Casual Tips About Depreciation On Equipment Is $800 For The Accounting Period

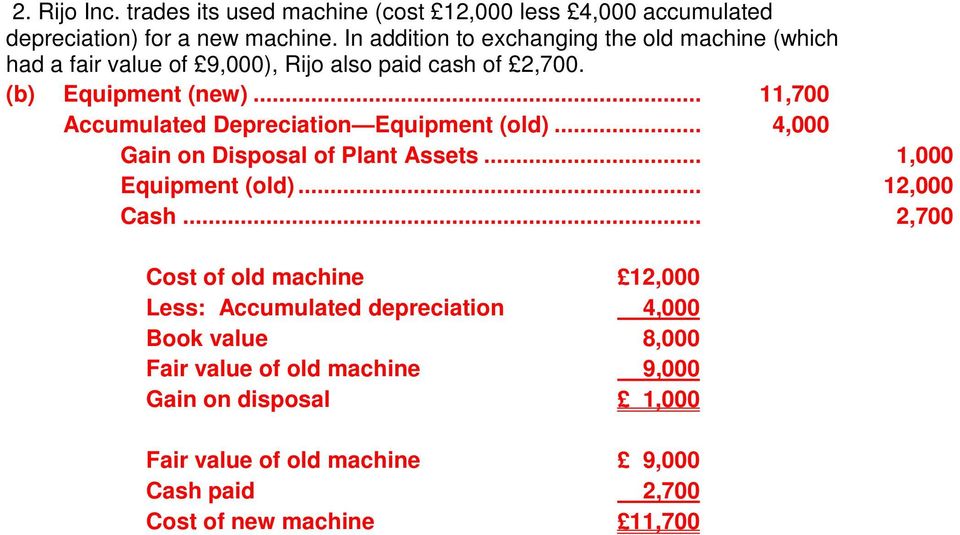

Often, the salvage value is estimated based on past experiences with similar assets.

