Real Tips About Income Tax In Profit And Loss Account

The profits shown in your profit and loss account are used to calculate both income tax and corporation tax.

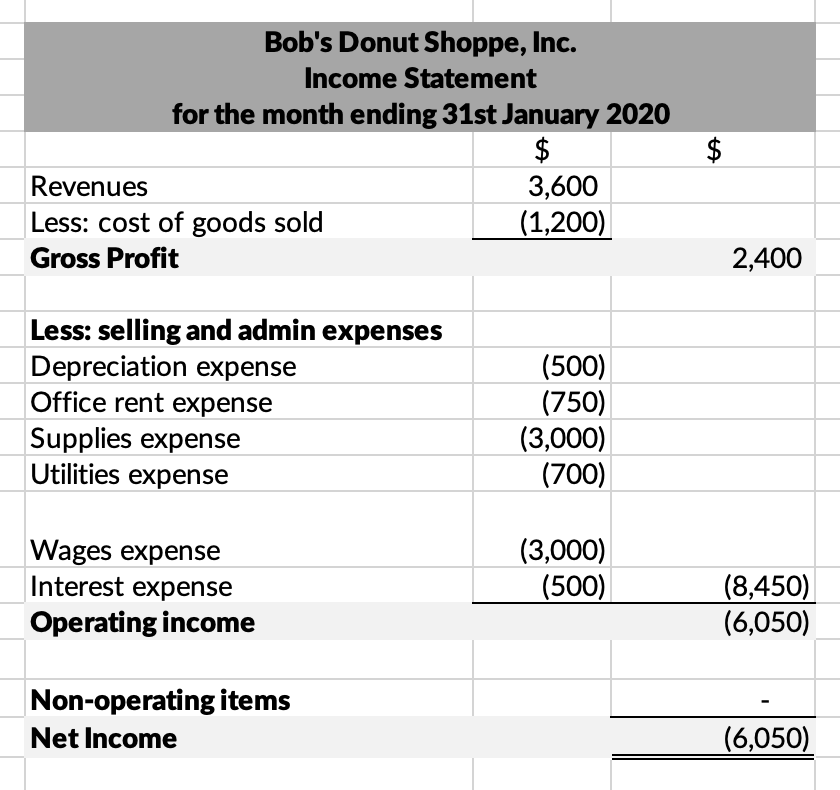

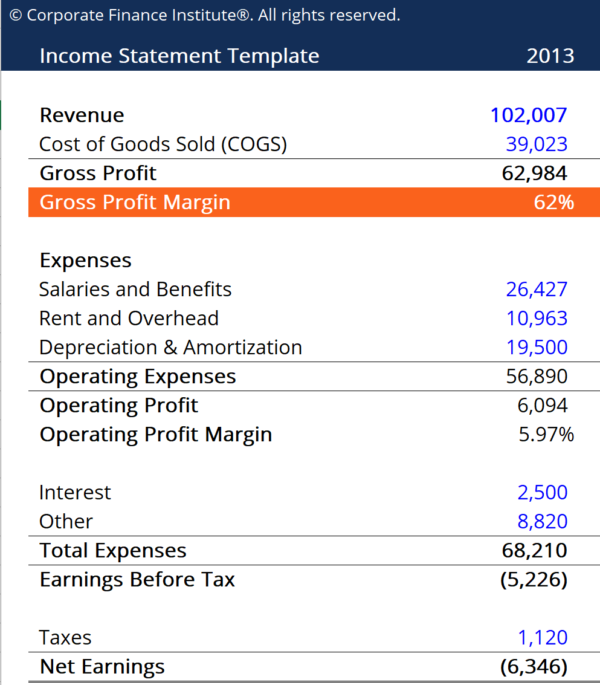

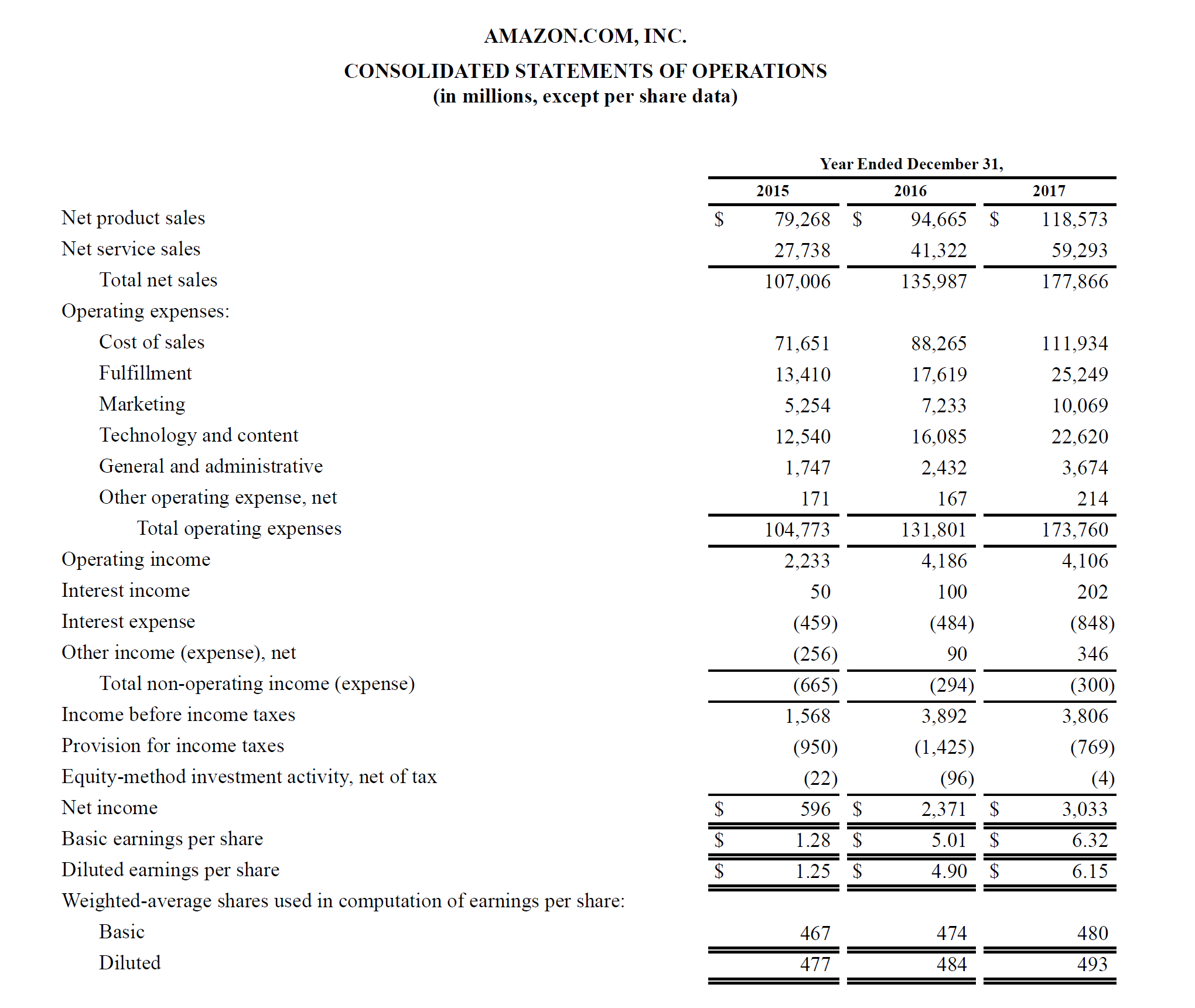

