Formidable Info About Income Tax In Cash Flow Statement

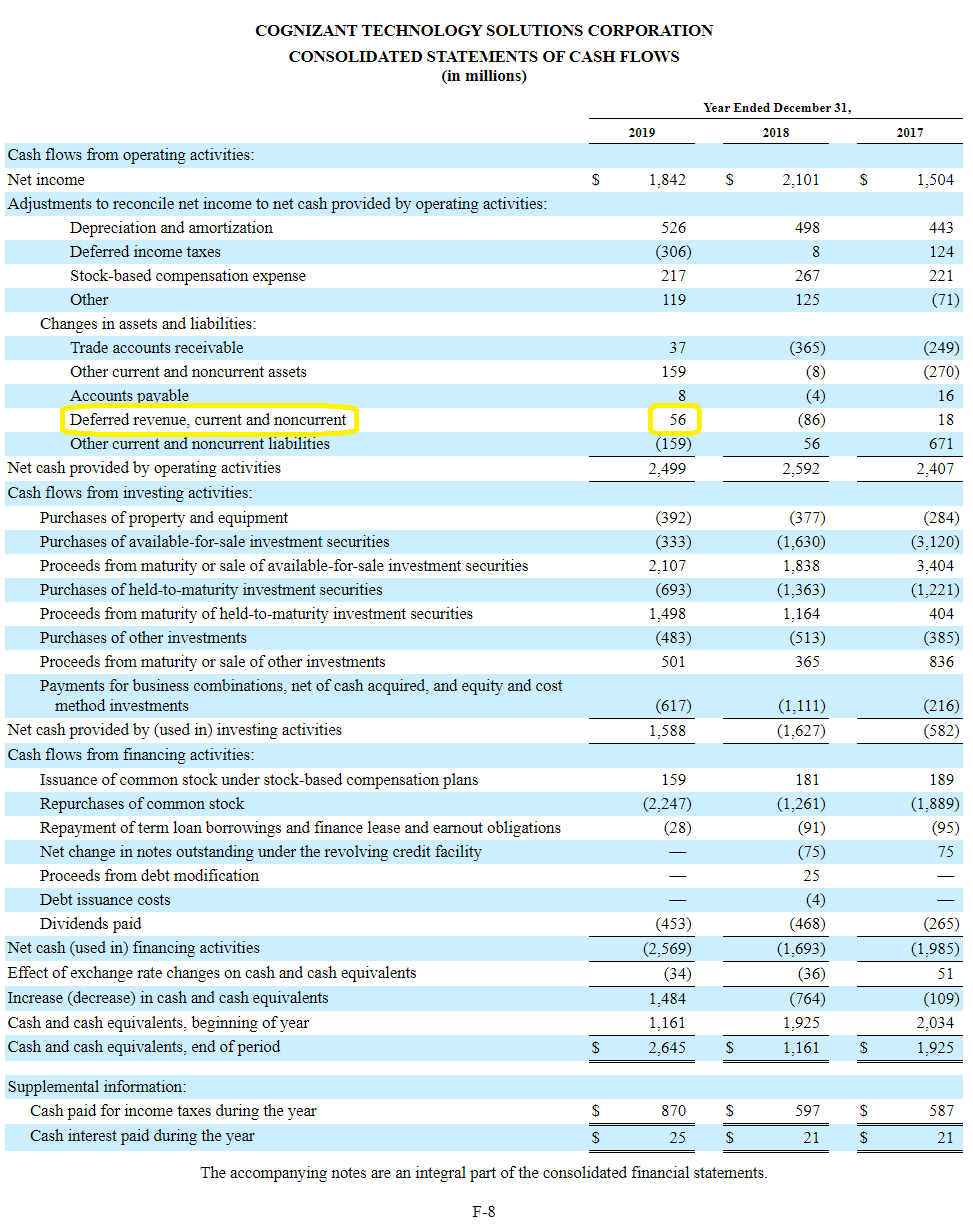

This item is found in the cash flow statement as it refers to the actual cash paid during the period.

