Who Else Wants Info About Debit And Credit Items In Trial Balance

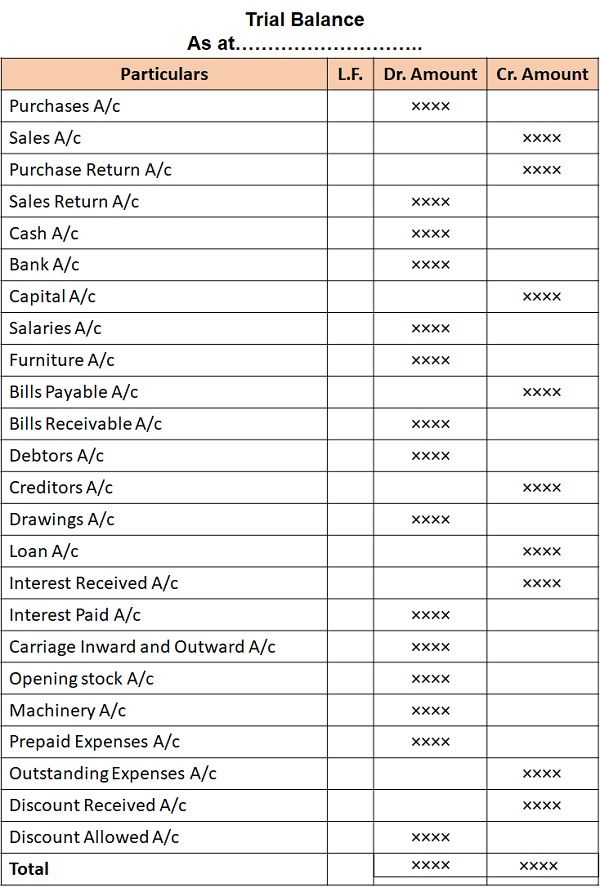

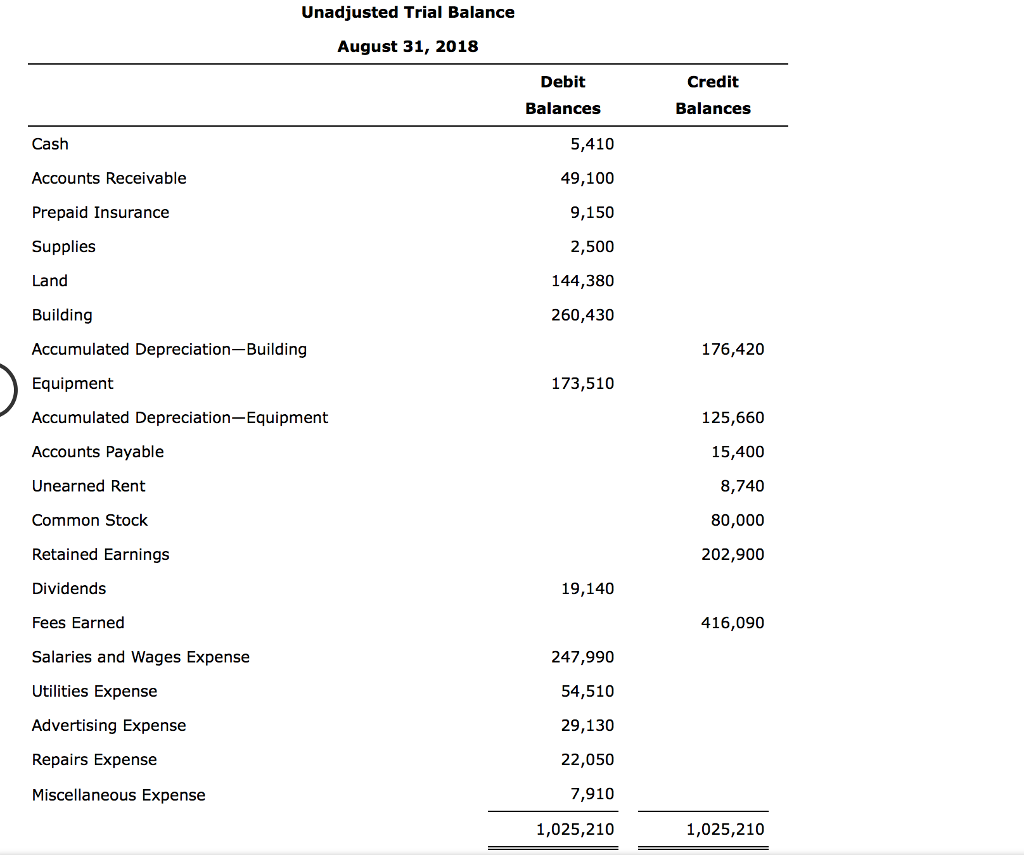

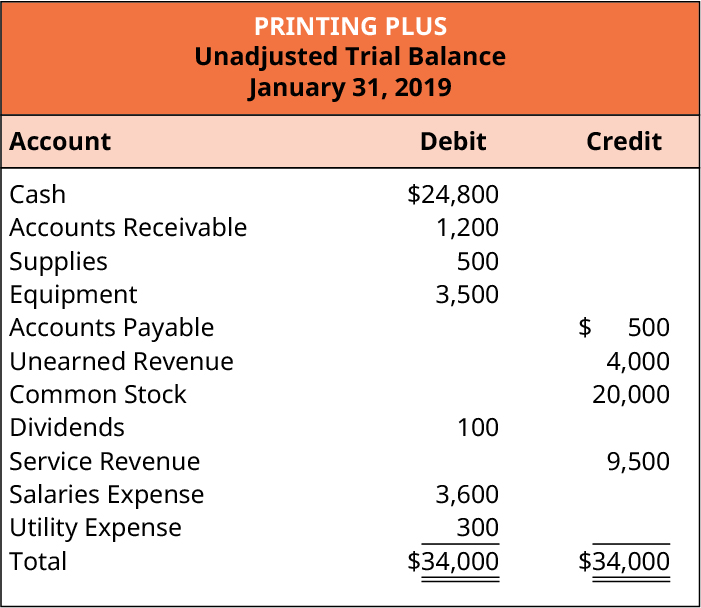

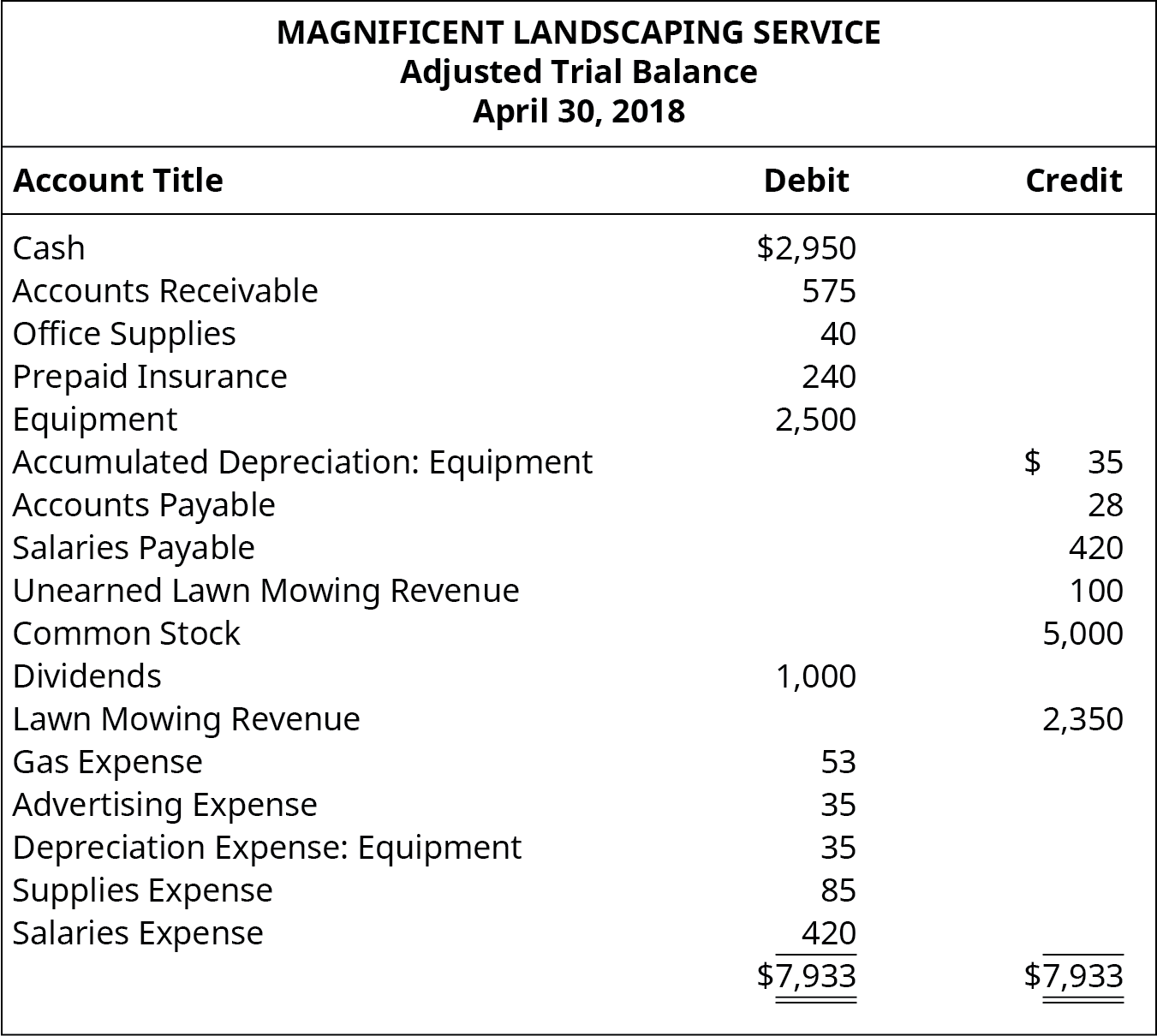

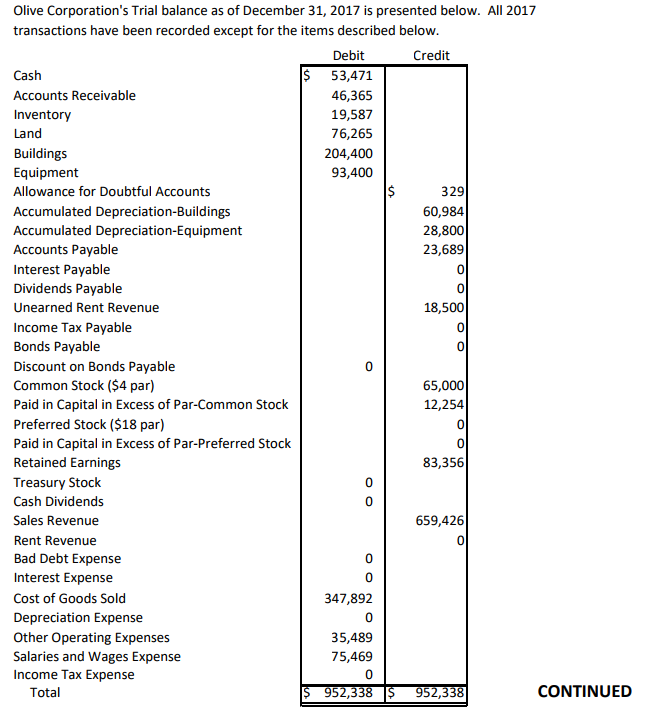

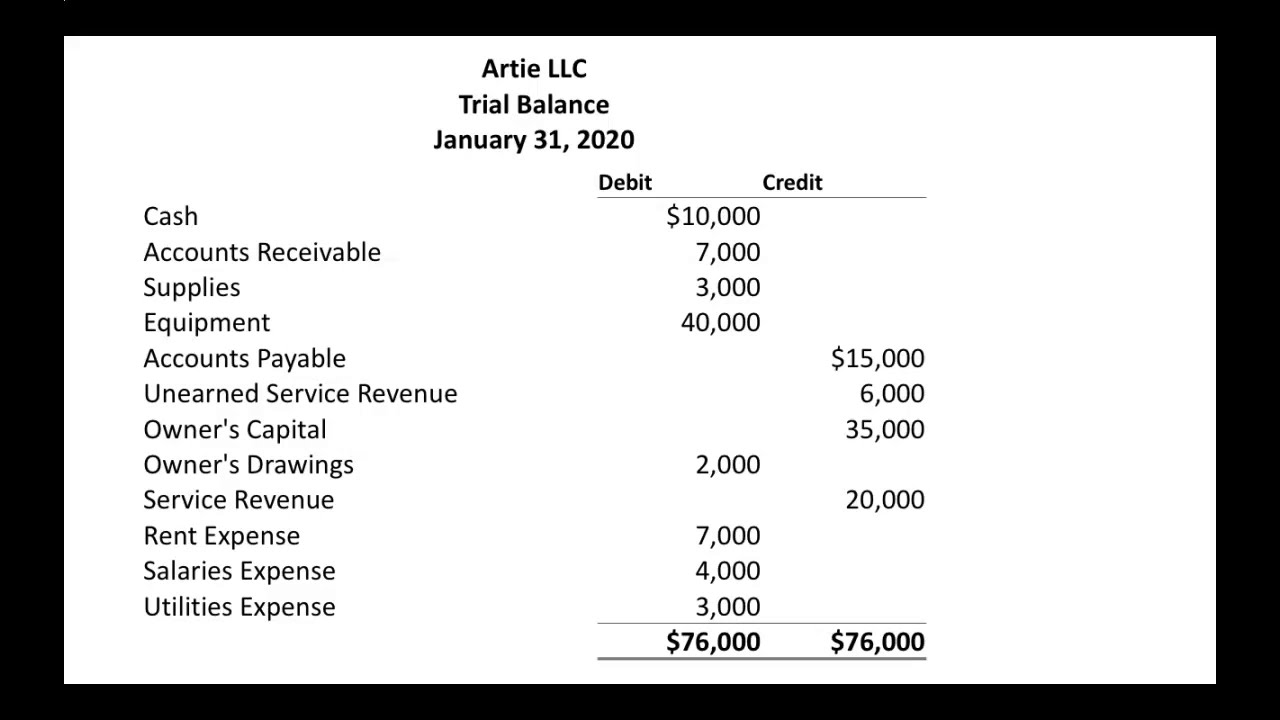

Example of a trial balance document

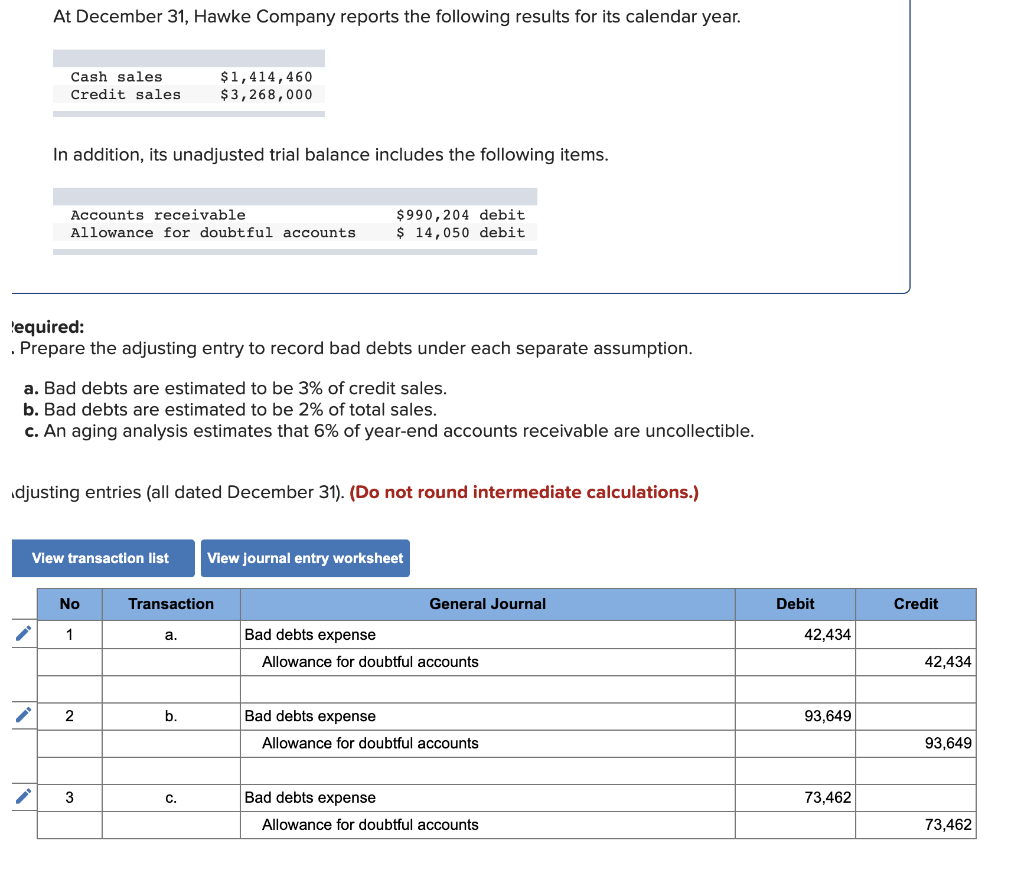

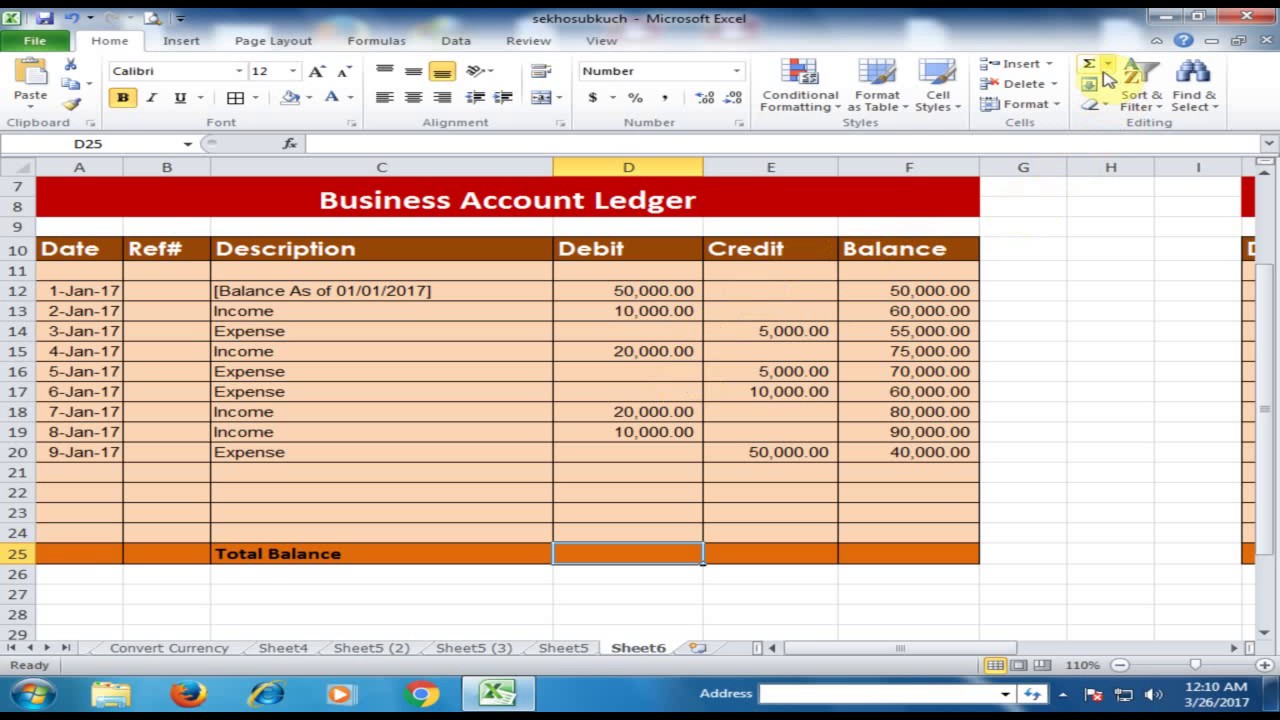

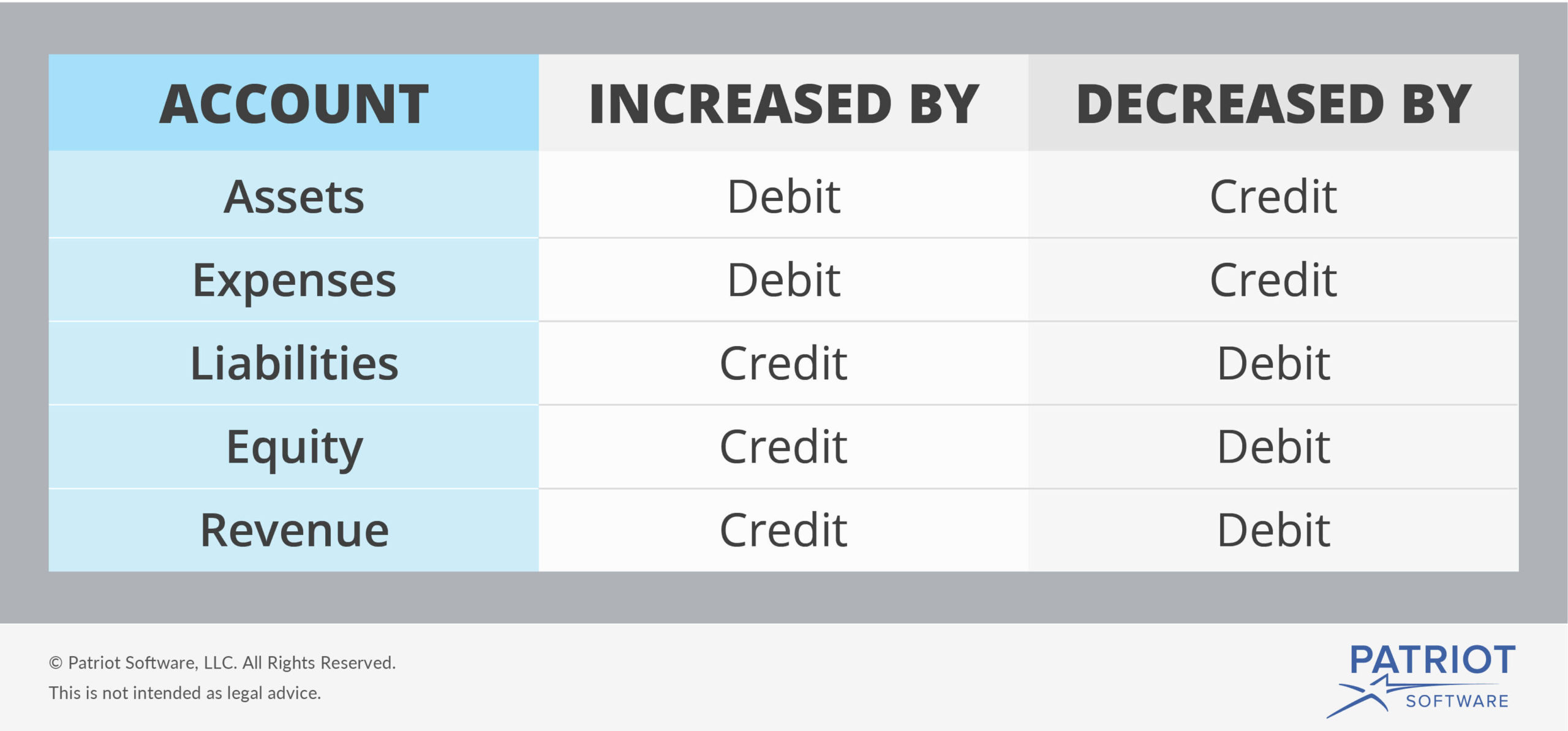