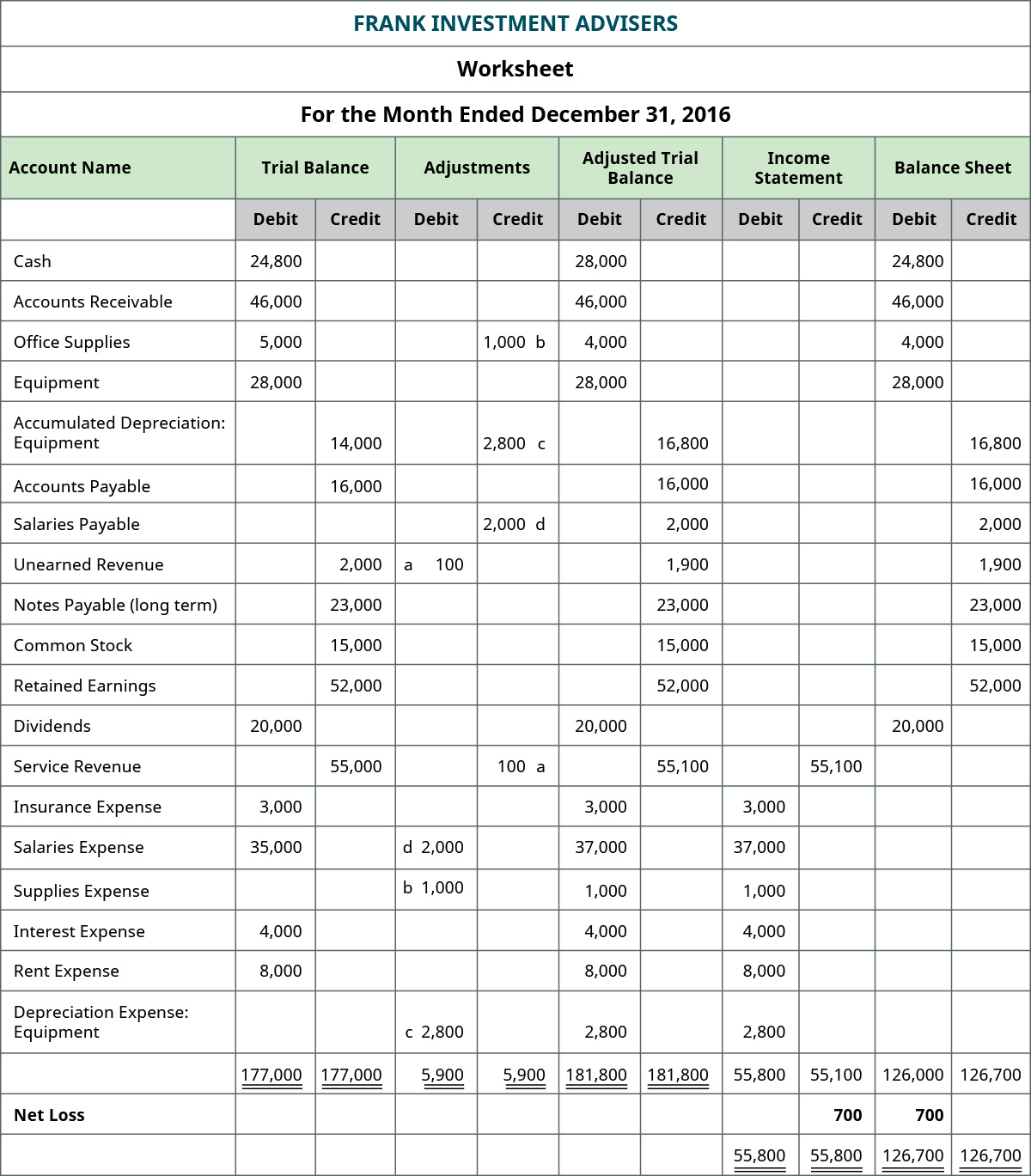

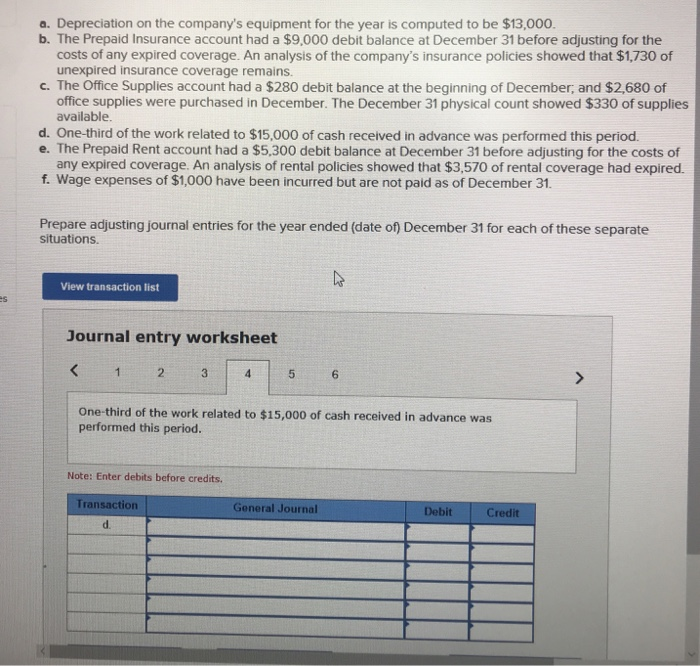

Depreciation on equipment is $800 for the accounting period. There was no beginning balance of supplies and purchased $500 of office supplies during the period. There was no beginning balance of supplies and $550. In both cases the depreciation method should be applied consistently each.