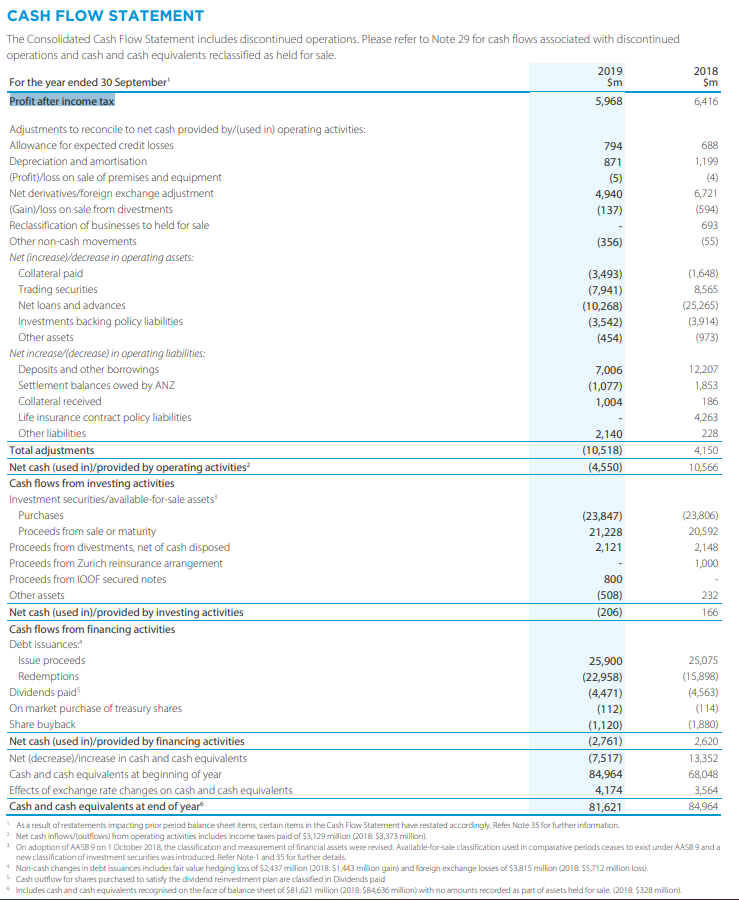

Income tax in cash flow statement. Cash flow statements are one of the three fundamental financial statements used, alongside income statements and balance sheets. Ias 7 requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Income from operations of $652 million;

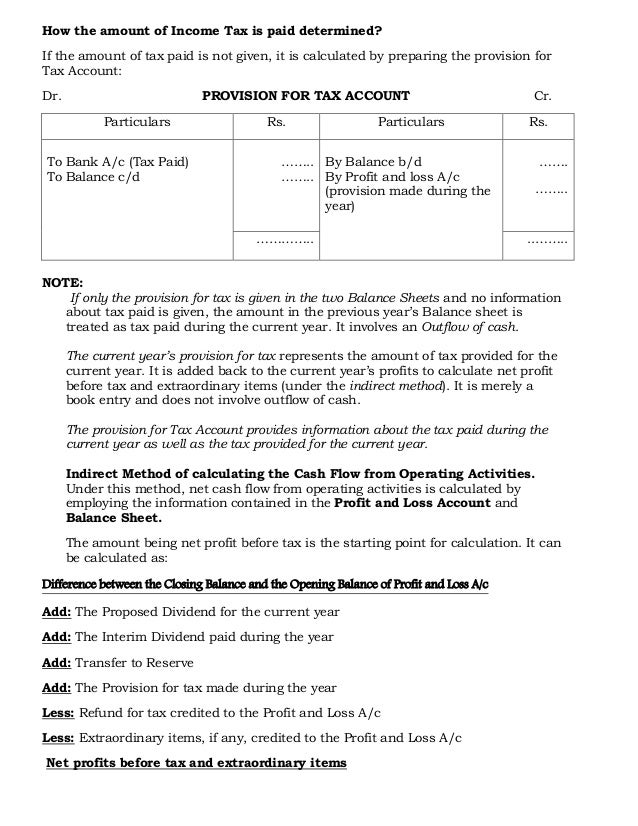

The two differences between the corporate cash flow and net equity distributions bases can be seen to be the following. Income tax payable goes on the balance sheet while you find tax paid in the cash flow statement. The beginning balance of current tax payable of cu 14000 is increased by the current portion of income tax expense, cu 27000.