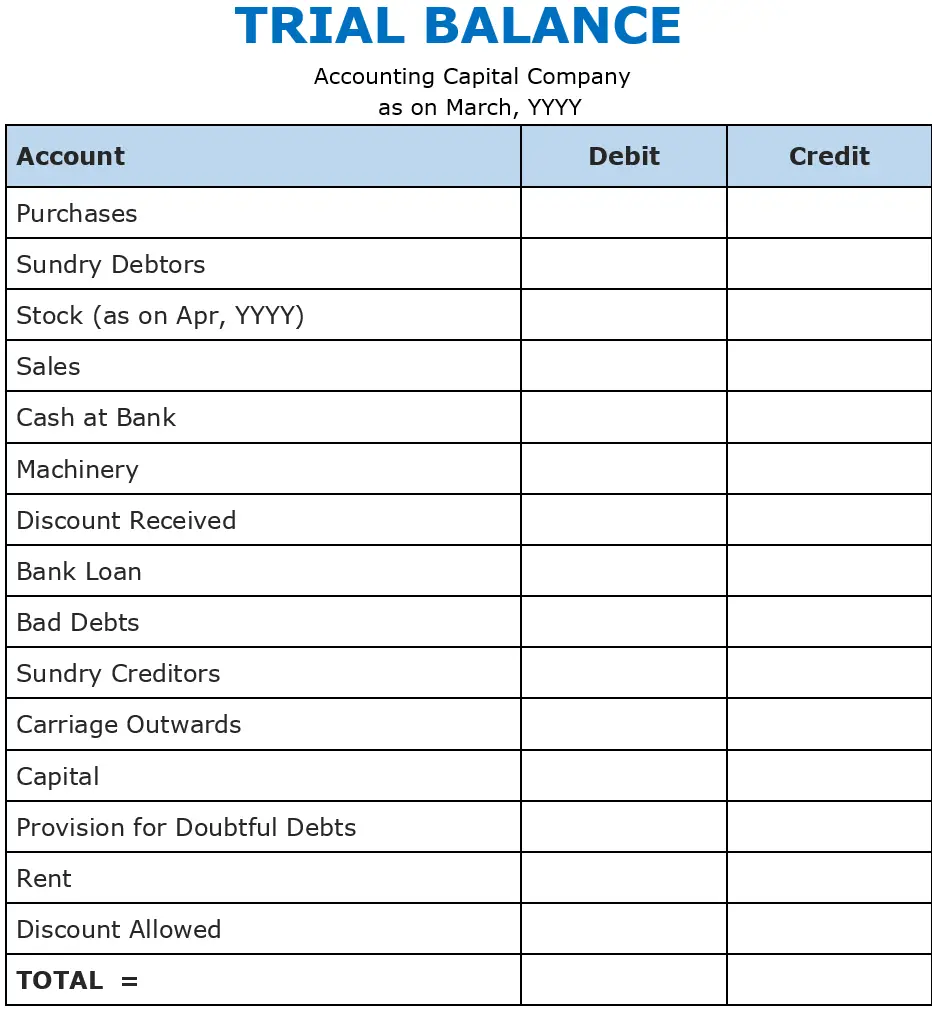

Debit and credit items in trial balance. The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains, and losses. The total debit and the credit side of the tb are recorded on their respective sides of the debit and credit columns. This method provides a summary view of the total debits and credits.

Add up the amounts of the debit column and the credit column. The final total in the debit column must be the same dollar. If there is a difference, accountants have to locate and rectify the errors.