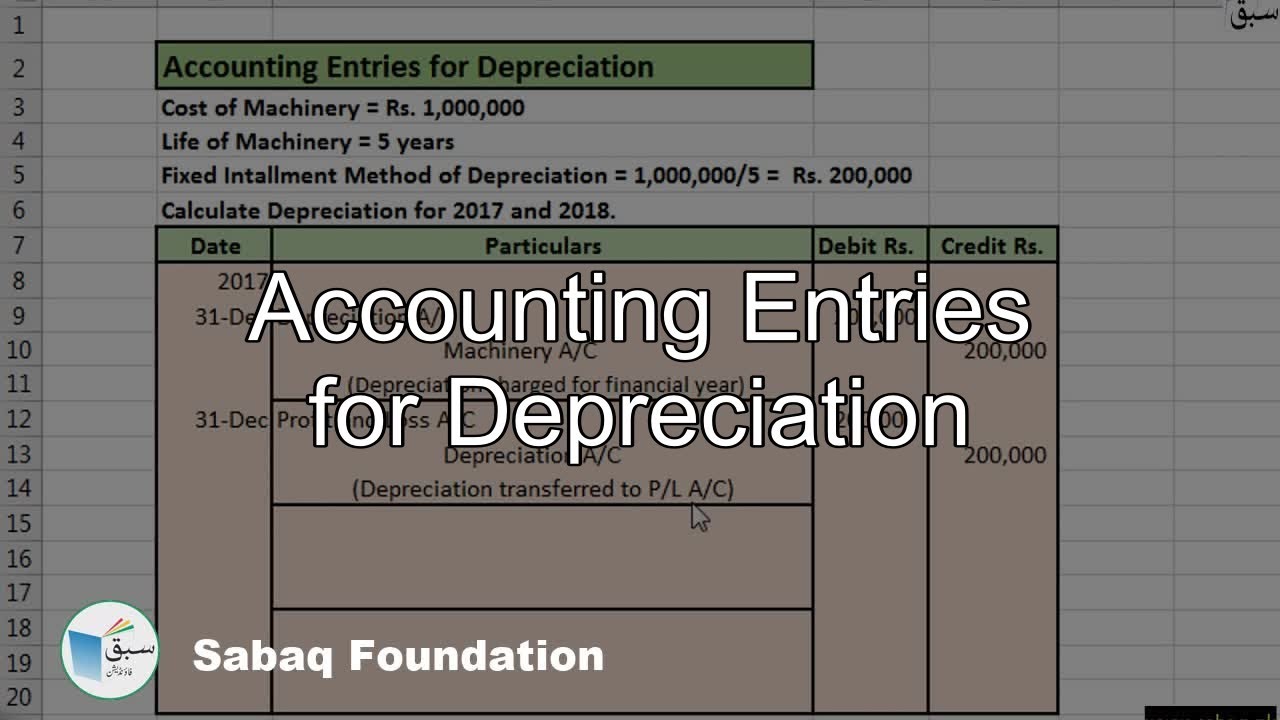

This is a simple linear form of depreciation. There was no beginning balance. The following calculator is for depreciation calculation in accounting.

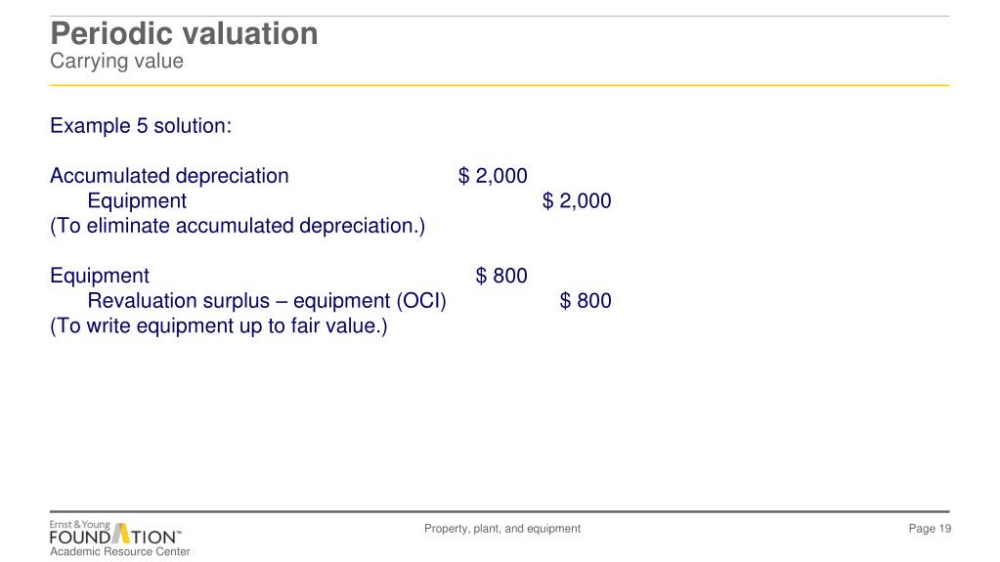

Equipment depreciation is a financial concept that involves accounting for the decrease in value of equipment over time. You can use it to compare three models. Depreciation on equipment is €800 for the accounting period.

There was no beginning balance of supplies and purchased $600 of office supplies during the period. Consequently the amount of depreciation expense for the first year is 1,000 x 9/12 = 750. It takes the straight line, declining balance, or sum of the year' digits method.

Depreciation on equipment is $1,340 for the accounting period. There was no beginning balance of supplies and $600 of supplies were purchased during the period. Depreciation on equipment is $800 for the accounting period.

There was no beginning balance of supplies and purchased €700 of office supplies during the period. A common method is to allocate depreciation expense based on the number of months the asset is owned in a year. Prepaid rent had a $1,000 normal balance prior to.

For example, a company purchases an asset with a total cost. The depreciation calculator uses three different methods to estimate how fast the value of an asset decreases over time. Equipment depreciation is the gradual decrease in the asset’s value over the time it is used.

Interest owed on a loan but not paid or recorded is $275. Depreciation on equipment is $800 for the accounting period. There was no beginning balance of supplies and $780 of supplies were purchased during the period.

2 what types of equipment depreciate? First estimate the asset's salvage value which is the residual value of an asset at the end of its useful life. The depreciation expense over the asset’s useful life.

If you are using the double. Depreciation on equipment is $800 for the accounting period. At the end of the period $120 of sup 3.