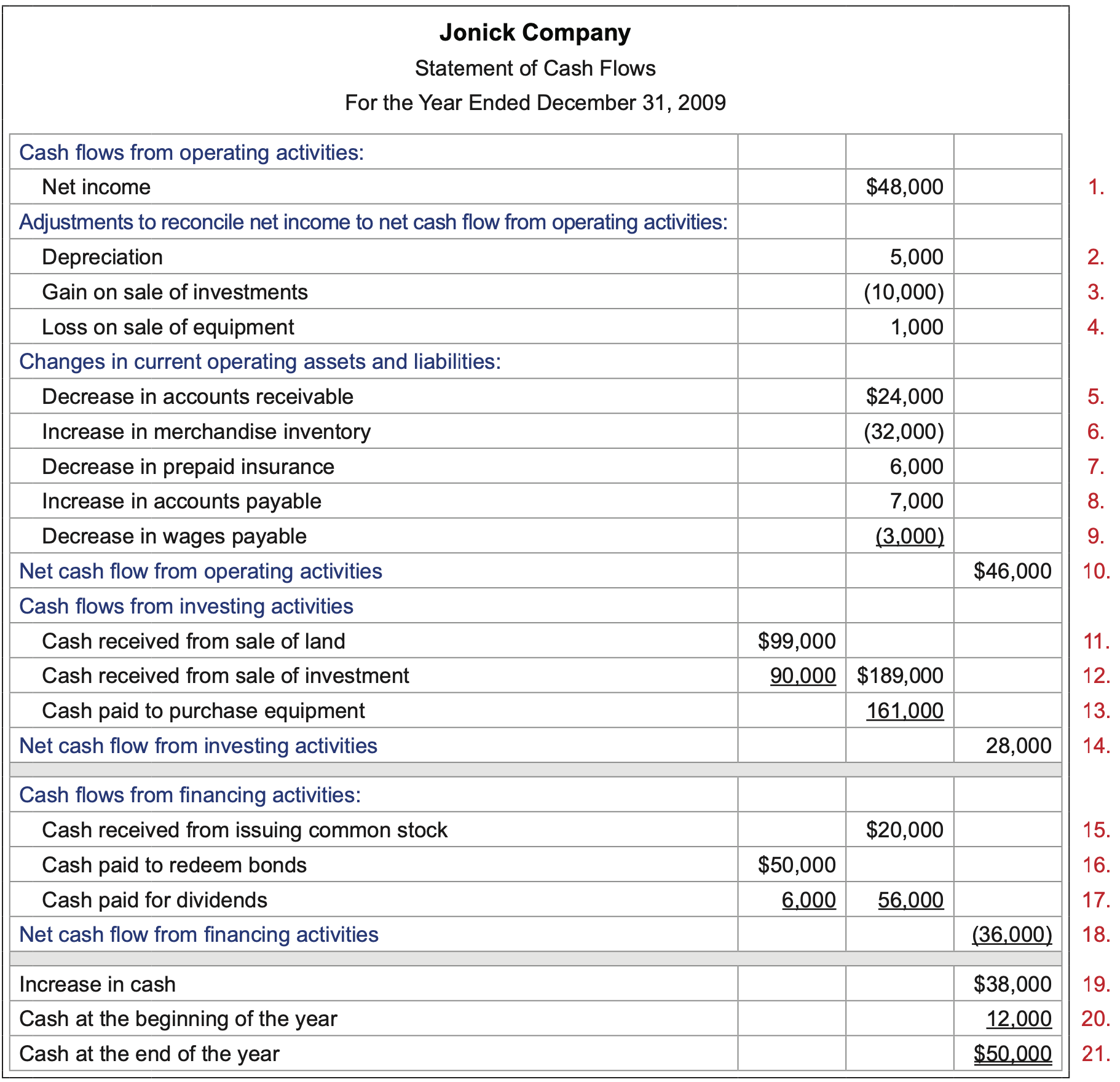

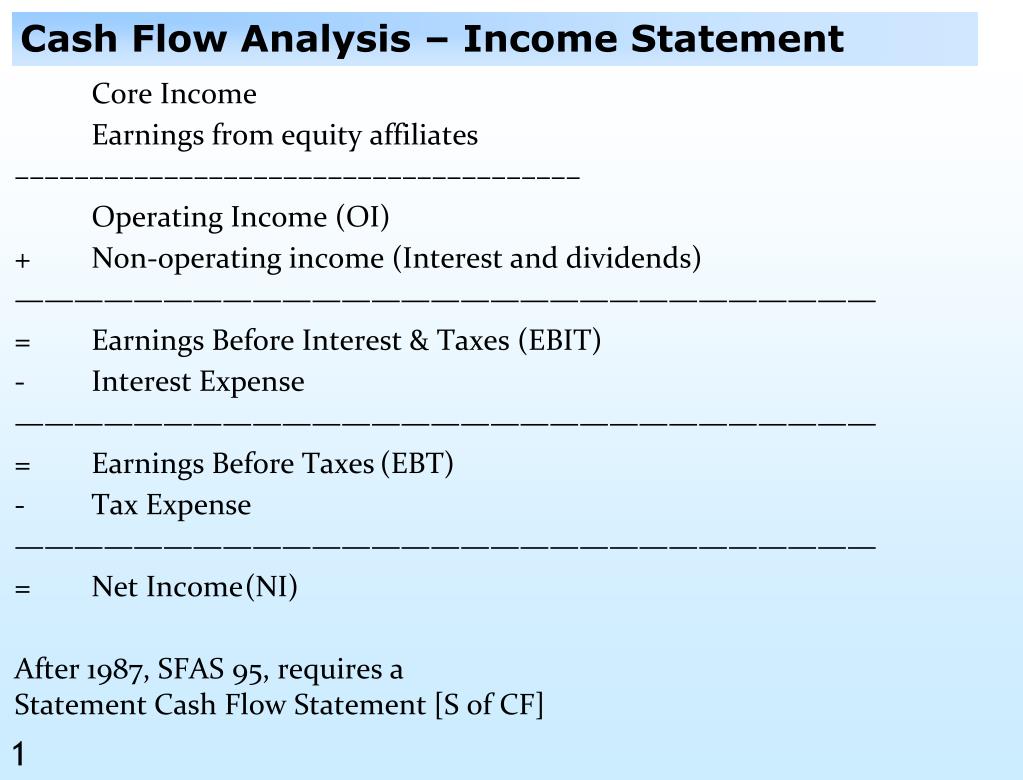

Begin with net income from the income statement. * constant currency (c.c.) adjusts prior year for movements in currencies. An income statement (also called a profit and loss statement) measures the amount of profits generated by a firm over a given time period (usually a year or a quarter).