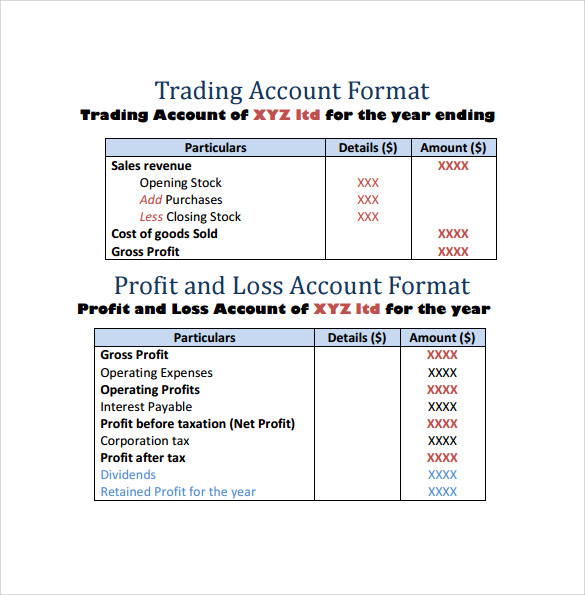

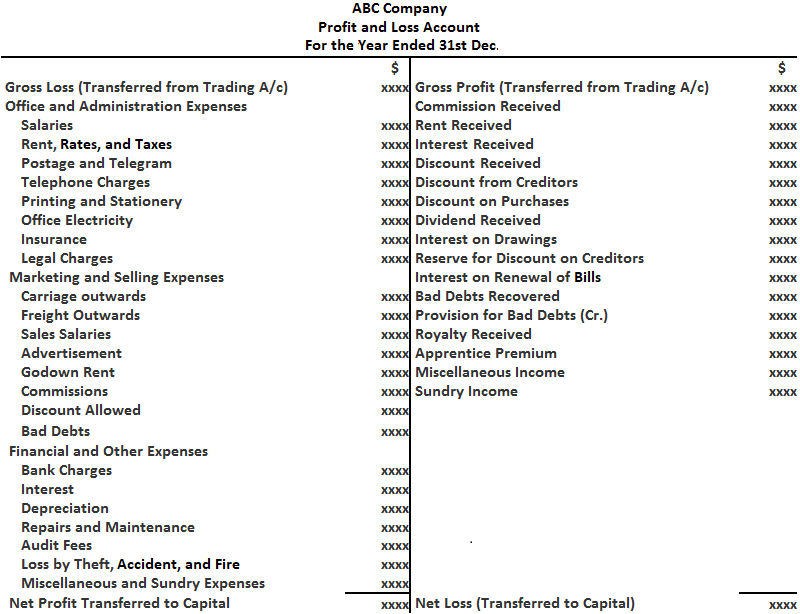

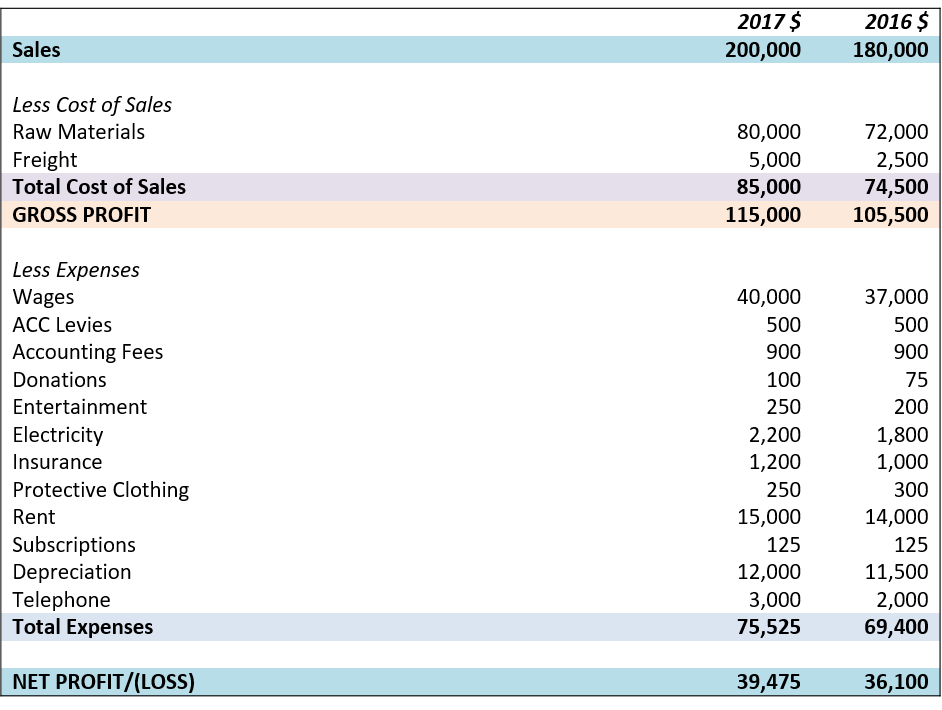

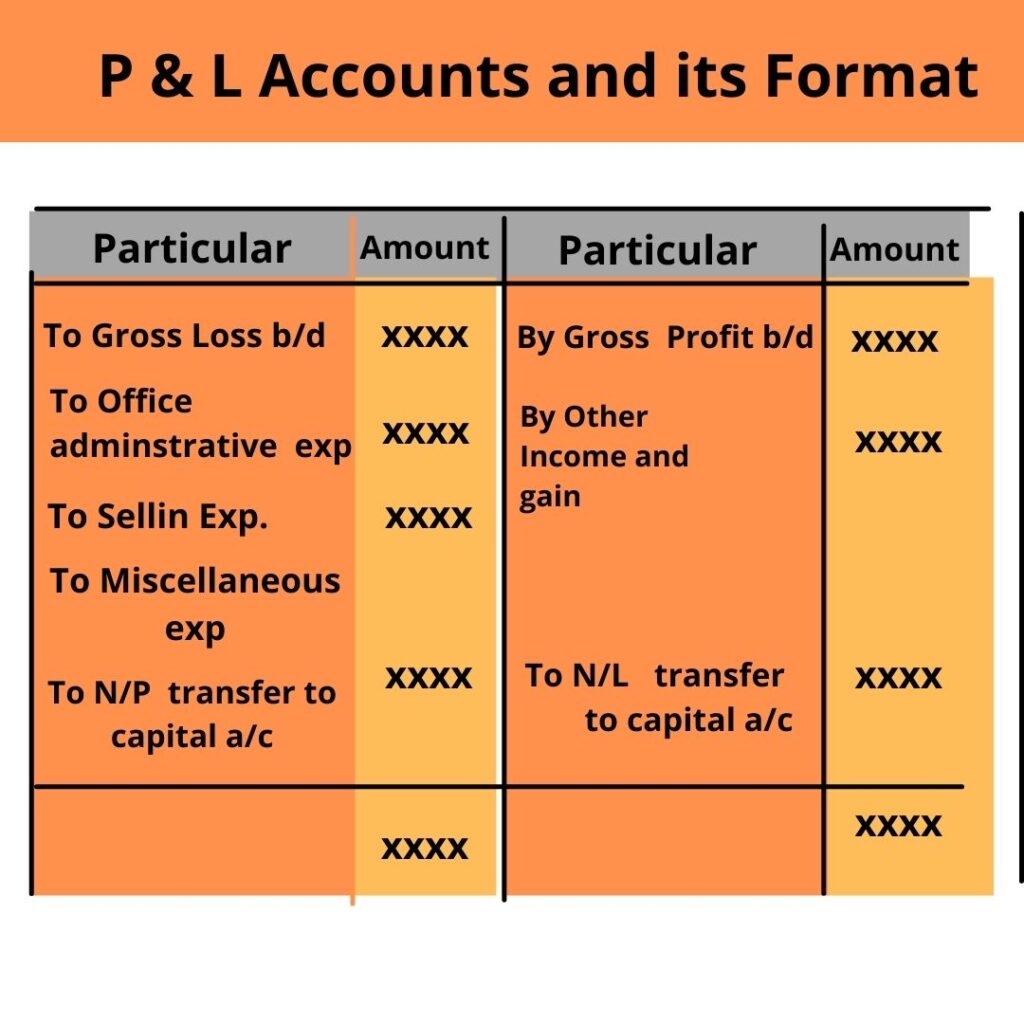

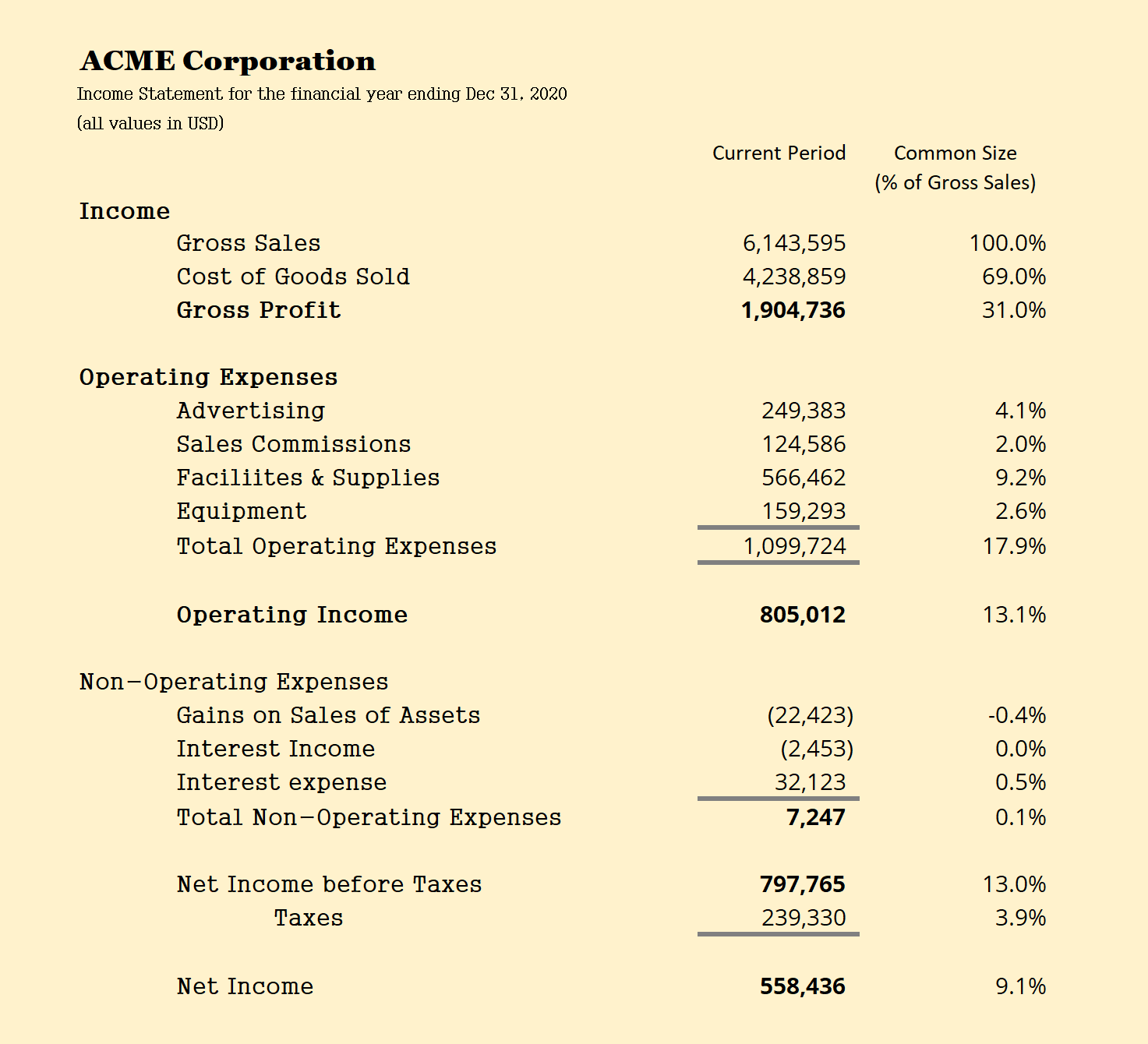

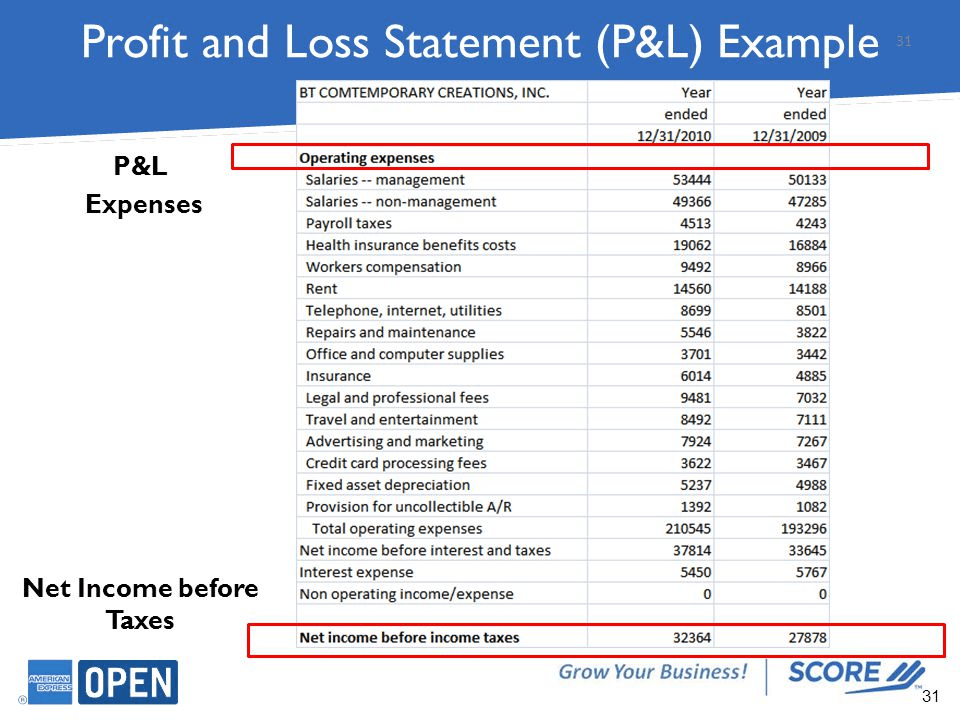

