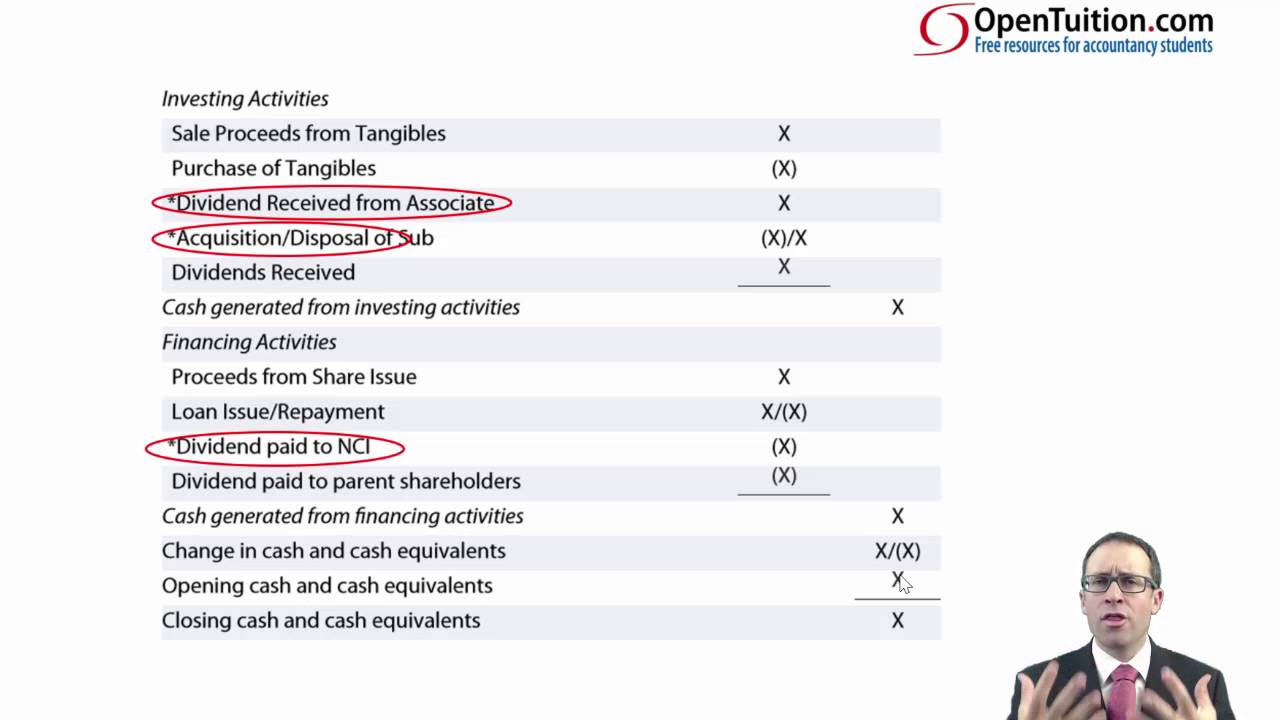

We explain the treatment of dividends and interest paid, and dividends and interest received in the cash flow statement. Cash flows from interest and dividends received and paid shall each be disclosed separately. How do dividends impact cash flow?

These will form part of their own line in the cash flows from financing activities. Knowing how much cash a company uses toward paying. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992.

However, there are two approaches to deal with the treatment of unclaimed dividend: We learned that many users and members of formal advisory bodies (except for one member of the accounting standards advisory forum (asaf)4) support the removal of options for presenting cash flows arising from interest paid/received and dividends paid/received in the statement of cash flows. Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in.

And (b) results in a classification in the statement of cash flows that is generally consistent with the classification of the related income or expense in the Cash flow statement combination and projections; The treatment of dividends (associate and parent) in.

The treatment of dividends on a cash flow statement is an important aspect of financial reporting that provides insights into a company’s cash flow dynamics and dividend distribution practices. On the cash flow statement, you still combine parent co. The record date for the dividend has been set for february 29, 2024, with payment scheduled to be made to shareholders by march 15, 2024.

So, are dividends in the cash flow statement? As cash dividends are cash outflows, they are shown as negative numbers in the financing section of the cash flow statement (examined in detail in chapter 8). But it’s also important to note the treatment of dividends.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)