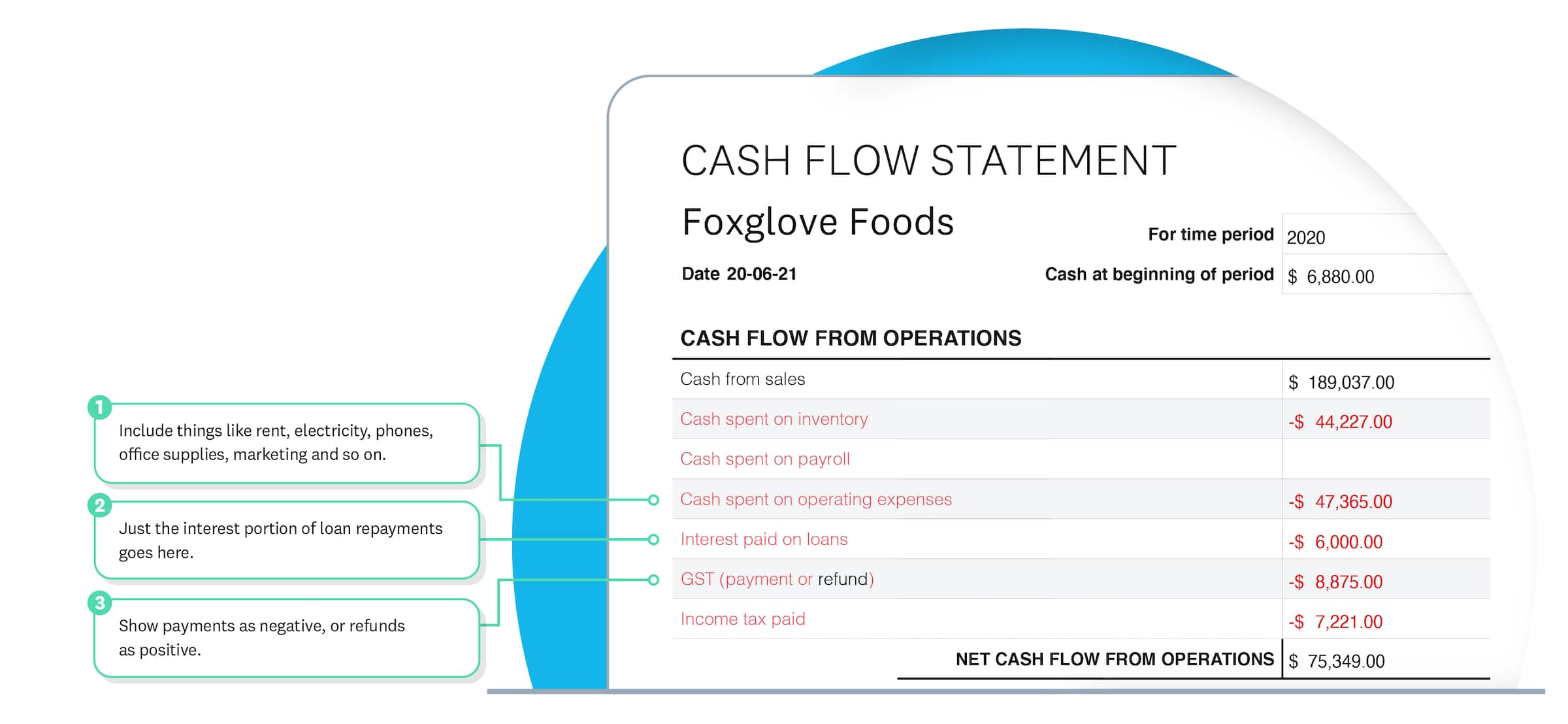

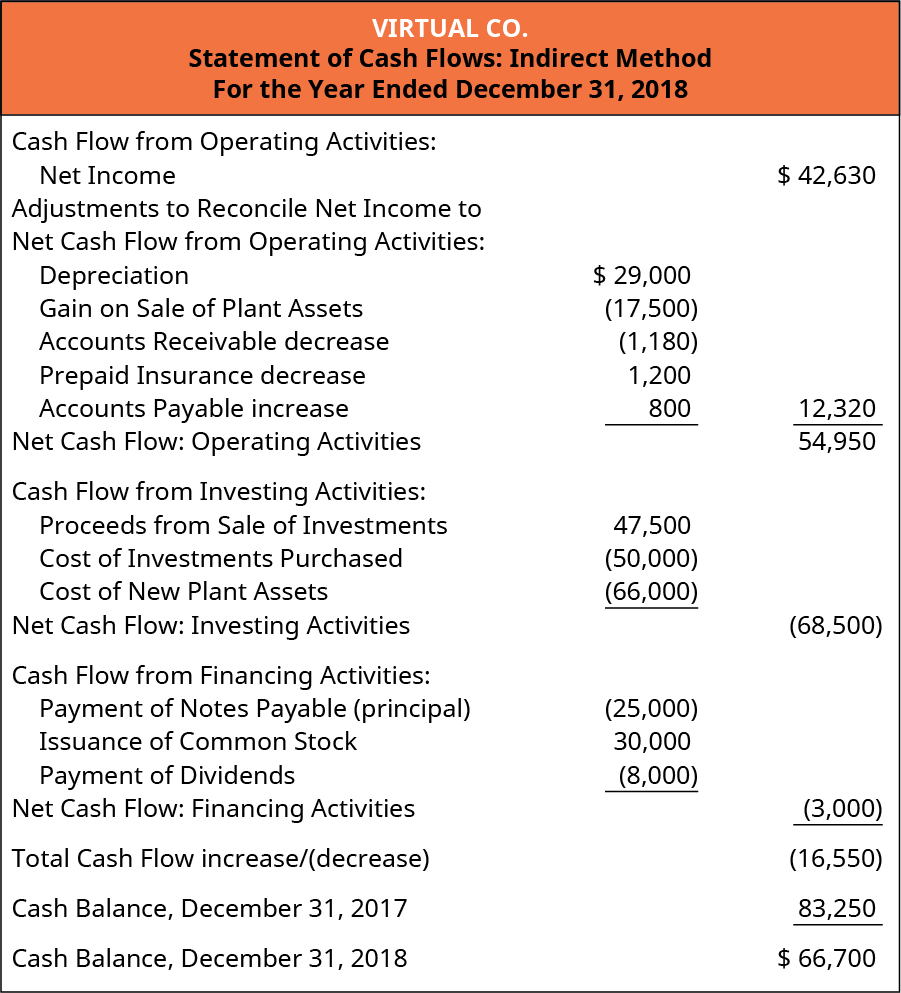

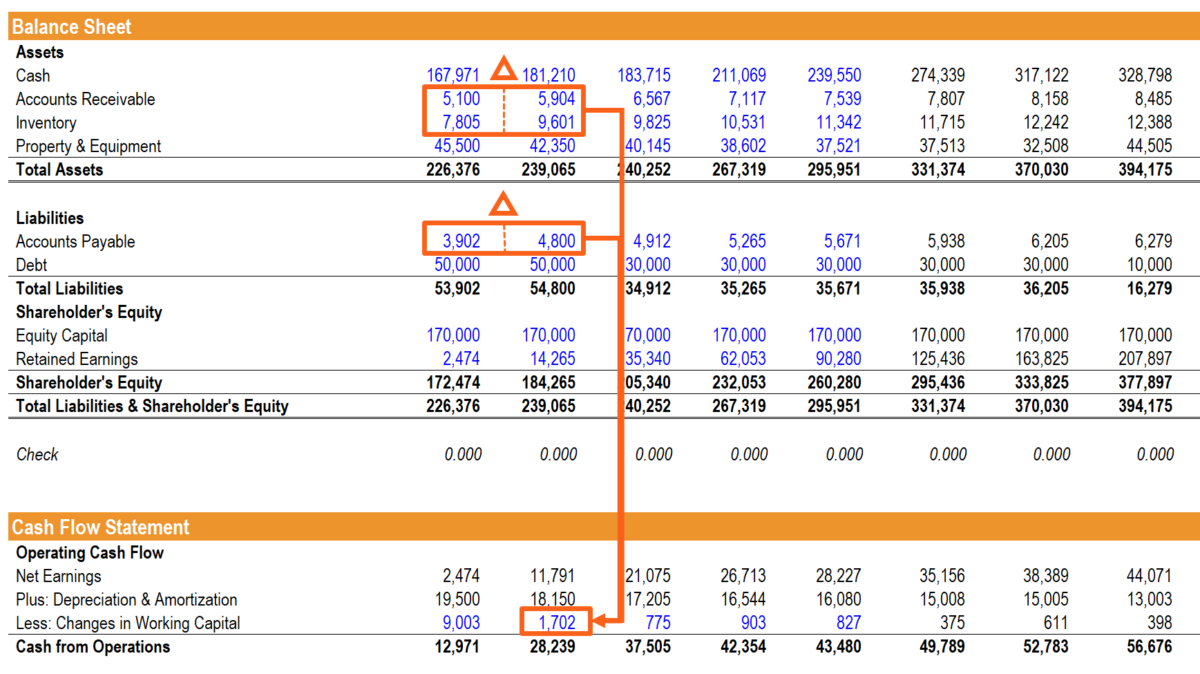

An income statement compares revenue to expenses to determine profit or loss. In this example, the business' operating costs come from inventory purchases, operating and administration expenses, wages, interest, and income taxes. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally presented on a gross basis.