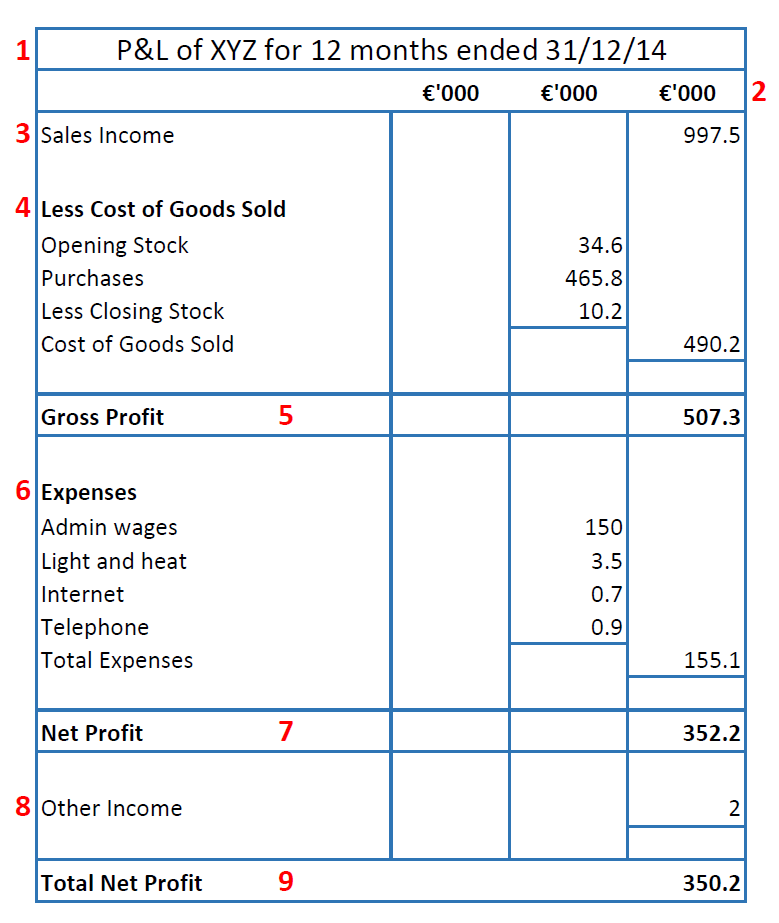

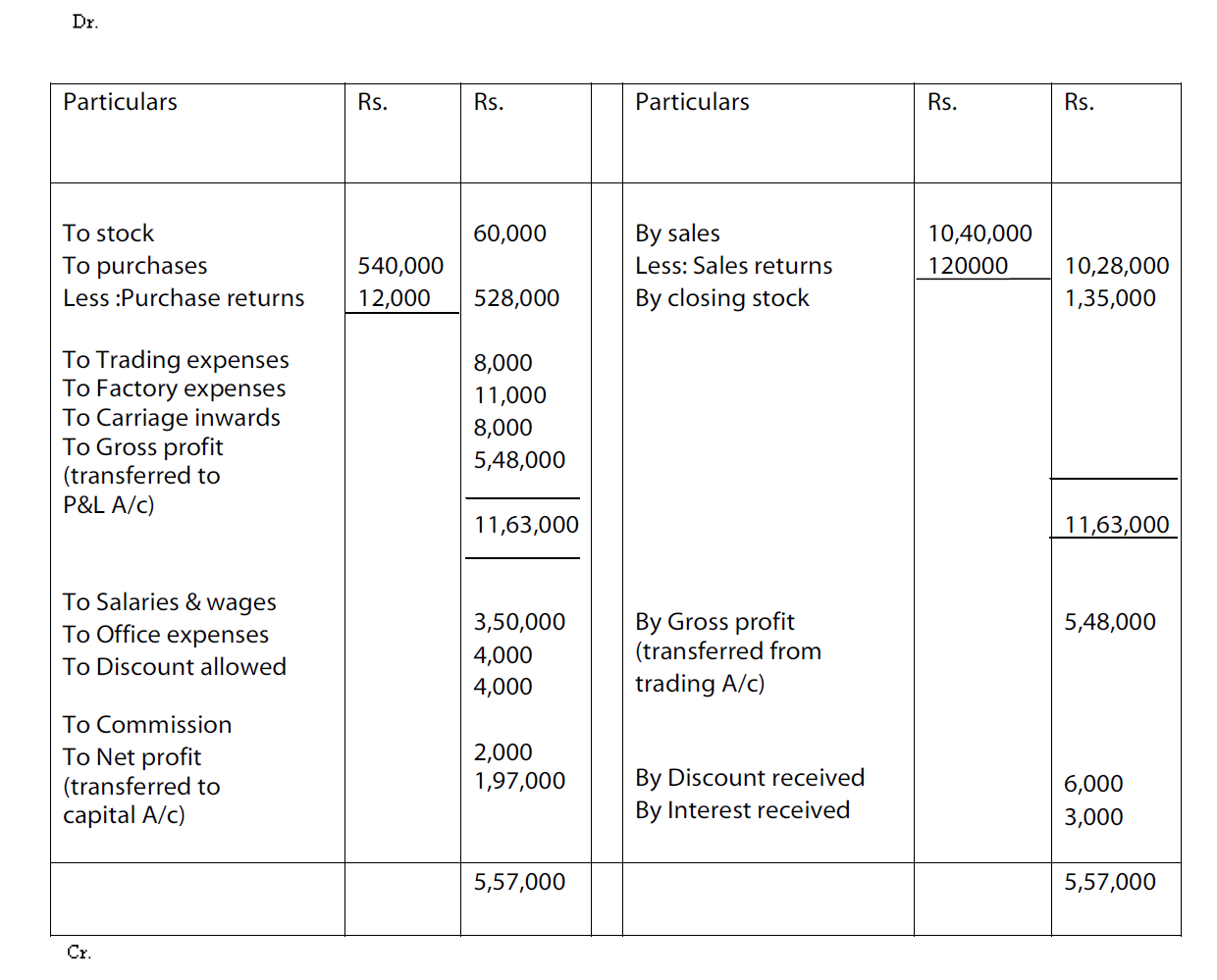

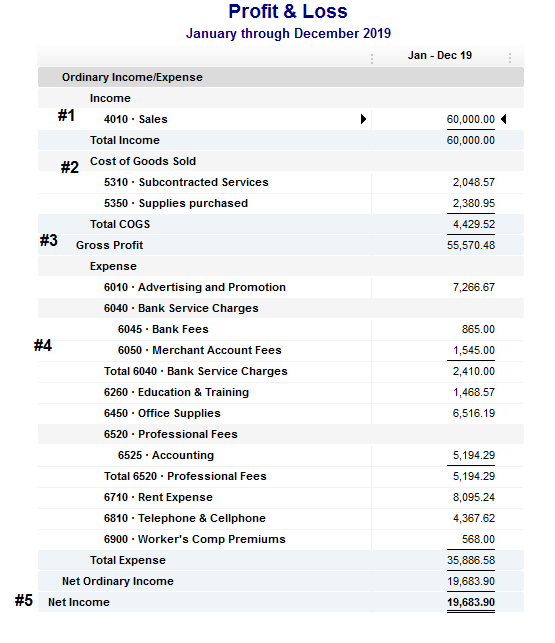

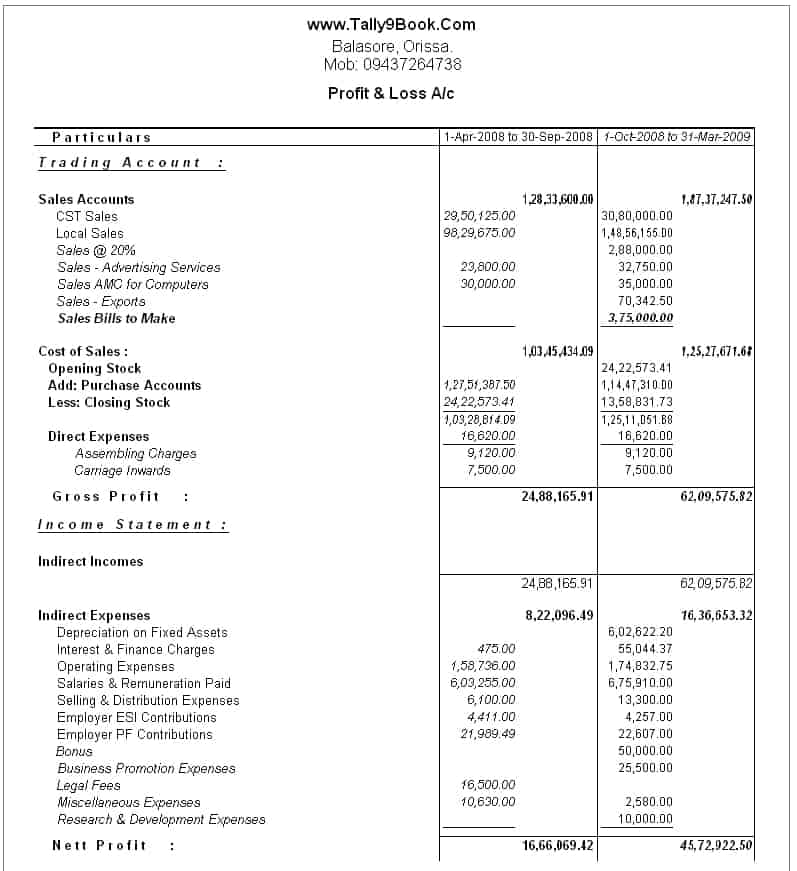

Income tax in profit and loss account. Revenue (or sales) cost of goods sold (or cost of sales) selling, general & administrative (sg&a) expenses marketing and advertising technology /research & development interest expense taxes net income example profit and loss statement (p&l) Otherwise known as your income statement or p&l, your profit and loss account shows your business’s revenue, expenses and net income over a given period. The irs excess loss rule takes effect when your total business deductions are more than your total gross income and above a threshold amount of $262,000 for a single taxpayer or $524,000 for a joint tax return.

Interest earned on your savings is classified as earned income by the irs. A new registered account designed to allow eligible individuals to contribute up to $8,000 per year, with a lifetime limit of $40,000, to save for a down payment on a first home. Failure to file either of these correctly can result in you paying added interest and penalties, so it’s important to get this report right.

The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. If the number is positive, you’ve made a profit. This is the profit you have after operating expenses (like rent) are.