This results in the majority of asset accounts having debit balances, and the majority of liability and equity accounts having credit balances. Credit balance when the credit side is greater than the debit side the difference is called “credit balance”. You'll record your credit balances in the center column (the credit column), while your debit balances are recorded in the far right column (the debit column).

So, if credit side > debit side, it is a credit balance. It shows a list of all accounts and their balances, either under the debit column or credit column. The learner needs to understand that a trial balance is prepared for twofold reasons.

The total credit balance will appear at the bottom of the columns. The trial balance is used to test the equality between total debits and total credits. This is required because they are on different sides of the accounting equation.

This means the company is waiting for money from customers who bought goods or services on credit. A trial balance is a list of the balances of all of a business's general ledger accounts. A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from cash book.

Creditor’s account above example shows credit balance in creditor’s account (to balance c/d) which is shown on the debit side. Instead of transferring individual balances, each ledger account's entire debit and credit sides are summed up and transferred. If the total of all debit values equals the total of all credit values, then the accounts are correct—at least as far as the trial balance can tell.

A debit increases the asset balance while a credit increases the liability or equity. Trial balance only confirms that the total of all debit balances match the total of all credit balances. An example would be an incorrect debit entry being offset by an equal credit entry.

If totals are not equal, it means that an error was made in the recording and/or posting process and should be investigated. The rule to prepare trial balance is that the total of the debit balances and credit balances extracted from the ledger must tally. A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process.

>read what are final accounts? If the sum of all credits does not equal the sum of all debits, then there is an error in one of the accounts. Once all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to see if the figures in each column match each other.