Did you get it ⬇️樂 question: Taxes appear in some form in all three of the major financial statements: Somer anderson fact checked by ariel courage the cash flow statement and the income statement are integral parts of a corporate balance sheet.

Finally, divide this number by 12 and add it back into your operating cash flow calculation. The following examples illustrate all three of these examples. First, because taxes paid enter into the sources and uses of funds statement, the corporate cash flow basis is.

A personal income tax rebate of 50 per cent for the. The cash flow statement or statement of. If no payments were made, the ending balance would be cu 41000.

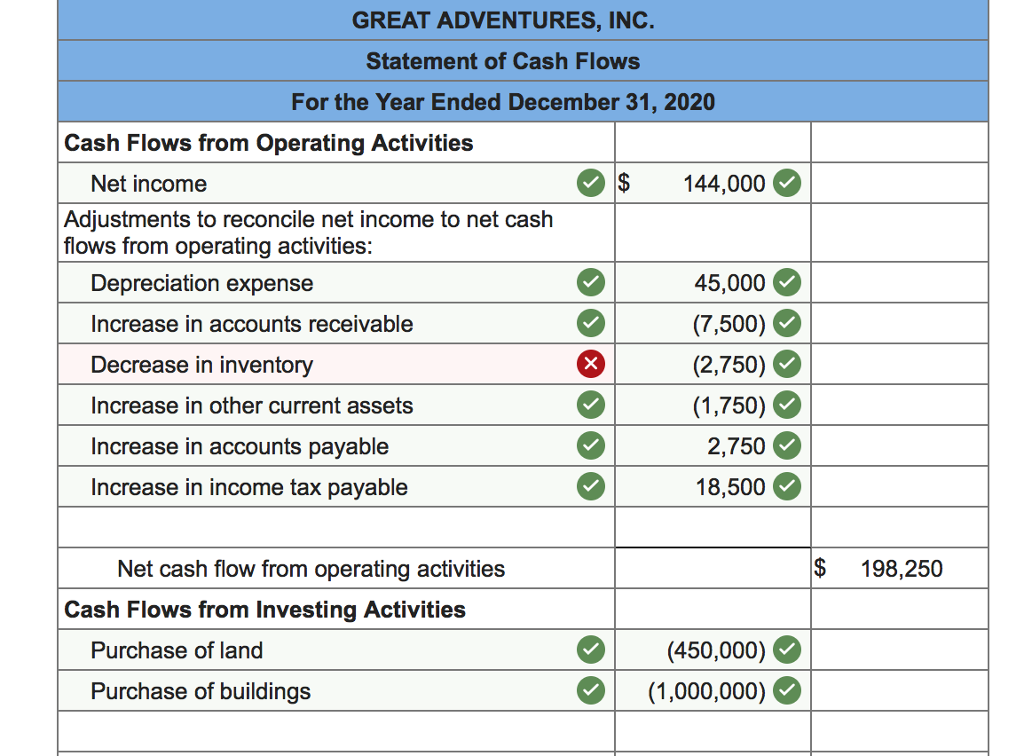

Operating cash flow, represented on the cash flow statement, refers to the income that flows in and out of a business due to its operational income and expenses. Lawrence wong's 2024 budget statement summarised in 90 seconds. Using the indirect method, operating net cash flow is calculated as follows:.

Learn how operating cash flow works, how it is used, and how you can calculate taxes from it. This is your total revenue minus any expenses that were paid during the year. Tip you report income tax payable on your current profits as a liability on the.

Adjusted income statement, balance sheet and cash flow adjusted income statement (in euro million) fy 2022 fy 2023 % change revenue 19,035 23,199 22% other recurring operating income and expenses (16,724) (20,155) share in profit from joint ventures 97 122 recurring operating income 2,408 3,166 31% % of revenue 12.6%. You can learn about the health of a business—up and down, and across time—by looking at its income statement. The statement of cash flows is prepared by following these steps:.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)