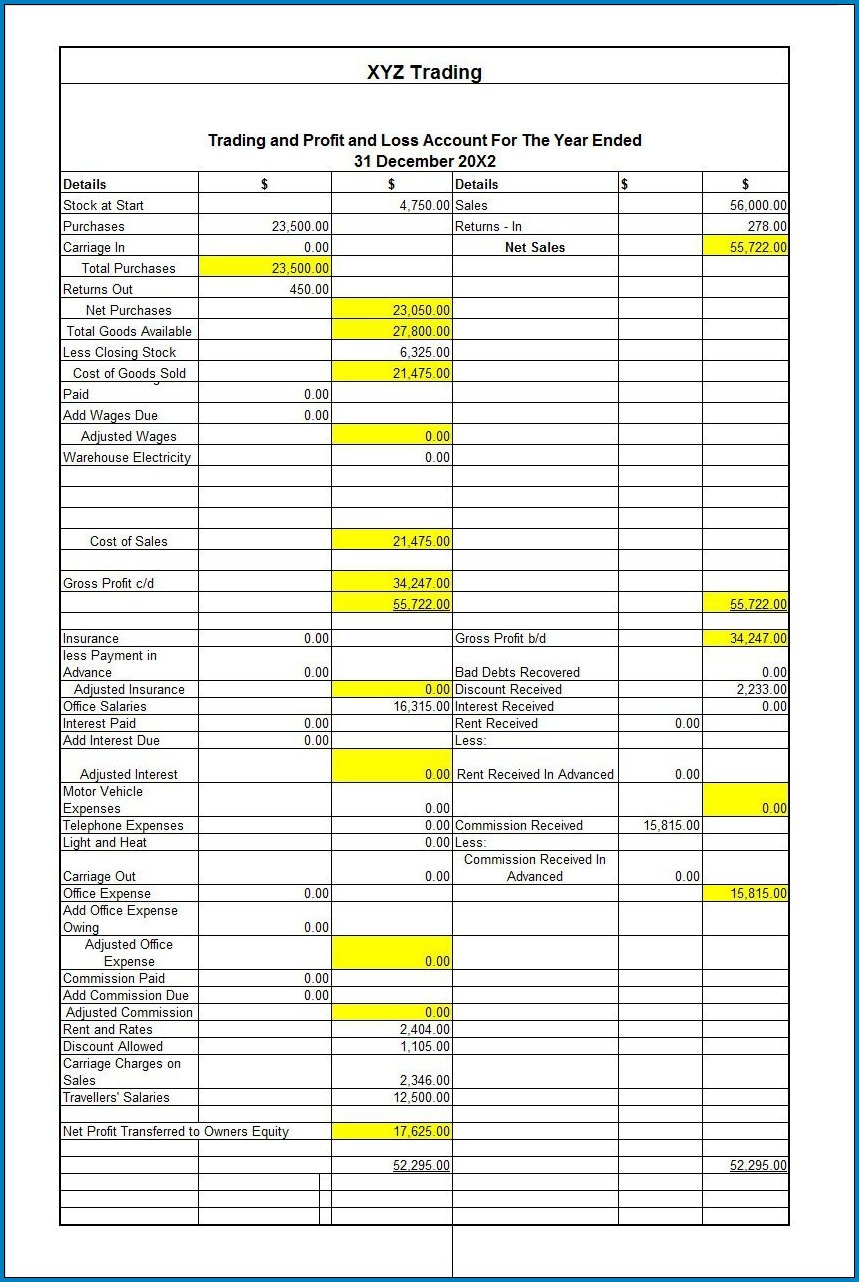

That means, technically, you need to report it on. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year. A profit and loss statement is calculated by totaling all of a business’s revenue sources and subtracting from that all the business’s expenses that are related to revenue.

Profits are income less expenses, but hmrc might arrive at a different figure than the estimate because not. July 23, 2023 at 7:04am there is so much wrong with xero its just not funny. The profit and loss account can be known by a number of different names, including a profit and loss statement, income statement, a statement of operation, a statement of financial results, an income and expense statement, or just simply as p&l.

Profit and loss account is made to ascertain annual profit or loss of business. In qbo, know that what you'll see in your profit and loss report is the income and expense total only. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

To determine the net profit or loss of your business, you will need to deduct total expenses, reported on line 28 of schedule c from total income reported on line 7. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. Income tax paid for earlier years dr (profit & loss a/c) to bank a/c.

Profit & loss account is also known as p&l a/c, profit & loss statement, income statement or income and expense statement. Before anything else, please be aware that sales tax is a liability. Only indirect expenses are shown in this account.

Then choose ok and go to step 4. The main categories that can be found on the p&l include: And of course, the greater the difference between the two.

If adjusted from other refund for another a.y., accounting entry will be as under: If you wish to track all your sales taxes, you'll want to run the balance sheet report. Here are the most common terms in the profit and loss account that you need to understand:

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-Loss-Gross-Profit-Net-Operating-Income.jpg)

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)